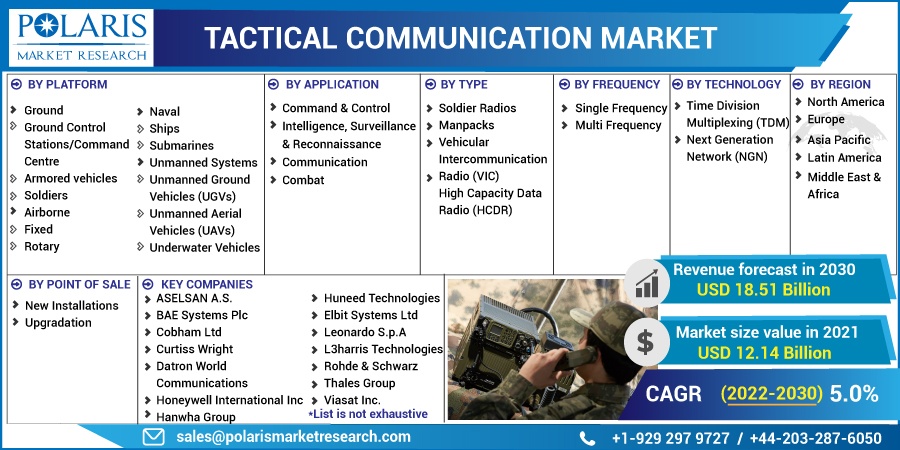

Tactical Communication Market Share, Size, Trends, Industry Analysis Report, By Platform (Ground, Airborne, Naval, Unmanned Systems); By Application; By Type; By Frequency; By Technology; By Point of Sale; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 101

- Format: PDF

- Report ID: PM2635

- Base Year: 2021

- Historical Data: 2018-2020

Report Summary

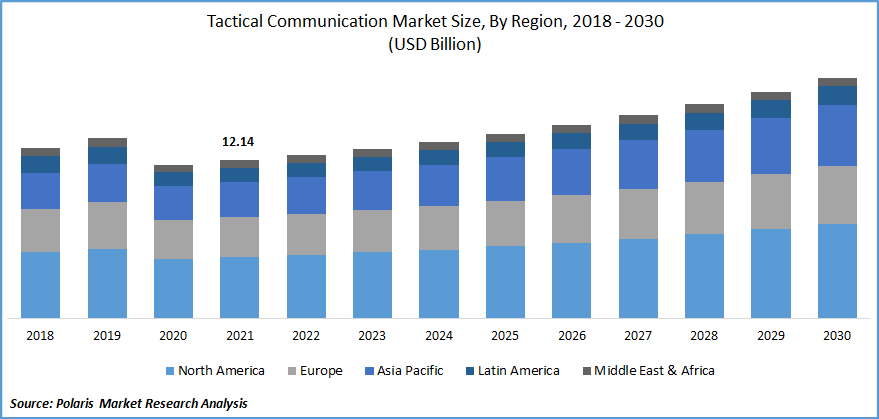

The global tactical communication market was valued at USD 12.14 billion in 2021 and is expected to grow at a CAGR of 5.0% during the forecast period. The world's armed forces are focused on increasing network-based communication of military platforms in the land, air, and sea domains, which is driving the growth of the tactical communication market.

Know more about this report: Request for sample pages

Tactical communication is mostly used in any military communications that take place on a battlefield and involve the transfer of information of any kind, especially commands and military intelligence, from one command, person, or position to another. In addition, information can be delivered in many different ways, including orally, in writing, visually, or through auditory.

The tactical communication industry has also seen significant growth in recent years as a result of increased investment in integrating cutting-edge battle technologies as well as rising demand for network-centric warfare and satellite-based communications. The rapid advancement of technology has increased the use of cutting-edge tactical communication tools in the defense sector.

Companies are focusing on developing new and inventive communication systems that can provide rapid and efficient responses in real time due to the increasing cases of terrorism and crime across the globe. The COVID-19 epidemic caused supply chain disruptions that slowed down manufacturing cycles and, as a result of this, the limiting the expansion of the tactical communication market.

Also, government of different regions announced complete lockdown and temporarily shut down of industries were adversely affected the overall sales and production of communication equipment manufacturing, in turn it affects the tactical communication industry.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The market is expected to grow as a result of an increase in the number of initiatives to improve public safety measures in developing countries and improvements related to the miniaturization of advanced technologies.

The integration of SATCOM in military communication, the increase in demand for the land-based communication, and technological advancements are collectively supplement the growth of tactical communication market.

Advancements in communication technology, including ear canal earphones, and passive and active noise cancellation devices, will increase the market demand. Additionally, the growing demand for the tactical headset in the law enforcement and military sectors are responsible for the market growth.

Report Segmentation

The market is primarily segmented based on platform, application, type, frequency, technology, point of sale, and region.

|

By Platform |

By Application |

By Type |

By Frequency |

By Technology |

By Point of Sale |

By Region |

|

|

|

|

|

|

|

Know more about this report: Request for sample pages

Ground segment accounted for the largest share in 2021

The ground segment holds the highest share due to the increasing demand for unmanned ground vehicles (UGV) in the defense and commercial sector. It tends to offer over surveillance data, carrying supplies, and help to activate explosives. These vehicles are intended for the transfer of people, supplies, and military equipment through any tough, restricted territory. Additionally, the vehicles are employed by emergency services such as the police and ambulance.

Governments' increasing investments in modernizing their military fleets and other nations' increasing military expenditures will support the adaptation of UGVs in the defense sector. In addition, Unmanned vehicles are becoming more common on the battlefield as well as domestically for the purpose of law enforcement, warning systems, and by NASA for research. The global development in asymmetric warfare and the number of cross-border conflicts contributed to an increase in the need for armored vehicles.

Furthermore, the operational zones or battlefield zones are frequently located in or close to the ground control stations (GCSs), even though they are frequently located thousands of miles from the location where the aircraft is flying.

Command and Control segment anticipated largest revenue share

Command and control segment is expected to grow in coming years owing to increasing border security and terrorism. Additionally, rising military spending in a number of countries are driving the segment growth. This system is made up of a number of components, such as software, hardware, computer processes, distinct standards, an interface, and applications, that enable communication at different levels of command.

Soldier Radios segment is expected to spearhead the market growth

The growing demand for faster communication and advancements in wireless communication technology is responsible for segment growth. In order to ensure a reliable connection to all soldiers on the battlefield, tactical radios are designed specifically for military use. They can also operate in a variety of difficult environmental conditions. They are frequently designed to transfer any type of data, including images, video, audio, and other types of data.

The solider radios segment is expected to grow over the forecast period owing to increasing customer demand for wireless, higher sound quality communicating media, and advancements in product technology to deliver portable devices. As a result of technological developments, soldier radios are smaller, lighter, and less expensive. They also provide better sound quality and high-tech features like location tracking.

Next Generation Network (NGN) is expected to spearhead revenue growth

By managing the service quality (QoS) end-to-end, the NGN seeks to offer strong broadband communications. All services and data, including voice data and calls, audio files, and multimedia files, including videos, are delivered via next-generation networks. Both voice and data connections can be established using a next-generation network, a packet-based mobile network. Infrastructure investment activities in developing nations are boosting the market for the newest generation of networks.

Upgradation segment is expected to witness faster growth

The advances in a variety of technologies and products, such as software-defined radio with speedy and efficient communication and AEHF band satellite systems, would experience significant growth in the forthcoming years. Additionally, the current 5G and upcoming 6G networks are designed to offer more data bandwidth, improved connectivity, and more coverage to military members on the battlefield, and also, they provide new options for tactical communication. It is also anticipated that these updated technologies will boost the market potential during the projected period.

North America is expected to dominate and witness the fastest growth over the forecast period

North America is expected to hold the greatest revenue-sharing share of the global market for tactical communication. The U.S.’s significant investments in tactical military communications technology are the primary driver of the regional industry's growth. This is due to the increased usage of unmanned ground vehicles (UGVs) for battle and surveillance in this region, as well as an increase in the defense budget.

In the upcoming years, Canada also intends to make large investments in the purchasing of mobile communication technology. The North American region will be fueled by these modernization efforts to improve the capabilities of the regional military services.

Asia-Pacific will continue to experience robust growth and the highest CAGR during the predicted period owing to the defense industry's continued purpose of growing its communications network infrastructure; the region is progressively concentrating on improving connectivity options through the purchase of cutting-edge tactical communication systems. In addition, the quick advancement of technology and the government providing support to industry players factors are responsible for the regional growth.

Competitive Insight

Some of the major players operating in the global market include ASELSAN A.S.; BAE Systems Plc; Cobham Ltd; Curtiss Wright; Datron World Communications; Honeywell International Inc; Hanwha Group; Huneed Technologies; Iridium Communications Inc; Elbit Systems Ltd; General Dynamics Corporation; Leonardo S.p.A; L3harris Technologies; Lockheed Martin Corporation; Northrop Grumman Corporation; Raytheon Technologies Corporation; Rohde & Schwarz; Thales Group; Viasat Inc.

Recent Developments

In February 2022, L3Harris Technologies Inc made next-generation secure manpack radios with integrated communications security for the U.S. Special Operations Command to enable commando teams to communicate on frequencies from 30 to 2,600 MHz with embedded communications security

In February 2021, The Ministry of Defense (MoD) and Defense Public Sector Undertaking (DPSU), Bharat Electronics Limited (BEL), signed a contract for the purchase of Software Defined Radio Tactical (SDR-Tac), which cost over Rs 1,000 crore.

In November 2021, Indra and Thales signed a memorandum of understanding (MoU) to work together to provide the Spanish Armed Forces with a tactical communications system.

In March 2020, the Israeli company Elbit Systems Ltd. provided satellite on the move (SOTM) communication systems to the Canadian Armed Forces as part of the Land Command Support System Life Extension (LCSS LE) program.

Tactical Communication Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 12.55 billion |

|

Revenue forecast in 2030 |

USD 18.51 billion |

|

CAGR |

5.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Platform, By Application, By Type, By Frequency, By Technology, By Point of Sale, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

ASELSAN A.S.; BAE Systems Plc; Cobham Ltd; Curtiss Wright; Datron World Communications; Honeywell International Inc; Hanwha Group; Huneed Technologies; Iridium Communications Inc; Elbit Systems Ltd; General Dynamics Corporation; Leonardo S.p.A; L3harris Technologies; Lockheed Martin Corporation; Northrop Grumman Corporation; Raytheon Technologies Corporation; Rohde & Schwarz; Thales Group; and Viasat Inc. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Gas Sensor Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Law Enforcement Software Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Inertial Measurement Unit Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Intelligent Virtual Assistant Market Share, Size, Trends, Industry Analysis Report, 2020-2026

- Customer Data Platform Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030