Meat Substitutes Market Share, Size, Trends, Industry Analysis Report, By Type (Seitan-based, Tofu-based, Textured Vegetable Protein, Quorn-based, Tempeh-based); By Product; By Source; By Form; By Distribution Channel; By Region; Segment Forecast, 2022 -

- Published Date:Jan-2022

- Pages: 101

- Format: PDF

- Report ID: PM1824

- Base Year: 2021

- Historical Data: 2018 - 2030

Report Summary

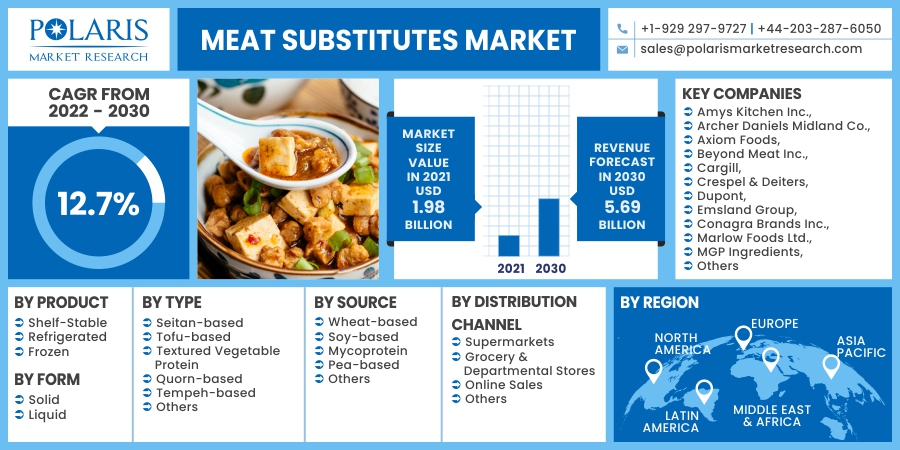

The global meat substitutes market was valued at USD 1.98 billion in 2021 and is expected to grow at a CAGR of 12.7% during the forecast period. Increasing health-related problems such as obesity and others, along with the rising vegan population, are some factors fueling the industry growth.

Know more about this report: request for sample pages

The outbreak of the COVID-19 pandemic had a positive influence on the meat substitutes market growth. An increasing number of animal-borne diseases, including coronavirus, has increased the substitutes demand for plant-based meats among consumers, which in turn has shifted consumers towards meat substitutes. Furthermore, due to lockdowns and trade restrictions, major plants stopped their operation due to factory closure, which decreased the supply of flesh. Thus, due to a shortage in supply, consumers shifted their focus on meat substitutes, driving the industry demand.

Industry Dynamics

Growth Drivers

Individuals are becoming more concerned about excessive meat intake as a result of the hazards of increased cholesterol levels, cardiovascular disease, as well as other disorders which have lately been linked to red flesh.

Increasing global rates of obesity, along with consumer preference for healthy food options, are boosting the demand for the meat substitutes market, which in turn, is expected to propel the industry over the forecast period.

Know more about this report: request for sample pages

Report Segmentation

The market is segmented on the basis of product, type, source, form, distribution channel, and region.

|

By Product |

By Type |

By Source |

By Form |

By Distribution Channel |

By Region |

|

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Product

The frozen food segment dominated the global market in 2021 and is expected to maintain its dominance over the forecast period. Increasing shelf life along with nutritional values are some factors expected to be responsible for the growth. Furthermore, the outbreak of the COVID-19 pandemic has led consumers and vendors to stock more products due to a shortage of supply which has fueled the demand for frozen food, contributing to industry growth.

Insight by Type

The demand for the tofu-based meat substitutes segment is expected to be high during the forecast period. The main reason for tofu-based products' increasing popularity is their use as a protein-rich supply and vegan substitutes to animal foods. Tofu is being used to manufacture a wide range of meals, including hot dogs, burgers, seasonings, ice cream, smoothies, and sweets. The increasing customer desire for high-quality products is expected to substantially influence the natural tofu demand.

Tempeh is becoming more popular in both advanced and developing nations due to the numerous health benefits it provides, including the capacity to construct a greater immune structure, reduce carbohydrates, lower cholesterol levels, increase antibodies, regulate appetite, lower cholesterol levels, and improve muscle growth, among others.

Insight by Form

The solid meat substitutes segment is expected to hold the majority of shares over the forecast period due to increased shelf life as compared to liquid. Eating solid meat substitutes is more beneficial for weight management and satiety due to the chewing process. However, the substitutes demand for the liquid form segment is expected to grow considerably over the forecast period owing to its benefits, such as it takes less time to consume as compared to solid form, which in turn will be a more effective addition to the diet.

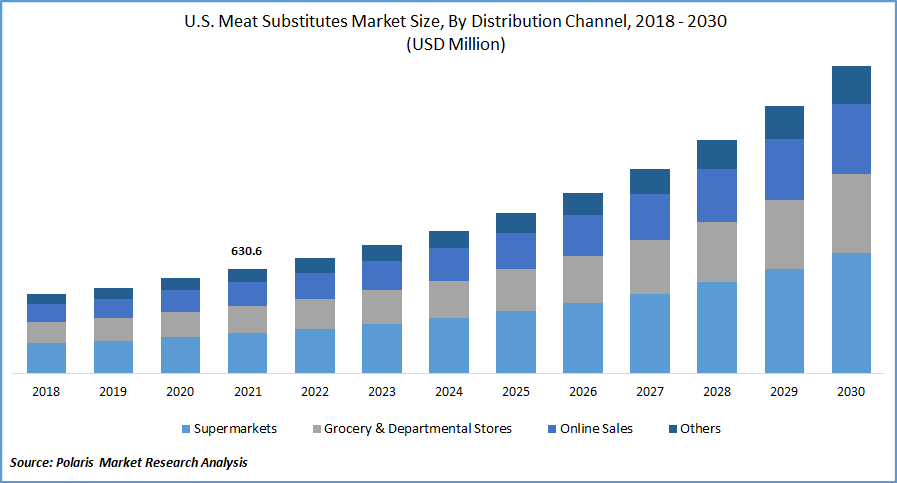

Insight by Distribution Channel

The supermarket distribution channel is expected to grow at a significant pace over the forecast period due to easy availability with various substitutes to choose from. Increased discounts and promotional offers are expected to increase the substitutes demand for the segment. Nevertheless, due to the COVID-19 pandemic, many consumers have shifted to online shopping due to the fear of virus transmission. Furthermore, increasing busy schedules of consumers along with convenient home delivery services provided by online merchants are expected to increase the online sale segment over the projected period.

Geographic Overview

North America dominated the global market in 2021 and is expected to maintain its dominance over the forecast period due to the increasing shift in the vegan population and rising cases of animal-based diseases. Furthermore, increasing awareness regarding animal welfare coupled with a growing health-conscious population are expected to follow the trend.

Asia Pacific is expected to grow at a considerable pace over the forecast period due to increasing knowledge of plant-based proteins. Moreover, increasing urbanization and growing income levels are expected to boost the meat substitutes market over the forecast period.

Competitive Insights

Some of the key players operating in the global market include Amys Kitchen Inc., Archer Daniels Midland Company, Axiom Foods, Beyond Meat Inc., Cargill, Crespel & Deiters, Dupont, Emsland Group, Conagra Brands Inc., Marlow Foods Ltd., MGP Ingredients, Quorn Foods, Sonic Biochem Extractions Limited, Sotexpro S.A, Vbites Food, Ltd., and Wilmar International Limited.

To extend their client base and expand their market position, these businesses increase their presence throughout various geographies, introduce new products, and establish new marketplaces in developing countries. For instance, Conagra Brands debut a fresh plant-based burger patty in the U. S. in January 2020, expanding its Gardein meat-free line.

Meat Substitutes Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1.98 billion |

|

Revenue forecast in 2030 |

USD 5.69 billion |

|

CAGR |

12.7% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Type, By Source, by Form, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Amys Kitchen Inc., Archer Daniels Midland Company, Axiom Foods, Beyond Meat Inc., Cargill, Crespel & Deiters, Dupont, Emsland Group, Conagra Brands Inc., Marlow Foods Ltd., MGP Ingredients, Quorn Foods, Sonic Biochem Extractions Limited, Sotexpro S.A, Vbites Food, Ltd., and Wilmar International Limited. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Powder Coating Equipment Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Dashboard Camera Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Net-Zero Energy Buildings Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Electricity Meters Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Urban Planning Software and Services Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030