Structured Cabling Market Share, Size, Trends, Industry Analysis Report, By Component (Hardware, Software, Services); By Cable Type (Category 5E, Category 6, Category 6A, Category 7); By End-Use (BFSI, Healthcare, Manufacturing, IT & Telecom, Retail, Transportation, Industrial); By Regions; Segment Forecast, 2021 - 2028

- Published Date:Mar-2021

- Pages: 101

- Format: PDF

- Report ID: PM1822

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Summary

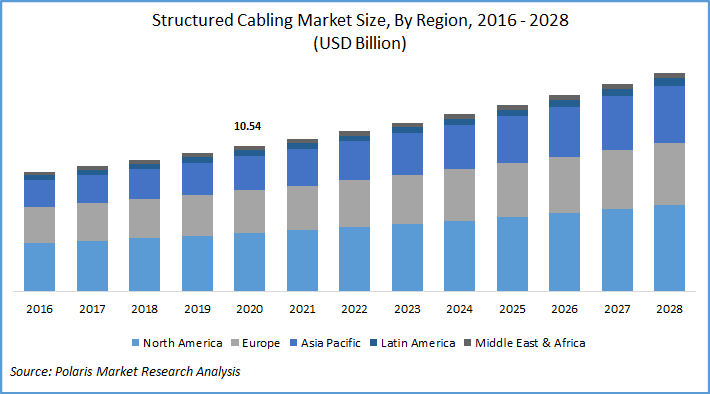

The global structured cabling market size was valued at USD 10.54 billion in 2020 and is anticipated to grow at a CAGR of 5.2% during the forecast period. The demand for structured cabling has increased significantly over the years owing to greater need for improved bandwidth, connectivity, and security. Copper cables, fiber cables, or a combination of both is used for offering high bandwidth.

Know more about this report: request for sample pages

The massive growth in internet services along with reductions in the cost of bandwidth demands deployment of advanced cabling solutions. Future broadband applications will foster a higher demand for high-density space utilization, reliable data transfer services and reduced provisioning interval. The increasing demand for high performance and expandability from data center supplements the market growth for structured cabling.

Data centers today struggle with major bandwidth capacity challenges arising out of migration from 10Gb/s to 40Gb/s and 100Gb/s and the subsequent increasing virtualization and cloud computing requirements. With the increased need to reduce costs, interference, noise and installation time, high quality cabling solutions are being used to ensure stability, reduce air gaps and reflections and reduce insertion loss.

Advanced structured cabling solutions are being launched by market players to perform better in challenging environments and provide stability to ensure uninterrupted transmission. Cabling systems are being designed to address significant space, energy and cooling constraints to enhance performance.

Copper cabling solutions are used in data centers owing to benefits such as low capital expenditures, reduced operational expenditures, enhanced reliability, and improved performance. Copper cables transfer data at high bandwidth and are capable of functioning with less power and less amount of cooling owing to their thermal design. The use of optical cable is expected to increase during the forecast period. Optical cables are thinner, lighter and offer higher data transmission rates. Optical cables are lighter in weight with smaller bend radius, which provide enhanced flexibility for data center configuration.

Industry Dynamics

Growth Drivers

The increasing data generation by various large and small businesses is driving this market. The growing need for high-speed data transmission without compromising the quality has increased the demand of structured cabling solutions. The growing adoption of mobile devices and mobility services by consumers has increased data requirements of customers, thereby boosting the market growth for structured cabling.

With the advent of new technologies and enhanced hardware, structured cabling solutions are now lightweight, small, and efficient to render enhanced performance. The rising adoption of Internet of Things (IoT) and Bring Your Own Devices (BYOD) is further driving the growth of this market. The increasing penetration of smart devices, growing digitization, and need to provide improved customer experiences further supplements the market growth for structured cabling.

Know more about this report: request for sample pages

Structured Cabling Market Report Scope

The market is primarily segmented on the basis of component, cable type, end-use, and region.

|

By Component |

By Cable Type |

By End-User |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Component Outlook

On the basis of components, the market for structured cabling is segmented into hardware, software, and services. In 2019, the hardware segment accounted for the highest market share. The hardware market segment of structured cabling industry encompasses cables, patch cords, and cable assemblies, communication outlets, connectors, and patch panels, among others.

Copper cables are increasingly being used in data centers owing to their ability to transfer rates at a higher rate over long distances. Copper cables are cost-efficient, consume less power, and do not require excessive cooling. A combination of copper and fiber optic cables are being used for greater network flexibility and improved network performance.

Cable Type Outlook

The cable-type segment has been divided into Category 5E, Category 6, Category 6A, Category 7, and Others. Category 6A has the capability to offer 10 Gbps of the data transfer rate at a bandwidth of 500MHz. It is affordable, backward compatible with Category 6 and Category 5E, and provides enhanced performance for power over ethernet. Category 6A has additional and tighter twists, with extra insulation to reduce crosstalk.

End-Use Outlook

On the basis of end-use, the market is segmented into BFSI, healthcare, manufacturing, IT and telecom, retail, transportation, industrial, and others. In 2020, the IT and telecom segment accounted for the highest market share. A massive increase in the use of smartphones, mobile devices, and multimedia content has resulted in increased demand for structured cabling from this sector. With the increased need to reduce costs, interference, noise, and installation time, high-quality structured cabling is being used to ensure stability and reduced reflections and insertion loss.

Geographic Overview

North America dominated the global structured cabling market in 2020. Established communication infrastructure in the region combined with high adoption of advanced technologies fuels the growth of the market for structured cabling. Increasing adoption of cloud services, development of smart cities, and rising adoption of FTTH/FTTP boost the market growth for structured cabling.

The high market share of structured cabling accounted for by North America is also attributed to various mergers and acquisitions taking place between leading vendors. The industry leaders are expanding and strengthening their presence in the region, leading to market growth.

Competitive Landscape

The leading players in the structured cabling market include TE Connectivity Ltd., CXtec Inc., Reichle & De-Massari AG, DataSpan, Inc., Paige Electric Co., Schneider Electric SE, Belden Solutions, Teknon Corporation, PennWell Corporation, Corning, Inc., Broadcom Inc., Brand-Rex Ltd., Hitachi Cable America Inc., and The Siemon Company.

These companies are taking initiatives to strengthen their market presence by introducing advanced solutions for its customers. These players are also collaborating with other market leaders of structured cabling to expand their offerings and acquire new customers.

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Bone Densitometers Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Anti-Crease Agent Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Chromatography Resin Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Sensitive Toothpaste Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Honey Wine Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028