Small Modular Reactor Market Share, Size, Trends, Industry Analysis Report, By Type (Thermal-neutron Reactors, Fast Reactors), By Technology (Cooling, Thermal,/Electrical Generation, Staffing, Load Following), By Deployment, By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 101

- Format: PDF

- Report ID: PM2157

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Summary

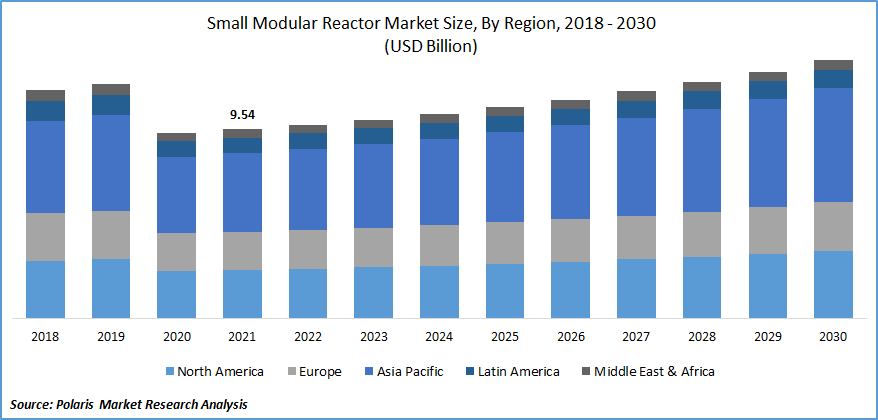

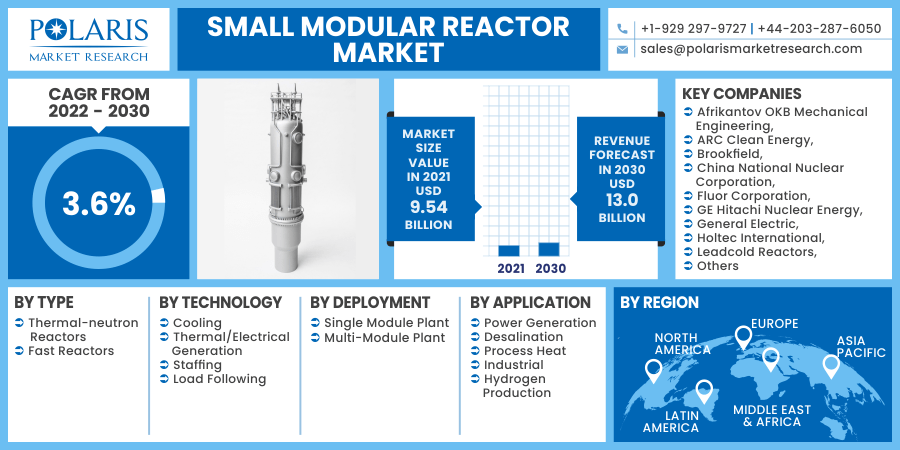

The global small modular reactor market was valued at USD 9.54 billion in 2021 and is expected to grow at a CAGR of 3.6% during the forecast period. The low cost of Small Modular Reactors (SMRs) on account of the modularization and factory construction, along with the growing interest in small and mid-sized reactors due to their ability to meet the need for power generation, is positively influencing the market.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

In addition, the growing market demand for advanced SMRs, coupled with government regulation and initiatives associated with decarbonization, is also augmenting the positive growth outlook for the small modular reactor market. The recent outbreak of the COVID-19 pandemic at the global level has tremendously impacted the economic growth with trade disruptions due to the nationwide lockdown imposed by the government in these countries.

Therefore, nuclear power companies that were involved across industrial and commercial establishments were also temporarily shut down to prevent the spread of novel coronavirus. To counter those issues, several government authorities were setting out tariff-related measures to mitigate the impact of the COVID-19 crisis. Therefore, the market demand for small modular devices is witnessed a lower demand, which is projected to hamper the small modular reactor market growth in recent years.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Clean energy sources have observed rapid advancements and cost reductions in recent years. Solar PV, hydropower, wind power, dispatchable geothermal (both deep and shallow), concentrating solar power, biomass, and fossil energy with carbon capture have undergone rapid technological and economic developments. As a result, nuclear energy has the potential together with other energy sources, resulting in the adoption of an integrated system. Hence, it has led to the higher implementation of the small modular device.

Further, in October 2019, the International Conference on Climate Change and the Role of Nuclear Power was held by the IAEA, which stated that these devices are more efficient in generating CO2-free electricity as compared to fossil fuel-operated plants. Thus, these kinds of environmental initiatives and the technology development of SMRs for immediate and near-term deployment are progressing worldwide.

For instance, the Advanced SMR R&D program was launched in 2019 that supports R&D and deployment activities to boost the availability of SMR technologies into domestic and international markets. Such development has led to the rising implementation of SMRs across different power companies, which eventually accelerates the small modular reactor market growth.

Report Segmentation

The market is primarily segmented on the basis of type, technologies, deployment, application, and region.

|

By Type |

By Technology |

By Deployment |

By Application |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Deployment

On the basis of the deployment, the multi-mode plant segment is leading the market globally and is expected to register the fastest CAGR over the foreseen period. This is due to the ease of financing additional units of SMR, which leads to economies of series of production. The multi-mode configuration also delivers greater flexibility to grid operations, allows integration with renewables, and supports replacing existing nuclear power plants and retiring coal-fired plants.

Further, the SMR plant with multi-mode deployment helps minimize upfront investment, reducing financial costs. Thus, power companies majorly implement multi-mode SMR, which is expected to contribute towards high segmental growth. However, the single-module plant segment accounts for a significant share in the overall market. This is due to single module plants being easy to install and cheaper than multi-mode, as well as the considerable demand for reliable and flexible nuclear, which may drive the small modular device market growth worldwide.

Insight by Application

The power generation segment is projected to gain a larger share in the global market due to the rise in implementing the small modular device in power plants because of their capability to integrate with renewable energies to offer baseload and flexible power. Further, the ease of sitting and operations flexibility in power generation capacity lead to substantial market demand for SMRs in such applications.

In addition, several nations are looking for an alternative to coal-based power plants as the global climate is deteriorating at an alarming rate. This resulted in the rise in demand for SMRs to generate safe, clean, and affordable nuclear power options. Therefore, these factors are anticipated to promote market growth across the BFSI vertical. On the contrary, the process heat segment is projected to register a significant growth rate in the overall small modular reactor market.

Geographic Overview

Geographically, Asia-Pacific dominated the global small modular device industry in 2021 and is estimated for the significant revenue share on account of the increasing investments for the deployment of SMRs in the countries, particularly China and India. The recent economic growth in these countries has led to a rapid rise in energy demand. Energy producers are looking to opt for advanced power solutions that can help in meeting the growing electricity demand. As a result, the demand for advanced small modular devices is expected to grow significantly in the overall region.

Moreover, China plans to promote the creation of Generation III coastal nuclear power plants and speed up the development of SMRs and offshore floating nuclear reactors. While Japan’s government has also made several policy reforms and taking measures to accelerate the decarbonization across the energy sector. For instance, in October 2020, the Japanese government announced its ambitious plan to reduce greenhouse gas emissions (GHGs) to net-zero by 2050, setting Japan on course to create a carbon-neutral society. This strategy is key to aiding Japan in attaining this ambitious goal. Such a strategy is expected to promote the adoption of the small modular device industry.

In addition, the Asian region has a large pool of market vendors with significant operations and customer bases, therefore, creating better availability of such solutions in the region. For instance, in July 2021, China launched a commercial construction project related to onshore nuclear using a small modular reactor – Linglong One. Such initiative is further responsible for the high adoption of the small modular reactor in the region.

Moreover, North America is witnessing a considerable growth rate during the forecast period. Over the last few years, the energy regulations and advances in technology have driven a significant rise in the demand for small modular reactors across the region. Many government bodies and industries are often projected to enhance grid infrastructure in North American countries, which led to the increasing deployment of SMR that reduces greenhouse gas emissions and promotes energy security.

Competitive Insight

Some of the major players operating in the global small modular reactor industry include Afrikantov OKB Mechanical Engineering, ARC Clean Energy, Brookfield, China National Nuclear Corporation, Fluor Corporation, GE Hitachi Nuclear Energy, General Electric, Holtec International, Leadcold Reactors, Mitsubishi Heavy Industries, Moltex Energy, Nuscale Power, Rolls-Royce, TerraPower LLC, Terrestrial Energy, Tokamak Energy, Toshiba Energy Systems & Solutions, Westinghouse Electric, and X Energy LLC.

Small Modular Reactor Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 9.54 billion |

|

Revenue forecast in 2030 |

USD 13.0 billion |

|

CAGR |

3.6% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Technology, By Deployment, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Afrikantov OKB Mechanical Engineering, ARC Clean Energy, Brookfield, China National Nuclear Corporation, Fluor Corporation, GE Hitachi Nuclear Energy, General Electric, Holtec International, Leadcold Reactors, Mitsubishi Heavy Industries, Moltex Energy, Nuscale Power, Rolls-Royce, TerraPower LLC, Terrestrial Energy, Tokamak Energy, Toshiba Energy Systems & Solutions, Westinghouse Electric, and X Energy LLC. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Blockchain in Healthcare Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Microprocessor Market Share, Size, Trends, Industry Analysis Report, 2022 - 2029

- Digital Pathology Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Leukemia Therapeutics Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Personal Health Record Software Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030