Polyol Sweeteners Market Share, Size, Trends, Industry Analysis Report, By Type (Isomalt, Erythritol, Xylitol, Sorbitol, Mannitol, Others); By Application (Cosmetics and Personal Care, Food & Beverages, Pharmaceutical, Others); By Form (Liquid, Powder); By Distribution Channel; By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 101

- Format: PDF

- Report ID: 2110

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Summary

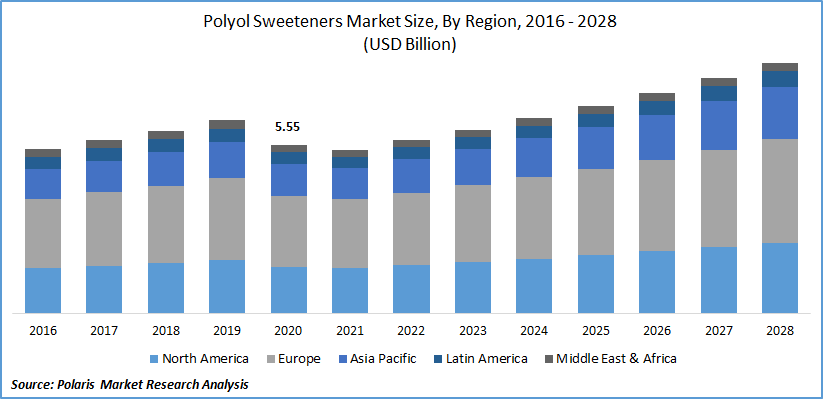

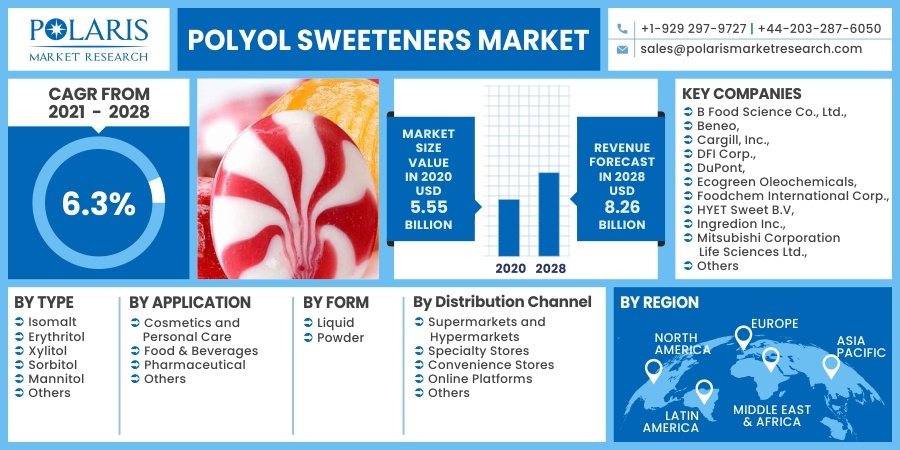

The global polyol sweeteners market size was valued at USD 5.55 billion in 2020 and is expected to grow at a CAGR of 6.3% during the forecast period. Polyol sweeteners are increasingly being used in food and beverages with low calorie and sugar content. They are a cluster of low-digestible carbohydrates, which are used in sugar-free diets. They also offer benefits such as weight management and improved oral health.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Some polyol sweeteners available in the industry include isomalt, sorbitol, maltitol, and xylitol, among others. Polyol sweeteners are also used as a binder, bulking agent, and humectant. Some applications of polyol sweeteners include baked goods, dairy, oral care products, and pharmaceuticals. The rise in demand for F&B with health benefits and low-calorie content has increased the demand for polyol sweeteners. Consumers are conscious regarding their sugar intake to maintain weight and overall wellness. Increasing health concerns and the sedentary lifestyle of consumers are expected to fuel the growth of polyol sweeteners market.

Growing disposable income of consumers and modifying lifestyles have further increased the consumption of polyol sweeteners. Growing application in oral care products and rising demand from the pharmaceutical sector are anticipated to aid the polyol sweeteners industry's growth over the forecast period. Polyol sweeteners are increasingly being used in the pharmaceutical industry to produce pills, tonics, and gelatin capsules, among others.

There has been significant growth in obesity across the globe, which leads to greater chances of acquiring obesity-related diseases such as diabetes and cardiovascular diseases. Consumption of food products with many carbohydrates, such as sugars and starches, contributes significantly to health problems.

Know more about this report: request for sample pages

Increasing concerns about healthy living have encouraged consumers to decrease their calorie and sugar intake, thereby increasing the demand for polyol sweeteners. There has been increased consumption of fast food in developing countries of Asia-Pacific. The growing adoption of western culture and rising disposable income of consumers in emerging economies encourages market players to incorporate polyol sweeteners in products to cater to changing tastes of consumers while also offering the health benefits associated with it.

Increasing awareness regarding the consumption of dietary supplements and products derived from natural ingredients supports the market growth of polyol sweeteners. Nevertheless, government restrictions on travel and lockdowns, disturbance in the supply chain, stopping of industrial activities, and restricted procurement of raw materials and personnel have all had a significant impact on polyol sweeteners industry growth.

Report Segmentation

The market is primarily segmented on the basis of type, application, form, distribution channel, and region.

|

By Type |

By Application |

By Form |

By Distribution Channel |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Type

On the basis of type, the market is segmented into isomalt, erythritol, xylitol, sorbitol, mannitol, and others. The demand for sorbitol is expected to be high during the forecast period. It provides a sugar-like taste with a low cooling effect. It is widely used in the food & beverage sector as it is an excellent humectant, freeze point depressant, crystallization inhibitor, and excipient. It is used in a variety of food products, including baked goods, cakes and cookies, chocolate, and frozen treats. Sorbitol is also used as a humectant and thickener in cosmetic products.

Insight by Application

The application polyol sweeteners segment has been bifurcated into food & beverages, cosmetics and personal care, pharmaceutical, and others. The demand from the food & beverages polyl segment is expected to be high during the forecast period. Increasing use in confectionery and dairy products for balanced sweetness, texture, reduced-calorie value, low glycemic index, and non-cariogenic properties supports the growth of the segments.

The sedentary lifestyle of consumers is encouraging them to focus on health and nutrition to maintain overall wellness. Increasing disposable incomes in developing countries and rising awareness associated with the health benefits of polyol sweeteners further foster the polyol market growth.

Insight by Form

On the basis of form, the market is segmented into liquid, and powder. The demand for powdered polyol sweeteners is expected to be high during the forecast period due to greater use in food & beverages manufacturing. Powdered polyol sweeteners are being widely used in food products such as baked goods, confectionery, dairy, and frozen desserts due to ease of use and storage, functional benefits, and increased shelf life.

Insight by Distribution Channel

The distribution channel segment has been divided into specialty stores, supermarkets and hypermarkets, online platforms, convenience stores, and others. The supermarkets and hypermarkets segment accounted for a major share in 2020. These stores bridge the gap between manufacturers and customers by offering a wide range of product variety at the same place. These stores are mainly rooted in highly populated cities and urban cities. Consumers are increasingly shopping for polyol sweeteners from these stores owing to heavy discounts, availability of a large variety of products under a single roof, and promotional offers to attract consumers.

Geographic Overview

Europe dominated the global polyol sweeteners market in 2020. The high disposable income of consumers and increasing application in the personal care sector drive the market growth in this region. High living standards, growing consumption of convenience food, shifting trend towards nutrition and wellness, and rising production of bakery and dairy products are some factors attributing to the polyol market's growth in Europe. The increasing inclination of consumers towards natural products and growing utilization in the pharmaceuticals sector further support the market growth.

Competitive Landscape

The leading players in the polyol sweeteners market include B Food Science Co., Ltd., Beneo, Cargill, Inc., DFI Corp., DuPont, Ecogreen Oleochemicals, Foodchem International Corp., HYET Sweet B.V, Ingredion Inc., Mitsubishi Corporation Life Sciences Ltd., Roquette Frères, Shandong Futaste Co., SPI Pharma, PT, Sweeteners Plus, LLC., and Zhejiang Huakang Pharmaceutical Co., Ltd.

These players are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their presence in the market. The companies are also introducing new innovative products in the market to cater to the growing consumer demands.

Polyol Sweeteners Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 5.55 billion |

|

Revenue forecast in 2028 |

USD 8.26 billion |

|

CAGR |

6.3% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Type, By Application, By Form, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

B Food Science Co., Ltd., Beneo, Cargill, Inc., DFI Corp., DuPont, Ecogreen Oleochemicals, Foodchem International Corp., HYET Sweet B.V, Ingredion Inc., Mitsubishi Corporation Life Sciences Ltd., Roquette Frères, Shandong Futaste Co., SPI Pharma, PT, Sweeteners Plus, LLC., and Zhejiang Huakang Pharmaceutical Co., Ltd. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Pea Protein Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Geriatric Medicines Market Research Report, Size, Share & Forecast by 2018 - 2026

- Trade Surveillance Systems Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Law Enforcement Software Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- C-Reactive Protein Testing Market Share, Size, Trends, Industry Analysis Report, 2022 - 2029