Saudi Arabia Bus Market Share, Size, Trends, Industry Analysis Report, By Type (Single Deck, Double Deck); By Seating Capacity (15-30, 31-50, Over 50); By Fuel Type (Diesel, Electric/Hybrid, Others); Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 101

- Format: PDF

- Report ID: PM2152

- Base Year: 2021

- Historical Data: 2018-2020

Report Summary

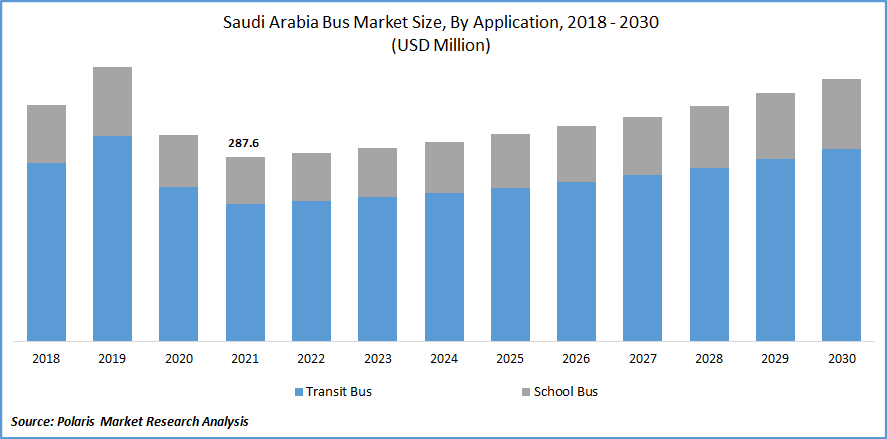

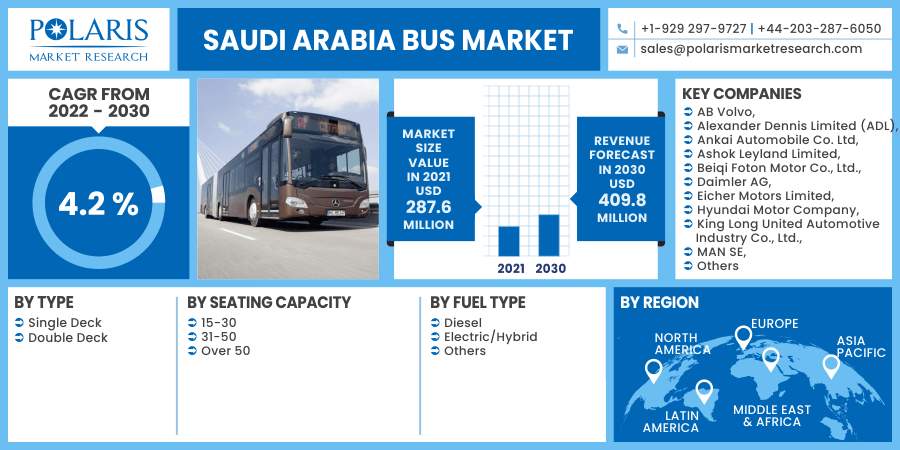

The global Saudi Arabia bus market was valued at USD 287.6 million in 2021 and is expected to grow at a CAGR of 4.2 % during the forecast period. Increasing investment by government and private entities in public transport along with rising urbanization is expected to drive the industry growth. Saudi Arabia's bus industry is among the biggest in the Middle East. Due to increased demand for public transportation, industrial progress, and expanding tourist industry, the UAE and Saudi Arabia are the top buyers of buses.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The rapid emergence of the COVID-19 virus has severely hampered the execution of structural reforms and growth in Saudi Arabia since infrastructure construction and strategy implementation have halted.

Furthermore, the country's economic upheaval has been exacerbated by constraints on oil revenues as a result of trade limitations. Falling oil prices and uncertainties in the oil business weighed on the Saudi Arabia economy in 2020.

Saudi Arabia's automotive distribution network is also experiencing various interruptions due to the nation's reliance on imports. The prohibition on foreign flights and commerce with other countries imposed to combat the COVID-19 virus has curtailed the number of car orders placed in the nation.

Furthermore, the consumer tendency to avoid congested locations has resulted in a decrease in demand for public transportation, which is expected to hinder the Saudi Arabia bus market expansion over the forecast period.

Know more about this report: request for sample pages

Market Dynamics

Growth Drivers

Under national Saudi Vision 2030, the nation intends to develop and improve public transportation, which would be expected to have a growth perspective for the industry development in the following years.

Furthermore, the government is focused on local bus manufacture in order to provide job prospects and reduce import prices, ultimately strengthening the domestic sector, which in turn will boost the Saudi Arabia bus market over the forecast period.

Increasing government initiatives to increase the country's automotive sector is expected to boost the Saudi Arabia bus market over the forecast period. For instance, the Saudi National Automotive Manufacturing Company ("SNAM") was set up by the government as the region of Saudi Arabia's first vehicular production corporation to build an integrated and sustainable nationwide auto sector through a strategic alliance with the South Korean SsangYong Motor Company.

Restraints

The temperature and geography in Saudi Arabia, on the other hand, provide significant hurdles to road development. Temperatures can be extremely high, mainly in desert settings which necessitates a proper selection of pavement construction components to assure no distortion, especially under strong traffic loads, which is expected to hinder the market.

Report Segmentation

The market is segmented on the basis of type, seating capacity, and fuel type.

|

By Type |

By Seating Capacity |

By Fuel Type |

|

|

|

Know more about this report: request for sample pages

Insight by Type

Double-decker type segment is expected to grow at the fastest pace over the forecast period due to increasing demand for comfortable travel along with the increasing disposable income. Furthermore, in the aftermath of the COVID-19 pandemic, the need for double-decker busses capable of offering improved protection and cleanliness is increasing, which in turn is expected to increase the demand for the segment over the forecast period.

Insight by Fuel Type

Diesel fuel segment dominated the market in 2020 and is expected to grow steadily over the forecast period due to low prices and the presence of sizeable vehicle quantity in the country. Though the electric/hybrid segment is expected to grow at the fastest pace over the forecast period due to rising awareness regarding increasing air pollution along with decreasing battery prices.

Furthermore, increasing government initiatives regarding clean energy and reducing pollution is expected to increase the demand for the segment. Additionally, stringent government regulations regarding vehicle emission and the decrease in the maintenance cost compared to others are also expected to fuel the trend.

Competitive Insights

Some of the major players operating in the market include AB Volvo, Alexander Dennis Limited (ADL), Ankai Automobile Co. Ltd, Ashok Leyland Limited, Beiqi Foton Motor Co., Ltd., Daimler AG, Mitsubishi Fuso TruckEicher Motors Limited, Hyundai Motor Company, King Long United Automotive Industry Co., Ltd., MAN SE, Mercedes Benz AG, and Bus Corporation, Scania AB, Tata Motors Limited, Toyota Motor Corporation.

These market players are investing in research & development to introduce innovative technology and are adopting strategies such as new product launches, mergers & acquisitions, and others to increase their product portfolio and to increase their market dominance.

For instance, Ashok Leyland launched two passenger bus types in Saudi Arabia in December 2020. Falcon buses would be sold primarily to corporate clients and will be produced in the firm's Ras Al Khaimah factory in the UAE.

Saudi Arabia Bus Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 287.6 million |

|

Revenue forecast in 2030 |

USD 409.8 million |

|

CAGR |

4.2 % from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Seating Capacity, By Fuel Type |

|

Key Companies |

AB Volvo, Alexander Dennis Limited (ADL), Ankai Automobile Co. Ltd, Ashok Leyland Limited, Beiqi Foton Motor Co., Ltd., Daimler AG, Eicher Motors Limited, Hyundai Motor Company, King Long United Automotive Industry Co., Ltd., MAN SE, Mercedes Benz AG, Mitsubishi Fuso Truck and Bus Corporation, Scania AB, Tata Motors Limited, Toyota Motor Corporation. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Metal Powder Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Diethylene Glycol Monoethyl Ether Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Mortuary Bags Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Cable Blowing Equipment Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Glycolic Acid Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030