Mining Equipment Market Share, Size, Trends & Industry Analysis Report, By Type (Surface; Underground); By Product (Mining Drills & Breakers; Mineral Processing Machinery; Crushing, Pulverizing & Screening Equipment; Others); By Application; By Region; Segment Forecast, 2021 - 2029

- Published Date:Dec-2021

- Pages: 101

- Format: PDF

- Report ID: PM1398

- Base Year: 2020

- Historical Data: 2017 - 2019

Report Summary

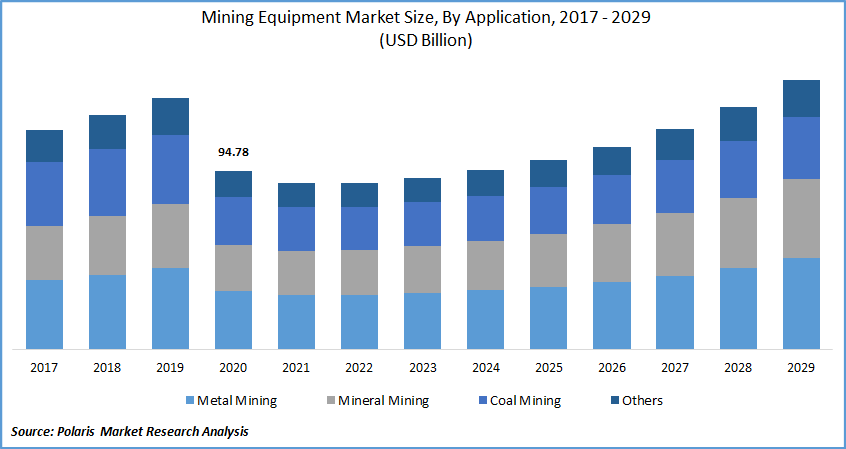

The global mining equipment market size was valued at USD 94.78 billion in 2020 and is expected to grow at a CAGR of 6.3% during the forecast period. During the next several years, the era of digital mine technology is likely to revolutionize critical elements of mining. Throughout the projection period, increased investment, combined with government assistance for digitized mine innovation, is likely to drive the market demand for the equipment.

Know more about this report: request for sample pages

The outbreak of COVID-19 had a direct impact on the world economy, affecting all businesses, including mineral excavation. Across key commodities, substantial price declines have been witnessed, although prices in certain cases have remained stable. The market for industrial and heating coal, for instance, has fallen, but the market demand for gold and mineral ores has soared.

Industry Dynamics

Growth Drivers

The growing industry for metallic mineral products and the increased use of materials such as coal, diamonds, and uranium are two main drivers driving the equipment industry. Furthermore, the growing market demand for mineral supplements to boost agricultural yields is predicted to propel the global industry forward. On the other hand, rising raw material costs and rigorous government restrictions are expected to stifle worldwide market expansion.

Nevertheless, rising market demand for technologically innovative equipment, increased use of coal for heat treatment and electricity generation, and increased renovation of rail track and road routes through hilly regions are anticipated to provide profitable possibilities for global industry growth over the projected period. The rising need for mineral supplements to boost agricultural yields and the increased construction of highways and railway tracks across mountainous terrain is likely to boost the excavation activity in growing countries like India and China.

Report Segmentation

The market is segmented on the basis of type, application, product, and region.

|

By Type |

By Product |

By Application |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Type

In 2021, surface mining equipment is expected to account for the highest revenue share and this mining equipment market trend is likely to continue during the projection period. During the next several years, rising coal consumption, chromium, iron ore, and diamonds in emerging nations will likely generate growth opportunities for surface mining technology. As this technology has grown more frequently employed, it has enabled more targeted mining operations, such as the exploration of high-quality minerals and the construction of embankments and stable platforms.

Insight by Application

Due to a rise in transporting metal resources and rising market demand for valuable metals, the metal mining industry is expected to grow at a CAGR of 6.7%. Government restrictions, the expansion of solid minerals end-use industries, and global price fluctuations are projected to impact mining equipment demand in the market in metals mining techniques substantially. Increased equipment deliveries are being procured by copper metal mines in Australia and South America, which is likely to fuel the expansion of this application area.

Geographic Overview

During the projected period, Asia Pacific is expected to account for 50.7% of the mining equipment market share in 2021. Several of the region's emerging countries have large coal-producing zones and big coal and metal extraction businesses that require large capital investments. In the country, there is a growing need for low-emission, low-cost, and elevated equipment.

Latin America market is expected to witness significant growth owing to the presence of several sites across the region. The growing mineral fuel exploration and soil rich with different types of metal and non-metal deposits is expected to have a positive impact on the market growth over the forecast period.

Competitive Landscape

Mining equipment manufacturers operating in the market include AB Volvo, Astec Industries Incorporated, Atlas Copco AB, Bell Equipment Limited, Bradken Limited, Caterpillar Inc., China Coal Energy Company Limited, CNH Industrial NV, Corum Group, Deere & Company, Doosan Corporation, Epiroc AB, Hitachi Co., Ltd., Hyundai Heavy Industries Company Limited, Komatsu Ltd., Kopex SA, Liebherr Group, Metso Corporation, RCR Tomlinson Limited, Sandvik AB, Techint Group, and Terex Corporation.

Major market companies are using business growth and product introduction as important developmental methods to increase the overall product range of the global mining equipment industry. Liebherr-International AG, for example, unveiled a new R 9150 G7 digger for mining applications in September 2021. It's a 130-ton/143-ton digger having a renowned 565-KW/757-HP engine.

The new Cat 963 crawler loaders replaced the 963K crawler loader in September 2020. It's a piece of multi-purpose equipment that could dig, load, transport, and fill. It offers up to a 10% increase in fuel efficiency, production, and cab and maneuverability. The 963 complies with EPA Tier 4 Final/EU Stage V pollution requirements inside the U.S.

Mining Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 94.78 billion |

|

Revenue forecast in 2029 |

USD 142.93 billion |

|

CAGR |

6.3% from 2021 - 2029 |

|

Base year |

2020 |

|

Historical data |

2017 - 2019 |

|

Forecast period |

2021 - 2029 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2029 |

|

Segments covered |

By Type, By Application, By Product, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

AB Volvo, Astec Industries Incorporated, Atlas Copco AB, Bell Equipment Limited, Bradken Limited, Caterpillar Inc., China Coal Energy Company Limited, CNH Industrial NV, Corum Group, Deere & Company, Doosan Corporation, Epiroc AB, Hitachi Co., Ltd., Hyundai Heavy Industries Company Limited, Komatsu Ltd., Kopex SA, Liebherr Group, Metso Corporation, RCR Tomlinson Limited, Sandvik AB, Techint Group, and Terex Corporation. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Automotive Wholesale and Distribution Aftermarket Market Research Report, Size & Forecast, 2018 – 2026

- Lithium-Ion Battery Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Feed Pigment Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Pharmaceutical Processing Seals Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Automated Storage and Retrieval System (ASRS) Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030