Trade Surveillance Systems Market Share, Size, Trends, Industry Analysis Report, By Component (Solution & Services); By Deployment Mode; By Organization Size; By Vertical; By Region; Segment Forecast, 2022-2030

- Published Date:Nov-2022

- Pages: 101

- Format: PDF

- Report ID: PM2853

- Base Year: 2021

- Historical Data: 2018-2020

Report Summary

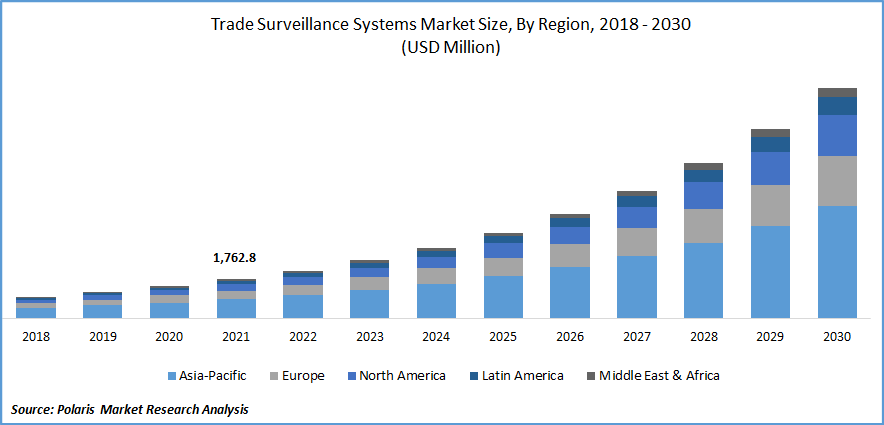

The trade surveillance systems market was valued at USD 1,762.8 million in 2021 and is expected to grow at a CAGR of 21.7% during the forecast period.

The necessity for the implementation of trade monitoring systems is the growing rise in incorrect or abusive trading. It aids in regulatory compliance and the prevention of market fraud. The global rise in fraud and market manipulation is the main element fueling the market's expansion. The general population suffers significant damages as a result of these frauds and manipulations. As a result, the market expansion is being driven by the requirement for pre- and post-monitoring trading operations in financial institutions.

Know more about this report: Request for sample pages

Trade surveillance is defined as the process of observing and evaluating an organization's trading behavior in the financial services sector which may result in criminal charges, legal action, or even corporate closure, that directly or indirectly uses market abuse or market manipulation techniques. Financial institutions focus on "at-risk" industries and improved preventative skills by recognizing urgent needs, identifying teams, and specifying requirements.

Additionally, as social media usage is growing, it is influencing businesses all around the world. Because of this, it is more important to carefully monitor the risks associated with market trends, which will help the market flourish. The COVID-19 pandemic had a modest impact on the global market due to intense pressure on businesses to preserve crucial data in the case of a pandemic and a decline in end-user spending.

Additionally, the global shutdown has increased market volatility, making it difficult for businesses to keep track of a variety of trading operations. Due to this, a lot of businesses are utilizing trade surveillance systems to keep an eye on a variety of activities during the pandemic condition and to control augmenting market quantities, which is promoting market expansion.

Industry Dynamics

Growth Drivers

Trade surveillance systems monitor data of client trades and detect and analyze suspicious trading. Trade surveillance systems are implementing surveillance techniques to investigate manipulative or unlawful trading practices in the securities markets. By observing and identifying trading activity, trade surveillance contributes to the maintenance of orderly markets. These include cross-market, market manipulation and cross-asset analysis, trade violence, an inspection of deals in suspected areas, and pre- and post-trade verification of the accuracy and fairness of transactions inside an organization.

Trade monitoring mandates must be complied with by financial institutions (FIs). For instance, the Dodd-Frank Swaps Surveillance law mandates that banks respond to requests for replays of deals and the conversations that go along with them within 72 hours. However, the frequency of questionable transactions is increasing, necessitating a robust surveillance system, particularly when traders are operating remotely and corresponding over social media.

Additionally, technology will help financial institutions deal with the growing business challenges brought on by evolving regulatory requirements, flexible client demands, and other essential roles in the sector.

As a result, the market for global trade surveillance is anticipated to develop over the course of the projected period due to the increasing demand for monitoring trade operations in financial institutions. For instance, financial service companies can monitor and identify market manipulation, fraud, behavioral pattern, and other activities across all products and classes with the aid of CRISIL Trade Surveillance Solutions, ensuring the detection, investigation, and prevention of dishonest or illegal activity in the securities markets. Wipro assisted a large worldwide player in financial services with the implementation of a centralized platform for AML and trade surveillance across regions, resulting in a 30% reduction in yearly TCO (Total Cost of Ownership).

Report Segmentation

The market is primarily segmented based on component, deployment mode, organization size, vertical, and region.

|

By Component |

By Deployment Mode |

By Organization Size |

By Vertical |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Based on Component, the solutions segment acquired the highest revenue share

The growing need to improve business performance and analyze vast amounts of data from numerous places, boost the solution segment of the trade surveillance systems market. Companies and organizations can benefit from trade surveillance systems in multiple ways, including, improved compliance management, data optimization, and simpler case management. To enhance capabilities and efficiency, businesses are also employing trade surveillance system solutions to automate, enhance, and manage the surveillance process.

Large Enterprises (SMEs) accounted for the largest market share in 2021

Large organizations have implemented trade surveillance systems more quickly as they require a contemporary, comprehensive approach to trade surveillance. They require regulatory coverage and extensive functionality and flexibility to meet the needs of today's complicated business environment. SMEs have invested in trade surveillance systems to better keep an eye on trade transactions across the business as a result of the increasing fraud and theft activities and rising number of restrictions imposed by the regulatory bodies.

Cloud-based Platforms Expected to Grow Significantly

Cloud-based trading activities are growing quickly as they are convenient and easy to access due to digitization. However, the demand for trade surveillance is further growing as a result of the expansion of cloud-based trading activities. Due to its scalability, speed, and flexibility, the cloud may significantly improve compliance areas for financial organizations like trade surveillance by enabling greater risk identification, expedited investigations, and faster data analysis. Due to the numerous advantages, cloud-based trade surveillance solutions are being adopted much more quickly than on-premise trade surveillance systems. In the financial sector also cloud computing is growing.

North America is expected to hold a large share of the global market

North America accounted for the largest revenue share due to the presence of big data analytics with trade surveillance. The requirement for consistent, scalable, and effective data platforms has increased as a result of the interrelationship across asset classes, and this is anticipated to significantly drive the expansion of the trade surveillance market in a particular region.

Due to the significant risk of fraud and manipulation in Europe, there is a greater need for trade monitoring in the continent. High prospects for trade surveillance vendors are anticipated in the APAC market, which offers significant growth for the market in the region. Furthermore, the effect of cross-border trading and market wrongdoing on the Asia Pacific market is likely to support the industry's expansion over the forecast period.

Competitive Insight

Some of the major players operating in the global market include Nasdaq, FIS (Fidelity National Information Services, NICE, OneMarketData, ACA Compliance, IPC, SIA, Aquis Technologies, Software AG, and BAE systems.

Recent Developments

In Oct 2022, ACA Group, the top governance, risk, and compliance (GRC) expert in the financial services industry introduced several new capabilities that have been added to ComplianceAlpha, the company's comprehensive RegTech solutions platform.

In Sept. 2022, NICE Actimize announced the release of Compliancentral, a cloud-based platform for financial services companies that monitors end-to-end communications and transaction compliance.

In July 2022, BXS, the industry's top provider of trade analytics and compliance reporting announced the introduction of their new Trade Surveillance Platform. In addition to Investigation, integrating Alerts, and Case Management into one system to meet and surpass the expectations of the regulators, BXS also designed this platform to meet and exceed the expectations of its clients.

In Feb. 2021, Nasdaq acquired Verafin, a company that offers anti-financial crime management solutions. The acquisition would greatly bolster Nasdaq's current regulatory and financial crime prevention strategies.

Trade Surveillance Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 2,139.2 million |

|

Revenue forecast in 2030 |

USD 10,270.1 million |

|

CAGR |

21.7% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Deployment, By Organization Size, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Nasdaq, FIS (Fidelity National Information Services, NICE, OneMarketData, ACA Compliance, IPC, SIA, Aquis Technologies, Software AG, BAE systems. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Pet Grooming Services Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Automotive Coatings Market Research Report

- Smart Cities Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Military Antennas Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Electricity Meters Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030