Kitchen Appliances Market Share,Size,Trend,Industry Analysis Report By Product (Cooking Appliances, Dishwasher, Refrigerator, Others); By Fuel Type (Cooking Gas, Electricity, Others); By End-User (Residential, Commercial); By Distribution Channel (Offline, Online); By Structure (Built-in, Free Stand); By Regions - Segment Forecast, 2020 – 2026

- Published Date:Feb-2020

- Pages: 101

- Format: PDF

- Report ID: PM1033

- Base Year: 2019

- Historical Data: 2015-2018

Report Summary

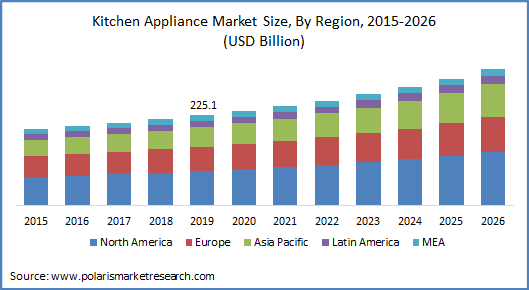

The global kitchen appliances market size was valued at USD 225.1 billion in 2019 and is anticipated to grow at a CAGR of 6.34% during the forecast period. Kitchen appliances are devices developed to perform a specific function in the kitchen. These appliances offer functionalities such as cooking, cleaning, and storage while ensuring efficient performance of kitchen activities. These appliances comprise refrigerators, dishwashers, and cooking appliances among others. Cooking appliances include food processor, coffee maker, induction or hotplate, microwave oven, waffle iron, toaster, cooking stove, and kitchen range among others. They operate on different fuel types such as cooking gas, electricity, and others.

Know more about this report: request for sample pages

The increasing urbanization, and growth in disposable income primarily drive the growth of this market. The stringent energy efficiency norms and increasing awareness regarding the use of efficient & environmental friendly appliances have encouraged consumers to use energy efficient and smart kitchen appliances. Introduction of affordable appliances by market players further support market growth. Increasing distribution of these appliances through online channels, and emergence of smart technologies and Internet of Things (IoT) is expected to augment the growth of global kitchen appliances market. A significant increase in the number of food establishments, and growing demand of induction technology is further expected to support the market. However, high energy consumption by most of these appliances, and high costs limit the growth of the market.

Segment Analysis

The global kitchen appliances market is segmented on the basis of product, fuel type, end-user, distribution channel, structure, and region. Based on product, the market is segmented into cooking appliances, dishwasher, refrigerator, and others. The fuel type segment is categorized into cooking gas, electricity, and others. On the basis of end-users, the market is segmented into residential, and commercial. The distribution channels included in this report are offline channels and online platforms. On the basis of structure, the market is segmented into built-in, and free stand. This report comprises a detailed geographic distribution of the market across North America, Europe, APAC and South America, and MEA. North America is further segmented into U.S., Canada, and Mexico. Europe is divided into Germany, UK, Italy, France, and Rest of Europe. Asia-Pacific is bifurcated into China, India, Japan, and Rest of Asia-Pacific. North America accounted for the largest share in the global kitchen appliances market in 2019.

Competitive Landscape

Leading players in the market are introducing new products owing to changing consumer preferences and increasing demand. They are also collaborating with other players to expand their offerings and enhance market reach. In August 2016, Whirlpool Corporation collaborated with Innit, a company that develops intelligent cooking technologies. The collaboration was aimed at development of a series of connected appliances for kitchen usage at affordable prices. In January 2017, Drop, a smart kitchen company collaborated with GE Appliances (GEA), to develop an additional intelligence to GEA's connected ovens. GEA’s connected wall oven can be controlled via a recipe in the Drop Recipes app, which enhances the Drop interactive cookbook experience.

In August 2016, Samsung electronics acquired Dacor, a luxury kitchen appliances manufacturer. This acquisition enabled Samsung to enhance its offerings in the global kitchen appliances market and strengthen its position. In January, Dacor, introduced its new range of premium household appliances at The Kitchen & Bath Industry Show 2017 in Orlando, Florida. The new range offers premium built-in column and French door refrigerators, and range & wall ovens. The line of ovens is equipped with Dacor’s Four-Part Pure Convection technology that provides even and quick cooking. The ovens are also Wi-Fi-enabled enabling the control of appliances through smartphones. Other leading players in the market include Whirlpool Corporation, Robert Bosch GmbH, LG Electronics, AB Electrolux, Haier Group Corporation, Panasonic Corporation, Samsung Electronics, Koninklijke Philips N.V., Sharp Corporation among others.

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Metadata Management Tools Market Share, Size, Trends, Industry Analysis Report, 2021 - 2029

- Industrial Crystallizers Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Structured Cabling Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Wood and laminate Flooring Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Air Cushion Packaging Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028