Rubber Processing Chemicals Market Share, Size, Trends, Industry Analysis Report, By Product (Accelerators, Anti-Scorch Agents, Blowing Agents, Anti-degradants, Flame Retardants, Processing Aid, Polymerization Regulation); By Application; By End-Use; By Regions; Segment Forecast, 2021 - 2028

- Published Date:Apr-2021

- Pages: 101

- Format: PDF

- Report ID: PM1842

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Summary

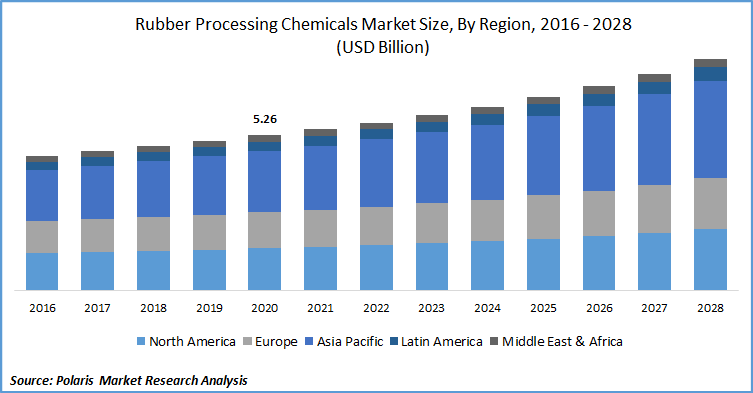

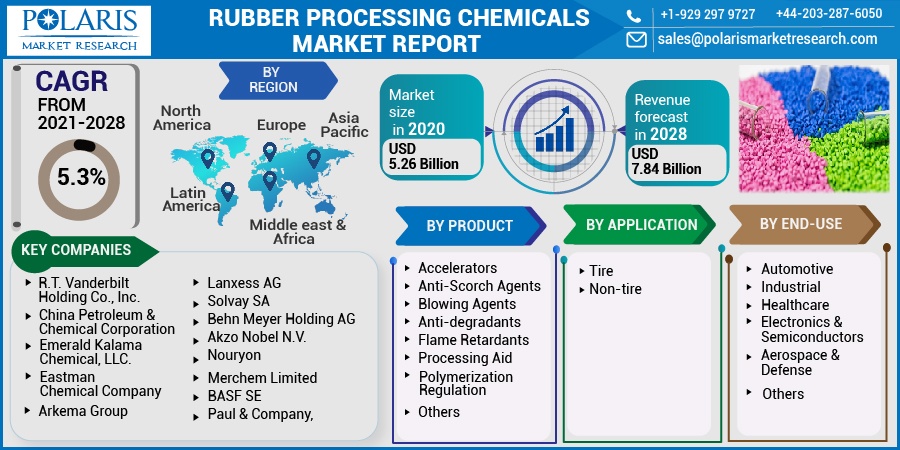

The global rubber processing chemicals market size was valued at USD 5.26 billion in 2020 and is expected to grow at a CAGR of 5.3% during the forecast period. Rubber processing chemicals are used in varied applications such as automotive, construction, industrial, manufacturing, and footwear among others.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

The use of rubber processing chemicals has increased to offer protection to rubber goods against external influences. Long-term exposure to heat, ozone, UV light, and chemicals leads to the destruction of rubber products. Rubber processing chemicals such as flame-retardant accelerators, anti-degradants, and processing aids are used to provide aging resistance, higher strength, durability, and improved performance.

The market demand for rubber processing chemicals is significantly high in the automotive industry. Rubber processing chemicals are widely used in the manufacturing of tires, and other automotive components such as body sealing systems, transmission systems, and automotive antivibration systems among others. The use of the product in tire manufacturing improves the life of tires, enhances fuel economy, and improves vibration and impact absorption.

Industry Dynamics

Growth Drivers

The rising market demand for passenger vehicles coupled with the growing electrification of vehicles and an increasing need to improve vehicle performance has fueled the market growth of rubber processing chemicals across the globe. The introduction of stringent safety regulations and the growing need for road safety has increased the use of the product in tire manufacturing market.

Accelerators are used in rubber compounds to escalate the vulcanization speed at reduced temperatures and offer higher efficiency. Primary accelerators are chemicals that offer scorch delay, medium to fast cure, and efficient modulus development. Thiazoles and Sulfenamides are primary vulcanization accelerators widely adopted for their broad vulcanization plateau, and high aging resistance. Secondary accelerators, such as Dithiocarbamate, Thiurams, and Guanidines, offer faster curing along with enhanced elasticity, durability, and tensile strength.

The adoption of processing aids has increased across various applications to improve the processing characteristics of rubber without influencing its physical properties. Processing aids are used along with rubber to offer superior properties such as lubrication, stabilization, strength, and softening, among others. They also impart properties such as filler dispersion, viscosity reduction, and enhanced extrusion characteristics to rubber products.

The global market for rubber processing chemicals is fueled by the economic growth in countries such as China, Japan, and India, rising industrialization, and growing demand for automobiles in Asia-Pacific. Global players are expanding into these countries to tap market potential provided by the automotive, industrial, and construction sectors, further boosting the market growth.

Growing disposable income, changing lifestyles, increasing investment in the automotive industry, and rising application in the manufacturing sector would provide market growth opportunities during the forecast period. Technological advancements, new product launches, and acquisitions by leading players in the market have strengthened the market for rubber processing chemicals.

Know more about this report: Request for sample pages

Rubber Processing Chemicals Market Report Scope

The market is primarily segmented on the basis of product, application, end-use, and region.

|

By Product |

By Application |

By End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Product Outlook

The product market segment has been divided into accelerators, anti-scorch agents, blowing agents, anti-degradants, flame retardants, processing aid, polymerization regulation, and others. The demand for anti-degradants is expected to be high during the forecast period owing to the greater need to prevent degradation of rubber products from environmental factors such as excessive heat, oxygen, ozone, UV light and weathering, storage aging, dynamic flex, and catalytic degradation. The use of anti-degradants enables rubber products to hold their properties and provide longer life.

Application Outlook

On the basis of application, the market is segmented into tire and non-tire. The tire segment dominated the global market for rubber processing chemicals in 2020. Rubber processing chemicals are widely used for the manufacturing of tires. Growing modernization of vehicles, integration of advanced technologies, development of autonomous vehicles, the introduction of stringent vehicular safety regulations, and increasing penetration of luxury vehicles are some factors influencing the growth of this market segment.

End-Use Outlook

The end-use segment has been divided into automotive, electronics and semiconductors, aerospace and defense, industrial, healthcare, and others. The automotive segment dominated the global market in 2020 owing to increasing use in tire manufacturing and other automotive components. The increasing demand for passenger vehicles and the introduction of stringent safety regulations further support the growth of this segment. Other driving factors include owing to rising disposable income, changing lifestyles of consumers, growth in automotive production volume, and increasing need for fuel-efficient vehicles.

Regional Outlook

Asia Pacific dominated the global market for rubber processing chemicals in 2020. The industrial growth in countries such as China, India, and Japan, and the established automotive industry drives the growth of this region. Increasing urbanization, expansion of international players in this region, and technological advancements are some factors attributed to the growth of this region.

Increasing demand for passenger vehicles and initiatives to promote adoption of electric vehicles in developing countries of this region further boosts the rubber processing chemicals market growth. Easy availability of raw materials and growing applications in the industrial, aerospace & defense, and electronics sector have further increased the demand for rubber processing chemicals in Asia Pacific.

Competitive Landscape

The leading players in the rubber processing chemicals market include Eastman Chemical Company, Arkema Group, Emery Oleochemicals Group, Merchem Limited, BASF SE, Paul & Company, Kumho Petrochemical Co., Ltd., Sinochem Group Co., Ltd., Lanxess AG, Solvay SA, Behn Meyer Holding AG, Akzo Nobel N.V., China Petroleum & Chemical Corporation, R.T. Vanderbilt Holding Co., Inc., Nouryon, and Emerald Kalama Chemical, LLC.

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Electronic Health Records Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Ethylene Market Research Report, Size, Share & Forecast by 2021 - 2029

- Water and Wastewater Treatment Equipment Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Payment Gateway Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Green Ammonia Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030