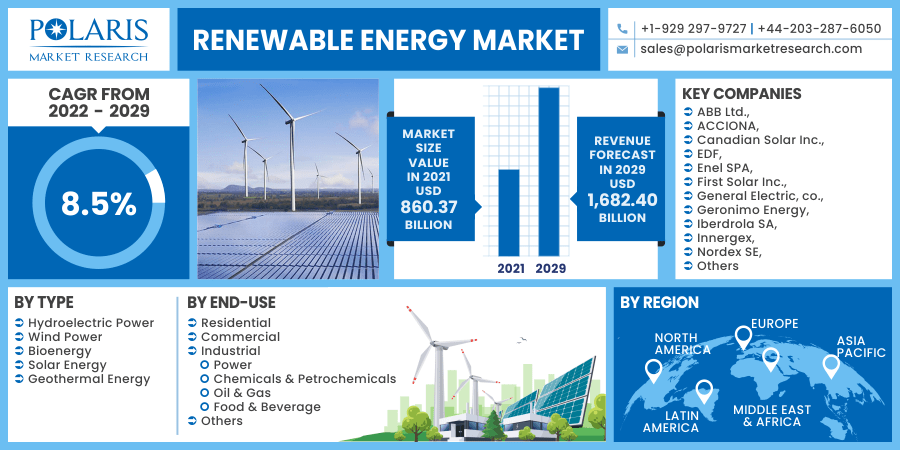

Renewable Energy Market Share, Size, Trends, Industry Analysis Report, By Type (Hydroelectric Power, Wind Power, Bioenergy, Solar Energy, Geothermal Energy); By End-Use (Residential, Commercial, Industrial {Power, Chemicals & Petrochemicals, Oil & Gas, Food & Beverage}, Others); By Region; Segment Forecast, 2022 - 2029

- Published Date:Jan-2022

- Pages: 101

- Format: PDF

- Report ID: PM2147

- Base Year: 2021

- Historical Data: 2017 - 2020

Report Summary

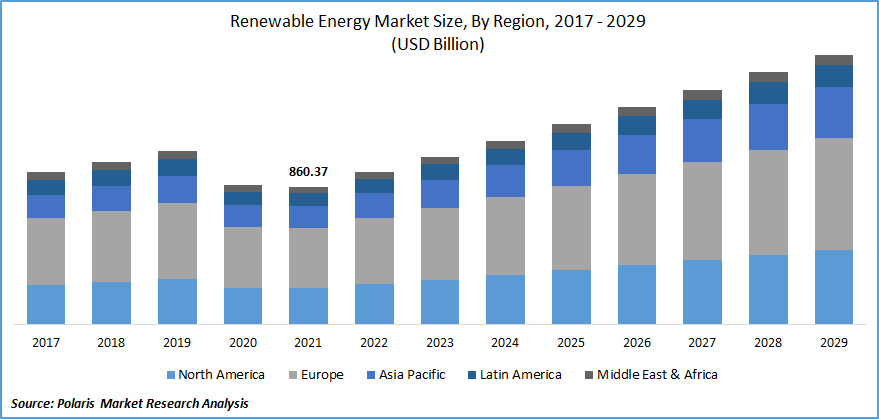

The global renewable energy market was valued at USD 860.37 Billion in 2021 and is expected to grow at a CAGR of 8.5% during the forecast period.

Concerns about reducing greenhouse gas emissions, an increase in the search for power security, resistance to traditional nuclear power, and a lack of advancement in nuclear power application are projected to stimulate market demand for geothermal power during the forecast period.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

For instance, the Climate Act calls for a 49% reduction in greenhouse gas emissions by 2030 versus 1990 levels and a 95% reduction by 2050. The National Climate Agreement includes sector agreements on what they will do to help reach these climate goals. The sectors such as electricity, industry, the built environment, traffic and transportation, and agriculture and land use are among others on which the government focuses on reaching climate goals.

By 2030, all new passenger automobiles will be emission-free. Encouragement for electric vehicles through various tax measures include support for the used car market; 1.8 million charging stations by 2030. Thus, the government's support for the multiple sectors to reduce GHG emissions boosts the renewable energy market growth during the forecast period.

Further, both emerging and developed countries have prioritized the promotion of clean power sources due to increased output efficiency, less pollution, and low maintenance costs. For example, as per the International Energy Agency, renewable power sources accounted for around 95% of the increase in global power capacity until 2026.

The renewable capacity from 2021 to 2026 is estimated to be 50% greater than from 2015 to 2020. All of these reasons, taken together, increase market demand for renewable power, hence boosting global renewable energy market growth.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Increasing investments in renewable power sources and favorable government policies are expected to boost the market growth over the forecast period. The National Ocean Industries Association developed the U.S.'s first offshore wind farm in 2017.

The U.S. wind power additions are growing strongly, with 9,000 MW of new capacity added in 2019. This brought a total U.S. capacity to 105.6 GW. Seventeen states installed 18 M.W. of highly scalable wind capacity in 2019, totaling 2,166 units and a $67 million expenditure. Distributed wind systems have been installed throughout Pennsylvania to California to support agricultural, commercial, governmental, industrial, institutional, residential, and municipal users.

Additionally, in September 2021, the U.K. government established a $1.2 billion package for public and private investment in India's green initiatives and renewable power. They have established a Climate Finance Leadership Initiative (CFLI) India collaboration, intending to mobilize private financing for sustainable infrastructure in India. These investments would help India meet its 450 Gw renewable power by 2030. Thus, the investment by the government for renewable power sources is boosting the market growth during the forecast period.

Report Segmentation

The market is primarily segmented based on type, end-use, and region.

|

By Type |

By End-Use |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Type

Based on the type segment, the hydroelectric power segment is the most significant revenue contributor in the global market in 2021 and is expected to retain its dominance during the forecast period. Brazil saw a tremendous quantity of hydropower development. There has been an uptick in activity across the continent, including significant projects in Colombia and Peru. Raised investments in off-grid electricity production and grid connection in developing countries like India, China, Brazil, and Vietnam have increased market demand for small hydropower facilities.

Furthermore, measures such as the Ministry of New and Renewable Power's Small Hydropower Programme and the Government of India's Rajiv Gandhi Grameen Vidyutikaran Yojana energize remote regions and encourage the use of small hydroelectric power for off-grid and mini-grid are anticipated to drive the market.

Geographic Overview

In terms of geography, North America had the highest share in 2021. The collaboration among the countries for the increasing power sources is boosting the region's growth. For instance, in March 2021, The U.S. and India have decided to organize their strategic power relationship to collaborate in cleaner power areas such as biofuels and hydrogen generation. The two countries would step up efforts to capitalize on advanced U.S. technologies and India's rapidly expanding power sector.

Moreover, Asia Pacific is expected to witness a high CAGR in the global market over the forecast period. Countries like China and India have seen considerable increases in power consumption due to increased investment in renewable power projects. According to the International Business Environment Forum, FDI inflows into India's non-conventional power business reached US$ 10.28 billion between April 2000 and June 2021. (DPIIT). Since 2014, over US$ 42 billion has been invested in India's renewable power sector.

In 2018, the nation's new renewable power investment was US$ 11.1 billion. Copenhagen Infrastructure Partners (CIP) announced an agreement to develop with Amp Energy India Private Limited in August 2021 to facilitate combined equity investments of more than US$ 200 million in Indian renewable power projects; during the projection period in Asia-Pacific, the residential and industrial sectors are expected to require more power.

Competitive Insight

Some of the major players operating in the global market include ABB Ltd., ACCIONA, Canadian Solar Inc., EDF, Enel SPA, First Solar Inc., General Electric, co., Geronimo Energy, Iberdrola SA, Innergex, Nordex SE, Orsted A/S, Siemens Gamesa, Sunpower Corp., The Tata Power Company Limited (Tata Power), Vestas Wind Systems, and Xcel Energy Inc.

Renewable Energy Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 860.37 Billion |

|

Revenue forecast in 2029 |

USD 1,682.40 Billion |

|

CAGR |

8.5% from 2022 - 2029 |

|

Base year |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2029 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2029 |

|

Segments covered |

By Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

ABB Ltd., ACCIONA, Canadian Solar Inc., EDF, Enel SPA, First Solar Inc., General Electric, co., Geronimo Energy, Iberdrola SA, Innergex, Nordex SE, Orsted A/S, Siemens Gamesa, Sunpower Corp., The Tata Power Company Limited (Tata Power), Vestas Wind Systems, and Xcel Energy Inc. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Interactive Whiteboard Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- AI-based Clinical Trial Solutions For Patient Matching Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Game-Based Learning Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Sunglasses Market Research Report, Size, Share & Forecast by 2020 - 2026

- Superhydrophobic Coatings Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030