Sonar Systems Market Share, Size, Trends, Industry Analysis Report, By Application; By Platform (Commercial Vessels, Defense Vessels, Unmanned Underwater Vehicles (UUVs), Aircraft, Ports); By Ports; By Installation, By Region; Segment Forecast, 2022 - 2030

- Published Date:Mar-2022

- Pages: 101

- Format: PDF

- Report ID: PM2337

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Summary

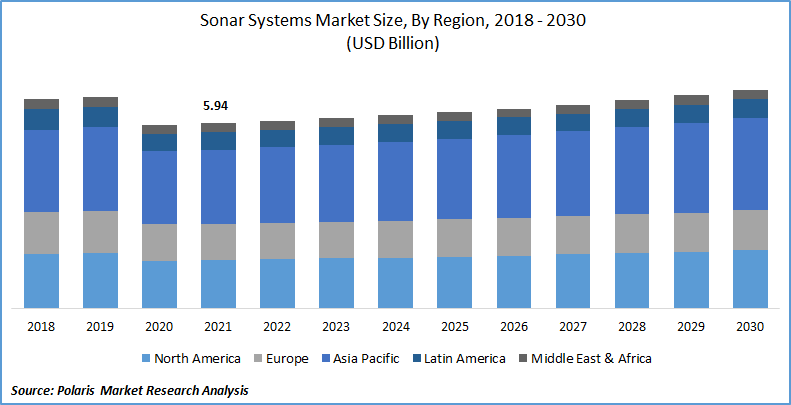

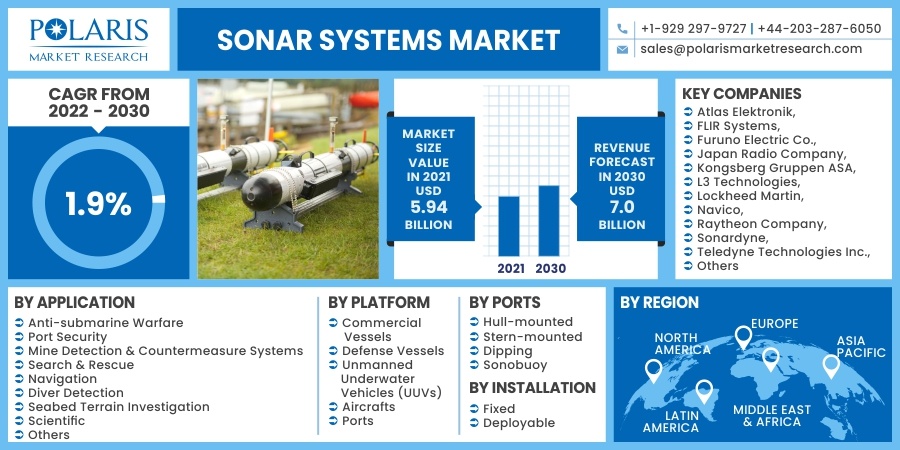

The global sonar systems market was valued at USD 5.94 billion in 2021 and is expected to grow at a CAGR of 1.9% during the forecast period. Increasing demand for sonobuoy for tactical defense operations and the growing use of sonar for aquaculture farms are driving the market growth during the forecast period.

Know more about this report: request for sample pages

A sonobuoy is a sophisticated underwater acoustic research system that is dropped or ejected by naval ships. Sonobuoys record and transmit underwater sounds using a sophisticated transducer and a radio transmitter. The special-purpose buoys also provide other environmental information, such as wave height and water temperature. The French Defense Procurement Agency (DGA) awarded Thales Group a contract to design, qualify, and develop the SonoFlash air-droppable sonobuoy in March 2021. The market is expanding due to the increasing use of sonobuoy in military vessels.

A high-precision imaging sonar and an underwater optical camera make up the deep neural network sonar. The device allows for nocturnal monitoring and aids in developing more efficient fish farming. A very advanced underwater optical camera can be used by the Sound Navigation and Ranging to acquire images. The SCAN-650 sector scanning sonar, developed by JW Fishers, is standard equipment used worldwide. Regardless of water clarity, it delivers a detailed image of the aquatic environment.

However, the expensive cost of development is a significant impediment to business expansion. The product includes data recorders, electronics, an inertial navigation system, and a Doppler velocity log system. The market's growth is hampered by the system's high installation and maintenance costs. The immediate impact of the COVID-19 pandemic on the navy industry has delayed naval vessel production due to lower market demand for maritime ships, and trade activities have slowed. The COVID-19 effect will cause delays in ship components, parts, and systems for navy vessels, stifling sonar systems market growth.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Market players extensively focus on high-end product launches, strategic alliances, and acquiring smaller companies to stay competitive in the capital-intensive market. For instance, in July 2021, Leonardo gave Cohort's subsidiary, ELAC SONAR, an order to assist the Italian Navy's U212 Near Future Submarines (NFS). For these two newly ordered U212 NFS, the subsidiary will offer sonar systems, unique test and training instruments, and related technical services valued at USD 58 million.

In addition, in April 2021, The UK Ministry of Defense (MoD) has granted SEA, a group company of the Cohort Group, a GBP 25 million order to manage and update in-service equipment until 2030. The contract allows SEA to enhance its revolutionary anti-submarine warfare solutions by designing and developing a Ministry of Defense's next-generation equipment component. As a result, acquisitions, government grants, and leading competitors' improvements drive sonar systems market expansion throughout the projection period.

Report Segmentation

The market is primarily segmented based on application, platform, ports, Installation, and Region.

|

By Application |

By Platform |

By Ports |

By Installation |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Application

Based on the application segment, the anti-submarine warfare (ASW) segment was the most significant revenue contributor in the global market in 2021. ASW is an underwater warfare branch that employs surface warships submarines to locate, track, and destroy enemy submarines. Detecting technology employed in ASW has improved as each new generation of the submarine has gotten quieter and tougher to detect. A target submarine is first detected, classified, located, and tracked using advanced technology. As a result, sensors are an important part of ASW.

Torpedoes and naval mines are standard weapons used to target submarines, and they can be launched from a variety of air, surface, and undersea platforms. Following the development of submarine-launched ballistic missiles, which substantially increased the perceived lethality of submarines, ASW capabilities are frequently regarded as of significant strategic importance. Big firms like Thales and Ultra Electronics have put a lot of money into AWS since it has proven its worth again and over.

Geographic Overview

In terms of geography, North America garnered the largest revenue share. Procurement of modern systems to incorporate better naval defense systems for the country's security and increased R&D for technological improvements of sonar systems by prominent companies in the region are driving the region's growth.

Moreover, Asia Pacific is expected to witness a high CAGR in the global sonar systems market. Due to the general region's geopolitical situation, it has become a hotbed for extraordinary skirmishes and armed standoffs, particularly between countries in the South China Sea. This has prompted numerous countries to purchase new naval assets while also encouraging the improvement of existing boats' capabilities.

For example, the PLAN is expanding its naval fleet to the point where it will surpass Russia as the world's greatest navy in terms of frigates and submarines. China focuses on improving its anti-submarine warfare (ASW) capabilities from coastal defense to blue-water operations. Other countries are increasing their spending on ASW technology, such as sonar systems, to improve maritime situational awareness.

Competitive Insight

Some of the major players operating in the global market include Atlas Elektronik, FLIR Systems, Furuno Electric Co., Japan Radio Company, Kongsberg Gruppen ASA, L3 Technologies, Lockheed Martin, Navico, Raytheon Company, Sonardyne, Teledyne Technologies Inc., Thales Group, and Ultra Electronics.

Sonar Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 5.94 billion |

|

Revenue forecast in 2030 |

USD 7.0 billion |

|

CAGR |

1.9% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Application, By Platforms, By Ports, By Installation, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Atlas Elektronik, FLIR Systems, Furuno Electric Co., Japan Radio Company, Kongsberg Gruppen ASA, L3 Technologies, Lockheed Martin, Navico, Raytheon Company, Sonardyne, Teledyne Technologies Inc., Thales Group, and Ultra Electronics. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Bakery Contract Manufacturing Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Inspection Management Software Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Reverse Osmosis (RO) Membrane Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Food Grade Lubricants Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Airborne SATCOM Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030