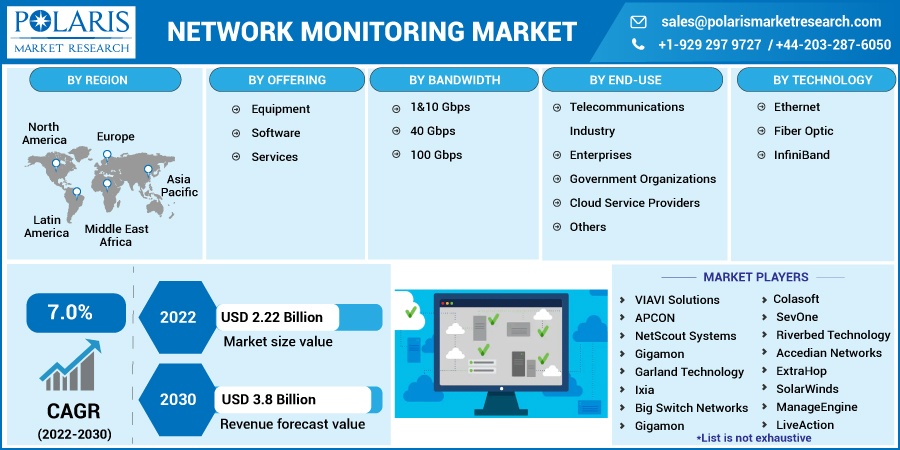

Network Monitoring Market Share, Size, Trends, Industry Analysis Report, By Offering (Equipment, Software & Services); By Bandwidth (1&10 Gbps, 40 Gbps, 100 Gbps); By End-Use; By Technology (Ethernet, Fiber Optic, InfiniBand); By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 101

- Format: PDF

- Report ID: PM2750

- Base Year: 2021

- Historical Data: 2018-2020

Report Summary

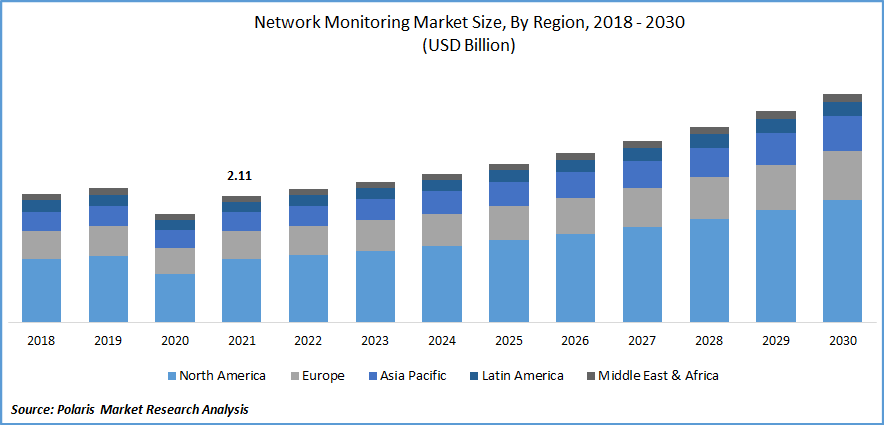

The global network monitoring market was valued at USD 2.11 billion in 2021 and is expected to grow at a CAGR of 7.00% during the forecast period.

The market is driven by the high adoption of monitoring technologies, with ever-rising network security issues, the necessity of real-time communication through secured networks, and the surge in demand for video service platforms, online games, and TV on-demand services among millennials.

Know more about this report: Request for sample pages

Consumers demand robust, secured networks to improve performance output and transition to more compact, multi-fiber connections. According to the Ericsson Mobility Report, the demand for high-speed data connectivity brought on by the rise in mobile data traffic is also propelling the market.

Data traffic is growing due to the widespread use of mobile and broadband data services by consumers and business applications, which explains the surge in demand for high-speed data services like 5G. The adoption of 5G is also anticipated to be fueled by the need for dependable and powerful communications during natural disasters like earthquakes, floods, and hurricanes.

Network monitoring is a service that keeps an eye on computer networks for interruptions and data theft and notifies the network administrator if it occurs. These monitoring systems continuously examine a sizable volume of data and filter it to look for any irregularities.

A network monitoring system constantly checks a computer network for delayed or failing operations. It alerts the network administrator through email, SMS, or other alarms in the event of outages or other problems. This system tracks problems brought on by overworked or malfunctioning servers, network connections, or other devices. Response time, availability, and uptime are often monitored measures, while stability and reliability metrics are also starting to gain ground.

People and businesses are experiencing significant difficulties and worries due to COVID-19. Most businesses have business continuity strategies, although they are not always fully functional. The global adoption of remote work will necessitate improved network monitoring and networking infrastructure to address the ongoing challenge. Additionally, infrastructure and security risks for telecommunications and internet service providers may increase. The manufacturing and distribution of network equipment, such as routers and servers, have been delayed, affecting the global supply chain.

Additionally, projects to implement sophisticated network monitoring technologies would be further delayed. System providers must be ready to handle difficulties brought on by the pandemic's uncertainty.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

Network monitoring helps the administration manage the networks' configuration, traffic, application performance, uptime, bandwidth usage, server performance, and other network-related procedures in order to provide the business with the best possible performance. To assess how well networks are performing, network monitoring uses several data collection techniques, such as the Simple Network Management Protocol (SNMP), Syslog, scripts, and others.

Operations at the corporation claim that downtime costs an organization a lot of money. The use of network monitoring technologies can lower these expenditures. Throughout the foreseeable period, this is expected to drive the market for network monitoring tools.

It is anticipated that the market will grow in the future years. This is brought on by concerns about security risks in a range of industries, including business, energy & utilities, healthcare & medical, and others, as well as an increase in the complexity of IT infrastructure.

Report Segmentation

The market is primarily segmented based on offering, bandwidth, end-use, technology, and region.

|

By Offering |

By Bandwidth |

By End-use |

By Technology |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The Equipment segment is expected to witness the fastest growth.

The equipment sub-segment is anticipated to grow quickly throughout the projected period. Regarding revenue, the equipment segment dominated the market in 2021. The expanding need for equipment, such as storage devices, in order to deploy network monitoring solutions is what is responsible for the segment's increasing expansion.

Network monitoring software continuously tracks, analyses, and reports on the health, availability, and effectiveness of networks, which include storage devices, networking gear, interfaces, virtual environments, and other essential components.

40 Gbps accounted for the largest market share in 2021

In the upcoming years, it is anticipated that the 40 Gbps sector will account for a sizeable portion of the market. Data centers and core network installations use monitoring equipment with a 40 Gbps capacity. The growing need for servers and virtualization technologies, as well as the expanding data center industry, are driving the need for greater bandwidth. These optimized network monitoring tools provide inexpensive switching alternatives. This significantly reduces the number of switches required on the same network.

The InfiniBand segment is expected to witness the fastest growth

It is anticipated that the InfiniBand market will grow at a sizable CAGR over the forecast period. By providing consumers with better performance, less complexity, the best interconnect efficiency, and durable and stable connections, InfiniBand addresses concerns with IT infrastructure. InfiniBand, which provides connections up to 120 Gbps, offers excellent products and performance with low latency. It was created to facilitate the efficient scalability of various systems.

The Enterprises segment is expected to witness the fastest growth

In 2021, enterprises had the largest share. The Enterprises segment is expected to grow the most during the projection period. Due to the enormous volumes of data produced by significant technological advancements across many industries and the challenges associated with IT infrastructure, enterprises are expected to hold the biggest market share during the projection period. Future needs for network monitoring are influenced by rising "bring your own device" adoption, expanding employee flexibility, and the expanding use of creative Big Data solutions for operational data explosion.

The demand in North America is expected to witness significant growth

North America dominated the global market and is expected to retain its dominance in the near future. Due to the region's advanced AI usage and well-established IT infrastructure, North America dominated the market for network monitoring tools in 2020. Due to significant industry players and the growing integration of data centers, the U.S. held most of the market share in the area. The US market is expected to grow quickly. Many companies are expected to opt for cloud services rather than pay upfront fees to build their own data centers. This will enable business continuity.

Competitive Insight

There are several major players in the global market, such as VIAVI Solutions, APCON, NetScout Systems, Gigamon, Garland Technology, Big Switch Networks, Keysight Technologies, Garland Technology, Cisco, Broadcom, Arista Networks, Juniper Networks, Inc., Zenoss, Network Critical, CALIENT, Netgear, LogicMonitor, Riverbed Technology, Accedian Networks, ManageEngine, LiveAction, Auvik Networks, Flowmon Networks, AppNeta, Zabbix Juniper Networks, Broadcom, Network Critical, and others.

Recent Developments

In June 2022, the 7130 Series, a line of integrated ultra-low latency and highly configurable systems, was introduced by Arista Networks. The new item sought to increase customer agility and combine many devices to save complexity, expense, and power. The new range includes two brand-new models with full-featured L2/3 switching, open programmability, and high-performance L1 connectivity.

In December 2020, Apstra, a provider of intent-based networking software, was acquired by Juniper Networks. The startup wanted to hasten the creation of a self-driving network by assisting private and public cloud manufacturers in optimizing their operations for application experience.

Network Monitoring Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 2.22 billion |

|

Revenue forecast in 2030 |

USD 3.8 billion |

|

CAGR |

7.00% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Offering, By Bandwidth, By Technology, By End-use, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

VIAVI Solutions, APCON, NetScout Systems, Gigamon, Garland Technology, Ixia, Big Switch Networks, Gigamon, NETSCOUT, Keysight Technologies, Viavi, APCON, Garland Technology, Cisco, Broadcom, Arista Networks, Juniper Networks, Inc., Zenoss, Network Critical, CALIENT, Netgear, Metadata, LogicMonitor, Colasoft, SevOne, Riverbed Technology, Accedian Networks, ExtraHop, SolarWinds, ManageEngine, LiveAction, Auvik Networks, Paessler, Flowmon Networks, AppNeta, Zabbix Juniper Networks, Broadcom, Network Critical. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Aerospace & Defense Coatings Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Isolation Beds Market Share, Size, Trends, Industry Analysis Report, 2020-2027

- Global Multiple Sclerosis Market Research Report - Trend, Analysis and Forecast till 2025

- Herbal Medicine Market Share, Size, Trends, Industry Analysis Report, 2020-2026

- Human Microbiome Therapeutics Market Share, Size, Trends, Industry Analysis Report, 2022 - 2029