Real Estate Crowdfunding Market Share, Size, Trends, Industry Analysis Report, By Investors (Individual, Institutional); By Model (Lending, Equity); By Real Estate Sector (Residential, Commercial); By Region; Segment Forecast, 2022 - 2030

- Published Date:Feb-2022

- Pages: 101

- Format: PDF

- Report ID: PM2292

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Summary

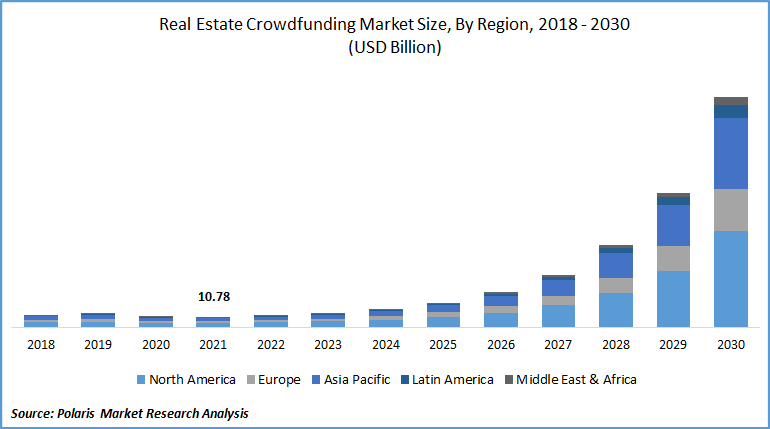

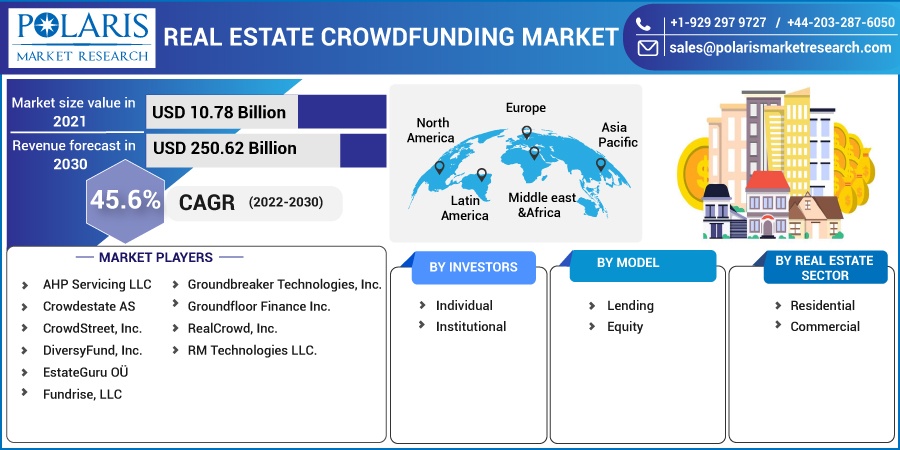

The global real estate crowdfunding market was valued at USD 10.78 billion in 2021 and is expected to grow at a CAGR of 45.6% during the forecast period. Real estate crowdfunding is a new innovative method for investing in the commercial & residential sector. These investments are gaining traction as more investors globally are looking out to diversify and de-risk their portfolios.

Know more about this report: request for sample pages

The growth of the industry can be primarily attributed to the rising industrialization and globalization, which is estimated to fuel the ever-increasing commercial activities. Furthermore, the implementation of favorable rules & regulations by government bodies across nations is anticipated to boost the growth of the global industry.

For instance, the changes made to SEC (Securities & Exchange Commission) regulations, allowing non-accredited and accredited investors to invest in real estate crowdfunding deals using online platforms, provide huge flexibility to new investors. Moreover, the growing trend of the adoption of cryptocurrency by most real estate crowdfunding platforms is estimated to drive the growth of the global industry.

The spread of the COVID-19 reflects the downfall in the industry growth on account of the significant disruptions in commercial activities. The COVID-19 outbreak has shifted the focus of investors to invest towards essential goods, hampering the investments towards the real estate crowdfunding market.

Further, the reduced consumer and corporate spending are estimated to hinder the industry growth. However, the flow of investments has not been majorly impacted as a huge number of investments in the industry starting around USD 100. Further, the growing adoption of online operations of businesses is anticipated to boost the growth of the industry. Moreover, the investments in the industry are projected to bounce back as governments across nations are lifting lockdown restrictions.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The exponential growth of the construction industry is the major driving factor for industry growth. The rising construction activities across both residential and commercial sectors worldwide are accelerating industry growth. The industry is growing because of the rising commercial activities, including the development of various commercial infrastructures such as apartments, hospitals, government buildings, educational institutions, and corporate offices.

On account of these developments, the growing need for investment of funds in order to promote these developments is anticipated to boost the growth of the industry. According to RICS Economics, the global CAI (Construction Activity Index) increased to +25 in Q2 2021 when compared to +14 of Q1 2021. Therefore, these factors are positively influencing the global demand in the approaching years.

Report Segmentation

The market is primarily segmented on the basis of investors, model, real estate sector, and region.

|

By Investors |

By Model |

By Real Estate Sector |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Investors

The institutional investor segment is recorded to hold the largest revenue share in 2021 and is expected to lead the industry in the forecasting years. This huge share of the segment can be attributed to the large amount of money invested by institutions at a given time.

For instance, institutional investors generally invest over USD 10 million; this significantly helps the online platforms raise a large sum of money at once. Nowadays, there is a recent trend in the global industry of the investments made by institutional investors such as insurance companies & pension funds, among others. The individual investor segment is projected to show the highest growth rate in the forecasting years.

The fast growth of the segment can be attributed to the growing use of real estate crowdfunding platforms by the population globally. As major real estate crowdfunding platforms start with investments as low as USD 100, enabling a large number of people to invest in the industry. Furthermore, the favorable crowdfunding regulations for the investment by individuals are anticipated to boost the growth of the segment.

Geographic Overview

Asia Pacific accounted for the largest market share in the global market in 2021. This huge market share can be attributed to the increasing commercial construction activities in emerging nations. These construction activities are backed by rising industrialization. Further, the growth of the industry is fuelled by the rapid urbanization, improving living standards, and rising disposable income of the population in the emerging nations. The emerging nations such as South Korea, India, Japan, and China are primarily attributing towards the market growth. Additionally, the rising adoption of innovative technologies such as digital payments, blockchain, machine learning, and others is anticipated to drive the growth of the market.

Moreover, the North American real estate crowdfunding market is anticipated to exhibit the highest CAGR over the forecasting years. The fast growth of the market in the region can be attributed to the increasing popularity & awareness regarding crowdfunding platforms. Furthermore, the rising focus of non-institutional investors for investing in crowdfunding platforms in the industry on account of the supportive regulatory landscape and high expected returns is anticipated to boost the growth of the market in the US. Additionally, the presence of key leading institutional investors in North America is anticipated to drive market growth.

Competitive Insight

Some of the major players operating in the global market include AHP Servicing LLC, Crowdestate AS, CrowdStreet, Inc., DiversyFund, Inc., EstateGuru OÜ, Fundrise, LLC, Groundbreaker Technologies, Inc., Groundfloor Finance Inc., RealCrowd, Inc., and RM Technologies LLC.

Real Estate Crowdfunding Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 10.78 billion |

|

Revenue forecast in 2030 |

USD 250.62 million |

|

CAGR |

45.6% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Investors, By Model, By Real Estate Sector, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

AHP Servicing LLC, Crowdestate AS, CrowdStreet, Inc., DiversyFund, Inc., EstateGuru OÜ, Fundrise, LLC, Groundbreaker Technologies, Inc., Groundfloor Finance Inc., RealCrowd, Inc., and RM Technologies LLC. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Epoxy Adhesives Market Share, Size, Trends, Industry Analysis Report, 2020-2026

- Artificial Intelligence Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Infertility Treatment Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Breathalyzer Market Share, Size, Trends, Industry Analysis Report, 2020-2027

- Neuralgia Treatment Market Share, Size, Trends, Industry Analysis Report, 2020-2027