Plant-Based Meat Market Share, Size, Trends, Industry Analysis Report, By Source (Soy, Wheat, Pea, and Others); By Product (Burger Patties, Sausages, Strips & Nuggets, Meatballs, Others); By Application (Retail Outlets, Foodservice, E-commerce), By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 101

- Format: PDF

- Report ID: PM1689

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Summary

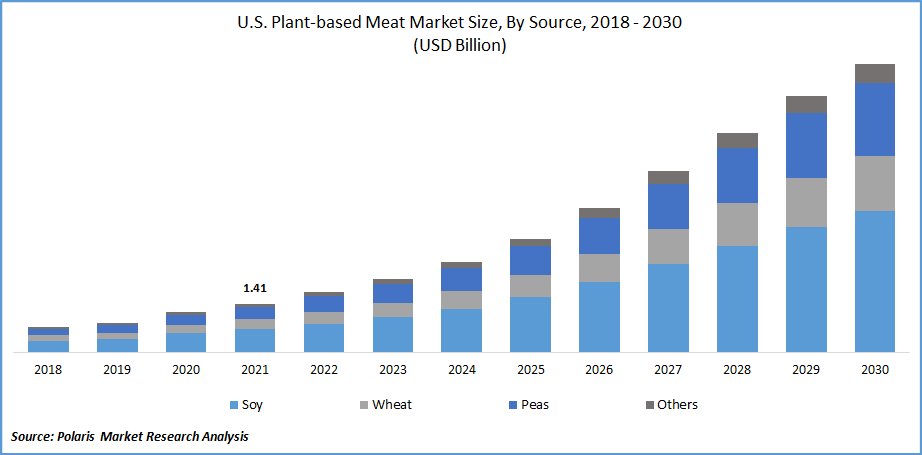

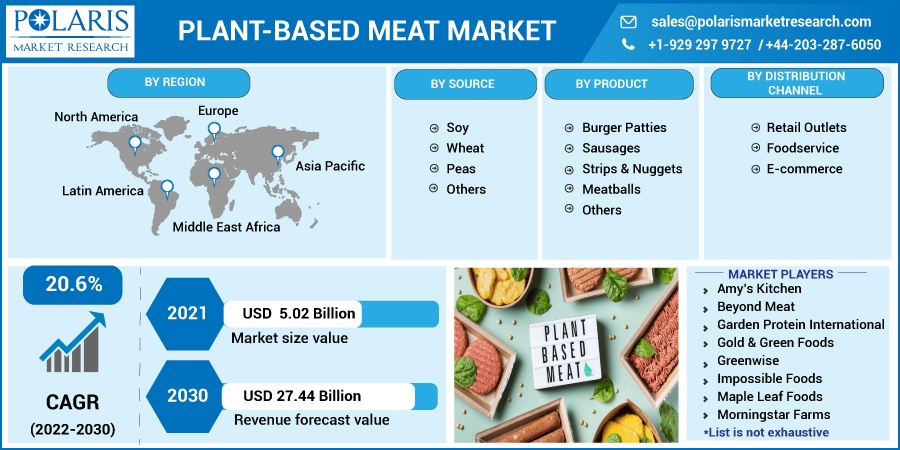

The global plant-based meat market was valued at USD 5.02 billion in 2021 and is expected to grow at a CAGR of 20.6% during the forecast period. Increasing awareness regarding nutrient contents along with rising concerns regarding animal slaughter is expected to propel the industry's growth.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Additionally, people all around the globe are opting for plant-derived flesh substitutes due to the environmental effect and malpractices due to animal husbandry and meat manufacturing which is contributing to markets growth. Furthermore, the emergence of flexitarian consumers to decrease flesh consumption is fueling the product demand.

Coronavirus pandemic in meat-packing factories caused widespread scarcity and shed light on how the business functions. Furthermore, increasing plant-based and flesh substitute items are emerging on grocery store shelves around the country, which is expected to increase the demand for the plant-based non-veg industry over the projected period.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Market Dynamics

Growth Drivers

Several of the primary drivers expected to fuel the expansion of the plant-based non-veg alternatives business over the forecasted timeframe include the risk of developing animal-borne illnesses, including COVID-19, rising health problems, desire for healthy food commodities, and organic products.

Consumer knowledge of plant-based non-veg substitutes is rapidly increasing, with more customers wanting these goods owing to their health advantages such as the avoidance of noncommunicable illnesses, digestion issues, and overweight.

In addition, COVID-19 has contributed to the growing demand for plant-based non-veg, which is regarded as an immunity booster. Furthermore, the product category allows many flexitarians to experience the flavor of non-veg despite ingesting animal products which in turn is fueling the industry growth.

Report Segmentation

The market is segmented on the basis of product, source, distribution channel, and region.

|

By Source |

By Product |

By Distribution Channel |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Source

The soy segment is expected to hold the majority of share over the forecast period as soy is a high-quality provider of plant-based fiber and protein along with its wide application in preparing burgers, and sausages.

Furthermore, soy contains all nine essential amino acids along with rich in magnesium and potassium. These benefits of soy are expected to increase the demand for soy meat alternatives over the forecast period.

Insight by Product

Burger patties segment dominated the global plant-based meat market in 2021 and is expected to grow at a significant pace over the forecast period due to similar taste and faster production. Furthermore, these burger patties mimic the taste and texture of beef that attracts more customers by giving non-veg flavor to the burger.

Insight by Distribution Channel

E-commerce distribution channel held the major share in 2021 and is expected to maintain its trend over the forecast period due to availability and wider selection options. Additionally, the COVID-19 outbreak has led consumers to shop online due to fear of virus transmission, which has benefited the segment growth. Furthermore, increasing internet users is expected to lead manufacturers to promote plant-based non-veg products online, which in turn will increase the product demand over the forecast period.

Geographic Overview

North America held the largest plant-based meat market share in 2021 and is expected to maintain this trend over the forecast period. Increasing cardiovascular diseases, including cancer and diabetics, has led consumers to opt for plant-based non-veg products as it helps prevent these diseases, which in turn is boosting the plant-based meat market growth. For instance, in 2020, as per the CDC, 34.1 million individuals had diabetes in the U.S.

Furthermore, increasing trends of vegan diets coupled with the growing adoption of plant proteins in processed foods are expected to propel the market demand over the forecast period. Additionally, consumers are also gravitating towards plant proteins due to allergies induced by animal proteins, as well as the abundance of nutrients found in plant proteins.

Competitive Insights

Some of the major players operating in the global industry include Amy’s Kitchen, Beyond Meat, Garden Protein International, Gold & Green Foods, Greenwise, Impossible Foods, Maple Leaf Foods, Morningstar Farms, Novameat, Omnipork, Quorn Foods, Sunfed, The Vegetarian Butcher, Tofurky, V2food, VBites, and Zikooin.

The expanding market offers both established businesses and disruptors an opportunity to develop and earn market dominance. Mergers & acquisitions, new product launches, and some other strategies adopted by these players to increase their market dominance.

For instance, Beyond Meat revealed the acquisition of a new manufacturing plant in Enschede, the Netherlands, in June 2020, to expand its manufacturing capabilities in Europe.

Plant-Based Meat Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 5.02 billion |

|

Revenue forecast in 2030 |

USD 27.44 billion |

|

CAGR |

20.6 % from 2022 - 2029 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Source, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Amy’s Kitchen, Beyond Meat, Garden Protein International, Gold & Green Foods, Greenwise, Impossible Foods, Maple Leaf Foods, Morningstar Farms, Novameat, Omnipork, Quorn Foods, Sunfed, The Vegetarian Butcher, Tofurky, V2food, VBites, and Zikooin. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Oil Free Air Compressor Market Research Report, Share and Forecast, 2017 – 2026

- Endometrial Ablation Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Dendritic Cell Cancer Vaccine Market Share, Size, Trends, Industry Analysis Report, 2023 - 2032

- Food Service Disposable Market Share, Size, Trends, Industry Analysis Report, 2022 - 2029

- Water Treatment Chemicals Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028