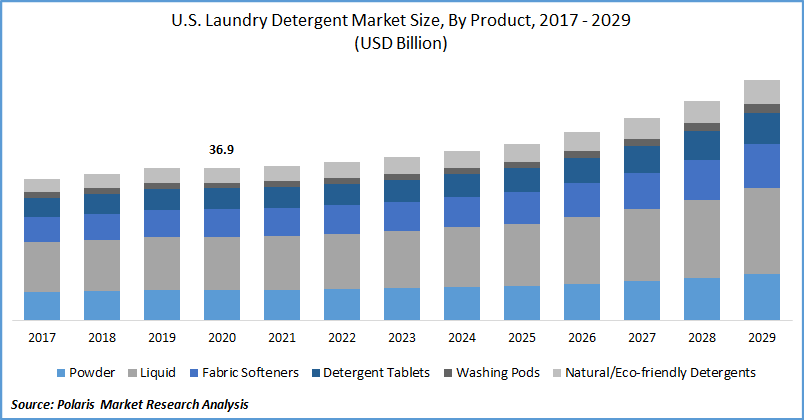

Laundry Detergent Market Share, Size, Trends, Industry Analysis Report, By Product (Natural/Eco-friendly Detergents, Powder, Liquid, Fabric Softeners, Detergent Tablets, Washing Pods); By Application (Household, Industrial); By Region; Segment Forecast, 2022 - 2029

- Published Date:Dec-2021

- Pages: 101

- Format: PDF

- Report ID: PM1489

- Base Year: 2021

- Historical Data: 2017 - 2020

Report Summary

The global laundry detergent market size was valued at USD 154.34 billion in 2021 and is expected to grow at a CAGR of 6.3% during the forecast period. The laundry detergent market trends are driven by factors such as the increasing inclination of consumers towards cleanliness and self-hygiene, rapid innovations pertaining to chemical ingredient research, thus leading to better laundry detergent formulations, and significant penetration in emerging economies, including China and India.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Some of the top brands of the laundry detergent industry include Tide, Purex, and Surf. The brands produced by Unilever, Proctor & Gamble, and Henkel concentrate on the middle and high-class segment of consumers, whereas Church & Dwight targets the low end of the consumer segment.

The global laundry detergent industry is witnessing globalization in the sector, as more and more global vendors are branching out in emerging markets to increase their revenues. With rising globalization, vendors face new challenges such as a lack of uniformity in rules and regulations of various government agencies. The potential opportunity in the developing economies is expected to provide ample opportunities for market participants in the laundry detergent market forecast period.

Industry Dynamics

Growth Drivers

There is an increasing trend among manufacturers to reduce supplier count to reduce procurement costs and improve associated financial benefits, often known as "supplier consolidation," which provides controlling power to the suppliers' group. Moreover, regulatory agencies are conscious of the ingredients/chemicals used in laundry detergents. Several countries have limited phosphates in laundry detergents, which are harmful to humans.

COVID-19 underlined the importance of household items, including washing machines, and brought them to the forefront. The somewhat under-penetrated washing machine segment witnessed a new surge, primarily due to the post-pandemic scenario where social distancing has become important, thus restricting maid movements, especially during lockdowns.

Report Segmentation

The market is primarily categorized on the basis of product, application, and region.

|

By Product |

By Application |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Product

In 2021, the powder segment accounted for 32.0% of the global revenue share owing to the strong demand from emerging countries, where a substantial rural population prefers economical powdered products over others.

Laundry detergent liquid segment is projected to register a significant growth rate over the market forecast period. This is due to increased product adoption in developed economies, attributes such as consumer comfort, convenience, cheaper manufacturing costs, and the ability to provide higher margins for retailers and wholesalers.

Insight by End-Use

The household segment is expected to grow at a CAGR of 5.5% over the forecast period, and it is expected to dominate the global demand over the forecast period. The surge in millennials with a busy lifestyle and lesser time for household activities coupled with a rise in the sale of washing machines in developing countries are critical drivers for the segment growth.

The industrial segment is expected to register lucrative growth over the forecast period on account of applicability in diverse industries such as dry cleaning, hospitals, engineering, paper, textile, rubber, and housekeeping and increased focus of manufacturers towards product development specific to the industrial segment.

Geographic Overview

Asia Pacific accounted for 35.7% of the overall revenue share in 2021. Urbanization in emerging countries, particularly in India and China, has significantly contributed to the region's growth. Moreover, increasing disposable income, innovative brand marketing strategies have stimulated the region's growth. The booming middle-class population is mainly responsible for such growth.

Significant rural population in India and other emerging economies is anticipated to drive the market for regional players as global players struggle to achieve product penetration, low pricing, and efficient access to distribution channels. For instance, in India, Ghari, a regional brand, has gained a significant share over the global players due to its economic pricing.

Similar trends can be observed in China's laundry detergent market share. The international brands are losing their revenue share to local players. China is witnessing a shift from traditional brands to premium brands. However, the regional market of premium products is growing with the rise in the disposable income of the masses.

The rising disposable income in the developing economies is forging new trends in the industry where consumer behavior is influenced by the brand, quality, and company's reputation. However, this trend is only common in mature markets such as North America and Europe. In regions such as Africa, price is a key influencing factor.

Competitive Landscape

Some of the major global industry players for laundry detergents are Unilever, Procter & Gamble, Lion Corporation, Church & Dwight, Henkel AG & Co. KGaA, Method Products, Kao Corporation, Reckitt Benckiser Group plc, and PBC.

In India, Hindustan Unilever Limited, a subsidiary of Unilever, has observed declining sales across its laundry detergent brands such as Rin, Surf, and Wheel. The growing prominence of the regional laundry cleansers brands in the rural regions of India is a crucial reason for the growth of the regional brands.

Laundry Detergent Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 154.34 billion |

|

Revenue forecast in 2029 |

USD 242.94 billion |

|

CAGR |

6.3% from 2022 - 2029 |

|

Base year |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2029 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2029 |

|

Segments covered |

By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Unilever, Procter & Gamble, Lion Corporation, Church & Dwight, Henkel AG & Co. KGaA, Method Products, Kao Corporation, Reckitt Benckiser Group plc, and PBC. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Railway Cybersecurity Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Cocoa and Chocolate Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Honey Wine Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Soft Tissue Sarcoma Treatment Market Research Report, Size, Share & Forecast by 2014 - 2025

- Spatial OMICS Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028