Saudi Arabia Halal Cosmetics Market Share, Size, Trends, Industry Analysis Report, By Product (Skin Care, Hair Care, Make-up & Color Cosmetics, Others); By Distribution Channel (Online, Offline); Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 101

- Format: PDF

- Report ID: PM2151

- Base Year: 2021

- Historical Data: 2018 - 2030

Report Summary

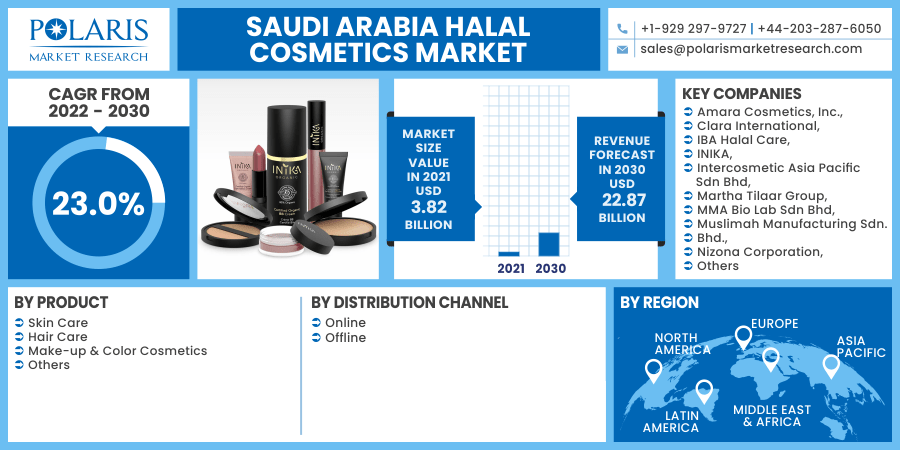

The Saudi Arabia halal cosmetics market was valued at USD 3.82 billion in 2021 and is expected to grow at a CAGR of 23.0% during the forecast period. The Saudi Arabia halal cosmetics market is expected to be accelerated by the rising internet penetration in the country, leading to increased options and easy product availability.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Saudi Arabia halal cosmetics market is categorized on the basis of applications and distribution channels. Major applications such as skin care, make-up, hair care, and others. Other segments mainly include deodorants and perfumes. The rising number of Muslims gaining higher education levels is another factor for the shifting trends and increasing demand for the use of safe and high-quality products. Though there is a rising demand for such products in Saudi Arabia, there is an absence of a robust regulatory system for these products in this region as compared to other regions of the globe.

The market is a niche with the presence of both large- and small-scale manufacturers. It has been reported that non-Muslim companies dominate the overall industry, which sometimes poses a serious threat among the Saudi Arabia halal cosmetics industry participants. For instance, Brunei has an established regulatory system that produces these cosmetics. There have been a lot of initiatives adopted by several Muslim countries to integrate the industry. Malay Chamber of Commerce Malaysia (MCCM) made efforts to build a marketing center in Dubai. This would help the growth of Saudi Arabia halal cosmetics industries and pave opportunities for manufacturers to advertise their product portfolio in various parts of the globe, including Saudi Arabia.

Increasing awareness among Muslim consumers about the substances used in personal care products is presumed to positively affect the Saudi Arabia halal cosmetics market growth over the next eight years. Since Muslims encompass a major part of the Saudi Arabia population, they thrive in the mainstream cosmetic industry to satisfy their needs. As a result, manufacturers started introducing Shariáh compliant products with a focus mainly on the Muslim population.

The outbreak of the Covid-19 pandemic has negatively impacted Saudi Arabia halal cosmetics industry growth. Nationwide lockdown forced the manufacturers to shut down their manufacturing facilities that led to the decreased production of cosmetic products. Strict rules and regulations also restricted the movement of workforces from one place to another within the country, which hampered the manufacturing and output of cosmetic products.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The rising demand for Saudi Arabia halal cosmetics among consumers owing to the product awareness and the ingredients used is anticipated to fuel industry growth over the forecast period. Muslim consumers are interested in shopping for personal care and cosmetic products that are halal certified and are Shariah-compliant. Such a factor would lead to an eco-ethical modern consumer and would assist the overall industry growth over the forecast period.

The Saudi Arabia halal cosmetic market is expected to witness a significant growth rate owing to the rising preference towards strict adherence to the halal code and increasing product portfolio of industry participants. In addition, the growing concern among the consumers associated with the usage of derived animal ingredients such as gelatin and collagen has led to the adoption of halal certification by many cosmetic market participants.

Report Segmentation

The market is primarily segmented on the basis of product, and distribution channel.

|

By Product |

By Distribution Channel |

|

|

Know more about this report: request for sample pages

Insight by Product

On the basis of product, the market is segmented into skin care, hair care, makeup, and others. Skincare products are likely to hold the major share in the near future. The increased growth in the skin care segment can be attributed to the fact that women in the country perceive these skin care products as a means to achieve religious adherence. In addition, the younger population in the country is embracing skin care products due to their inherent advantages such as no long-term side effects, animal welfare, lack of skin irritation, and others. Such trends are expected to benefit the segment growth.

The hair segment is also expected to account for a significant share over the forecast period. The development and introduction of novel hair care products are benefitting the segment growth. The development of advanced hair care products guarantees long-lasting fragrance and conditioning and also aid in the maintenance of hair volume, which in turn have resulted in the rise in demand for the segment.

A rising number of Saudi Arabia population is searching for such brand alternatives owing to their eco-friendly and cruelty-free characteristics. Lipsticks usually contain pig fat in normal personal care products. Such product usage by Muslims is against their law. Owing to their strict religious beliefs, the consumption of Saudi Arabia halal cosmetics is presumed to grow positively over the forecast period.

Insight by Distribution Channel

On the basis of distribution channel, the market is further clustered into online and offline channels. The prevalent high penetration of the internet is expected to greatly benefit the online distribution channel segment over the forecast period. Ease of convenience, easy comparison, and wide product portfolio are some of the factors benefitting the segment growth.

The offline segment is expected to witness lucrative growth over the forecast period. Reluctance to try online channels due to a host of factors such as the crisis of credibility and trust, well-established network of shopping malls, supermarkets, hypermarkets across the country, and dedicated shelf spaces earmarked for such cosmetic products are some of the factors favoring the segment growth.

Competitive Insight

Some of the major players operating in the Saudi Arabia halal cosmetics market include Amara Cosmetics, Inc., Clara International, IBA Halal Care, INIKA, Intercosmetic Asia Pacific Sdn Bhd, Martha Tilaar Group, MMA Bio Lab Sdn Bhd, Muslimah Manufacturing Sdn. Bhd., Nizona Corporation, NUTRALab, PHB Ethical Beauty, Prolab Cosmetics, Saaf Skincare, Sampure Minerals, Talent Cosmetic Co., Ltd, and Zelcos.

Saudi Arabia Halal Cosmetics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 3.82 billion |

|

Revenue forecast in 2030 |

USD 22.87 billion |

|

CAGR |

23.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Distribution Channel |

|

Key companies |

Amara Cosmetics, Inc., Clara International, IBA Halal Care, INIKA, Intercosmetic Asia Pacific Sdn Bhd, Martha Tilaar Group, MMA Bio Lab Sdn Bhd, Muslimah Manufacturing Sdn. Bhd., Nizona Corporation, NUTRALab, PHB Ethical Beauty, Prolab Cosmetics, Saaf Skincare, Sampure Minerals, Talent Cosmetic Co., Ltd, and Zelcos. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Global Specialty Generic Drugs Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- AI-based Clinical Trial Solutions For Patient Matching Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Agricultural Adjuvants Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Automotive Brake Systems Market Research Report, Size & Forecast, 2018 – 2026

- Gaucher Disease Treatment Market Research Report, Size, Share & Forecast by 2017 - 2025