Tax Management Market Share, Size, Trends, Industry Analysis Report, By Component (Software, Service), By Tax Type (Indirect Tax, Direct Tax), By Deployment Mode (Cloud, On-premises), By Organization Size, By Vertical, By Region; Segment Forecast, 2022 - 2030

- Published Date:Mar-2022

- Pages: 101

- Format: PDF

- Report ID: PM2349

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Summary

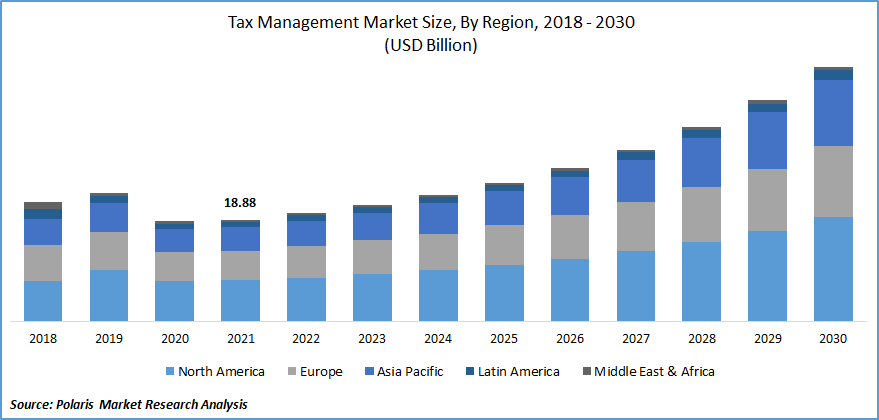

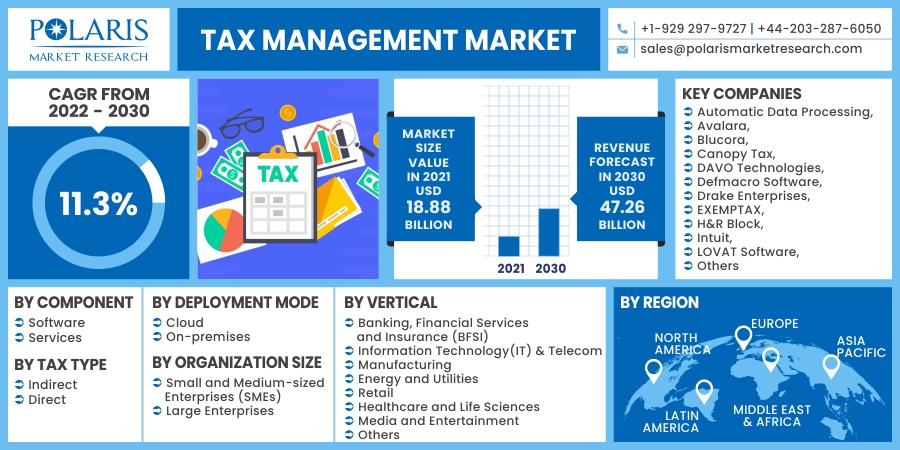

The global tax management market was valued at USD 18.88 billion in 2021 and is expected to grow at a CAGR of 11.3% during the forecast period. A tax management application is a software application that assists people and organizations in planning and completing income, corporation, and other tax filings. It simplifies the tax reporting procedure by leading the client through tax documents and duties and instantly assessing a person's or a business's tax responsibilities.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The COVID-19 outbreak has negatively influenced the industry in the past two years, resulting in a sharp drop in industry expansion. On the other hand, businesses in the marketplace have used a variety of tactics to enhance their operations. With cooperation for technology innovation, companies are improving their present offerings.

Furthermore, the transition between cloud-based systems, constant growth in effective tax digitalization, as well as a spike in the requirement for organizational restoration methods throughout the outbreak is projected to present sufficient prospects for industry manufacturers.

Industry Dynamics

Growth Drivers

Increasing the volume of financial transactions across different regions coupled with easy tax filing methods is expected to increase the demand for tax management software over the projected period. Furthermore, taxes may necessitate timely documentation management to obtain the necessary information at any moment without having to dive deep into paperwork congestion. These management technologies create and keep the paperwork in conveniently searchable categories, ensuring ease of handling documents. Increasing awareness regarding these benefits will increase the adoption of tax management software worldwide.

Automation is one of the primary growth factors boosting market growth. Automation in tax management minimizes efforts because all taxation procedures, including tax computation and tax filing, will be accomplished. Increasing the implementation of tax management software will fasten the tax filing process and decrease the chances of flaws and mistakes, which is expected to boost the tax management market over the projected period.

Know more about this report: request for sample pages

Report Segmentation

The market is primarily segmented based on component, tax type, deployment mode, vertical, and region.

|

By Component |

By Tax Type |

By Deployment Mode |

By Organization Size |

By Vertical |

By Region |

|

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Component

Software component segment is expected to dominate the global market over the forecast period due to the increasing adoption of advanced tax management software by large companies. Furthermore, big firms may use tax software solutions to continuously analyze company activity and offer notifications, all while generating tax liabilities in new locations depending on their specific linkage rules.

Insights by Deployment Mode

On-premises segment is anticipated to capture a significant share of the global market over the projected period as on-premises implementation allows enterprises and banking institutions to obtain ownership over their interconnections and gives several advantages, including adaptability, flexibility, and superior data protection.

Insight by Tax Type

Indirect tax segment is expected to dominate the global industry over the projected timeframe as this tax is paid more in comparison with others. This has increased the adoption of software solutions in order to calculate tax more efficiently. Furthermore, tax administration technology for taxation provides a consistent, unified framework for managing taxes and determining compliance duties which in turn will increase the adoption of these technologies over the coming years.

Geographic Overview

Asia Pacific is expected to dominate the tax management market over the forecast period due to the presence of emerging economies in the region. Furthermore, increasing adoption of software-based tax systems coupled with rising digitalization is expected to boost economic growth, which in turn will propel the market growth in this region.

North America is anticipated to grow at a considerable pace during the estimated period due to continuous changes in regulations coupled with the increasing adoption of the latest technologies.

Competitive Insight

Some of the key players operating in the global tax management market include Automatic Data Processing, Avalara, Blucora, Canopy Tax, DAVO Technologies, Defmacro Software, Drake Enterprises, EXEMPTAX, H&R Block, Intuit, LOVAT Software, SafeSend, Sailotech, Sales Tax DataLINK, SAP SE, Sovos Compliance, Taxback International, TaxCloud, TaxJar, TaxSlayer, Thomson Reuters, Vertex, Webgility, Wolters Kluwer N.V, and Xero.

These companies are investing in research & development and are adopting marketing strategies such as partnerships and collaboration, mergers & acquisitions, innovative product launches, and others to compete in the tax management market and increase their customer base. For instance, Avalara will handle cross-border regulation for Shopify businesses in November 2021. The firm announced that its cross-border regulatory technologies would fuel Shopify's latest tariff and import tax functionalities.

Tax Management Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 18.88 billion |

|

Revenue forecast in 2030 |

USD 47.26 billion |

|

CAGR |

11.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Tax Type, By Deployment Mode, By Organization Size, By Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Automatic Data Processing, Avalara, Blucora, Canopy Tax, DAVO Technologies, Defmacro Software, Drake Enterprises, EXEMPTAX, H&R Block, Intuit, LOVAT Software, SafeSend, Sailotech, Sales Tax DataLINK, SAP SE, Sovos Compliance, Taxback International, TaxCloud, TaxJar, TaxSlayer, Thomson Reuters, Vertex, Webgility, Wolters Kluwer N.V, and Xero. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Veterinary Reference Laboratory Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Recycled Plastics Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Virtual Power Plant Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Yogurt Drink Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Ambient Lighting Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030