Payment Processing Solutions Market Share, Size, Trends, Industry Analysis Report, By Component (Solutions, Services); By Payment Method; By Deployment Type; By Industry Vertical; By Region; Segment Forecast, 2022 - 2030

- Published Date:Sep-2022

- Pages: 101

- Format: PDF

- Report ID: PM2612

- Base Year: 2021

- Historical Data: 2018-2020

Report Summary

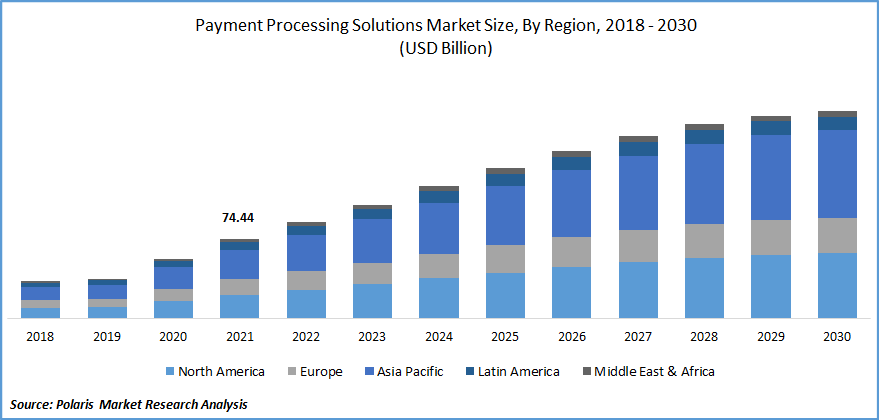

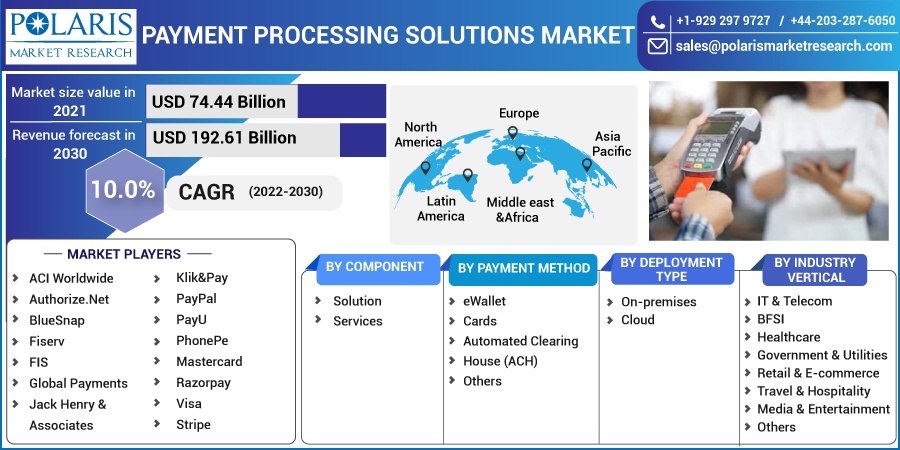

The global payment processing solutions market was valued at USD 74.44 billion in 2021 and is expected to grow at a CAGR 10.0% during the forecast period. Payment processing solutions enable secure and reliable transaction of credit and debit transactions. These solutions include authentication and settlement of payment processes for enhanced profitability and customer experience.

Know more about this report: Request for sample pages

These payment processes include transactions through methods of debit cards, credit cards, and e-wallets. The payment processing companies integrate several emerging technologies such as Europay, Mastercard, and Visa cards (EMV), blockchain, near field communication (NFC), and Payment Card Industry Data Security Standard (PCI DSS) compliance to maintain a secured payment environment.

The payment processing industry has become an adopter of technologies such as data analytics, cloud computing, AI, chatbots, APIs, blockchain, and machine learning. In addition, greater initiatives to enhance and simplify payment while offering superior customer experience and value-added services boost the industry's growth. Adoption & implementation of technologies to reduce operational cost & maintain security in the payment processing industry drives the industry growth.

These enable authorization of debit and credit card purchases. Debit and credit cards are widely used by consumers, wherein the card details are provided by the buyer, which is then transferred to the payment processor.

The popularity of e-wallets has increased over the years. Users are required to sign up for the e-wallet through their bank account or cards. Some prominent e-wallets available in the industry include apple pay, Paypal, and Alipay. Bank transfers are majorly used for B2B transactions for greater control over the transaction, involving self-authorization for initiating.

The COVID-19 pandemic positively influenced the growth of the global market. The pandemic led to the introduction of lockdown by governments leading to the temporary closure of businesses and restricted movement of the population, which led to growth in cashless transactions.

Increased adoption of this system by various industries, growth of e-commerce during the pandemic, and greater need to simplify financial transactions with greater efficiency boosted the adoption of these solutions during the pandemic.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The growth of the global payment processing solutions market is primarily driven by support from governments, regulatory bodies, and other authorities across several countries, which is expected to boost and strengthen the payment processing industry. Furthermore, technological advances in digitization & data processing have increased the availability and convenience of electronic payments.

Several regulatory bodies are playing an active role in accelerating and encouraging the growth of the secured payment processing industry. Increasing use of e-commerce platforms, higher adoption of contactless payments, and rise in mobile transactions are expected to provide growth opportunities to the industry in the coming years.

The popularity of the industry has increased over the years owing to the ease of cashless transactions and enhanced user experience. These solutions enable the processing of financial transactions through diverse and even remote locations, proving beneficial to customers as well as businesses.

Higher penetration of internet services, technological advancement, and reduced costs of mobile devices across the world have resulted in greater adoption of the system. Greater demand for these solutions has been observed in retail, healthcare, BFSI, and entertainment have been observed.

Report Segmentation

The market is primarily segmented based on component, payment method, deployment type, industry vertical, and region.

|

By Component |

By Payment Method |

By Deployment Type |

By Industry Vertical |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Solution segment accounted for the largest market share

By component, the payment processing solutions market is segmented into solutions and services. The market for solutions segment is expected to dominate the market during the forecast period. It includes recurring payments, pay-by-link, shopping carts, hosted payment pages, and mobile wallets, among others, to quickly process payments and save time and effort for both the customers & merchants.

In addition, it provides customers convenience and reliability while making the online payment mode via their mobiles, tablets, and laptops. Secure payment solutions provide access to real-time reporting for managing chargebacks and analyzing transactions, along with various sales activities to observe business performance. Moreover, it also offers a combination of payment processing expertise with mature gateway platform technology, which provides convenience to single vendors in the industry.

e-Wallet is expected to be the fastest growing segment

By payment method, the payment processing solutions market is cards, eWallet, ACH, and Others. Among these, the e-wallet is expected to be the fastest growing segment during the forecast period.

eWallet maintains the details of the customer’s payment status, such as debit and credit card and bank account information, and makes the payment process easier. eWallet is a widely used payment method for online transactions, wherein the money is added to a wallet electronically, which makes online payments easier to process for customers.

On-premises segment accounted for the largest market share

By deployment type, the payment processing solutions market is categorized into cloud and on-premises. Among these, the on-premises segment accounted for the largest market share. On-premise services help enterprise-level companies to take total control over the payment ecosystem without building their own payment gateway.

On-premise deployment brings all the processes and departments together with robust and flexible solutions that can be changed according to a particular company’s requirements. Furthermore, on-premise offers a replacement for the legacy system of processing payments enabling the shift of the payment ecosystem to individual servers for total control.

Retail & e-commerce segment is expected to garner a considerable market growth

By industry vertical, the payment processing solutions market is categorized into IT & Telecom, BFSI, Healthcare, Government & Utilities, Retail & E-commerce, Travel & Hospitality, Media & Entertainment, and others. With the help of the system, retail & e-commerce merchants can accept credit and debit cards and ACH payments on their website, offering fast, flexible, & secure payment options.

Furthermore, payment processing solutions help e-commerce platforms to reduce manual entry, prevent data entry errors, save time, safeguard customers’ payment information and protect the online business from fraud and abuse.

Asia Pacific region is expected to be the fastest growing segment

The Asia Pacific region is expected to be the fastest-growing segment during the forecast period. The rising population adopting digital payments is one of the major factors for the growth of payment processing solutions in the region. Furthermore, a reduction in the usage of cash and acceptance of mobile payments is a major boosting factor for the growth of the industry in the Asia Pacific region.

Furthermore, E-commerce is continuously growing in this region, contributing to the growth of online modes of payment. In addition, companies in the Asia Pacific region are collaborating with national and international payment gateway suppliers to offer more advanced processing services to their customers.

Competitive Insight

Some of the major players operating in the global market include ACI Worldwide, Authorize.Net, BlueSnap, Fiserv, FIS, Global Payments, Jack Henry & Associates, Klik&Pay, PayPal, PayU, PhonePe, Mastercard, Razorpay, Visa, and Stripe. The major market players in the industry are developing new solutions and adopting advanced technologies to strengthen their market presence and cater to a wider customer base. These players are also entering into partnerships and collaborations to enhance their offerings in the global market.

Recent Developments

In July 2021, ACI Worldwide, entered into a partnership with Swedbank to improvise its customer experience and for the growth for the Swedish bank. The development was aimed at controlling fraudulent activities and offering greater security.

In April 2021, FIS launched the RealNet for enabling account-to-account (A2A) transactions for customers, companies, governments over real-time payment networks.

Payment Processing Solutions Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 74.44 billion |

|

Revenue forecast in 2030 |

USD 192.61 billion |

|

CAGR |

10.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Payment Method, By Deployment Type, By Industry Vertical, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

ACI Worldwide, Authorize.Net, BlueSnap, Fiserv, FIS, Global Payments, Jack Henry & Associates, Klik&Pay, PayPal, PayU, PhonePe, Mastercard, Razorpay, Visa, and Stripe. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Authentication and Brand Protection Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Liquid Makeup Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Fertility Test Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Virtual Production Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Saudi Arabia Bus Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030