Jewelry Market Share, Size, Trends, Industry Analysis Report, By Product (Necklace, Ring, Earrings, Bracelet, Others); By Material Type (Silver, Gold, Platinum, Diamond, Others); By Category (Branded, Unbranded); By Distribution Channel (Offline, Online); By Region; Segment Forecast, 2022 - 2030

- Published Date:Feb-2022

- Pages: 101

- Format: PDF

- Report ID: PM2284

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Summary

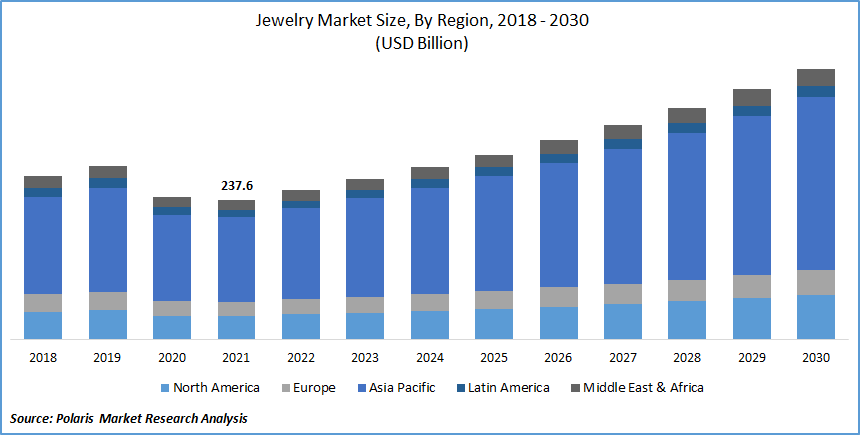

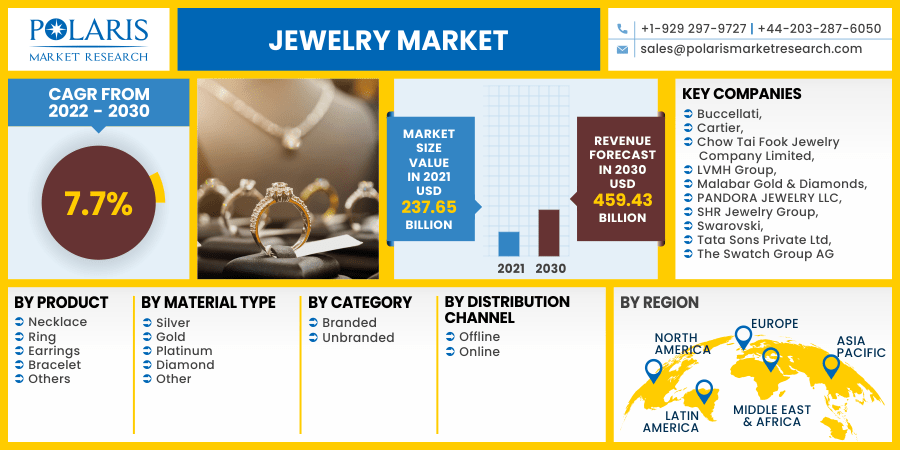

The global jewelry market was valued at USD 237.65 billion in 2021 and is expected to grow at a CAGR of 7.7% during the forecast period. The key factors, such as the strategic collaborations and acquisitions among major players, a growing trend for cross-cultural ornaments, and the adoption of e-commerce for jewelry purchasing, are driving the industry growth during the forecast period.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

For instance, In January 2021, the world's greatest luxury products company, LVMH Mot Hennessy Louis Vuitton SE, announced the completion of its acquisition of Tiffany & Co., the worldwide premium jeweler. This legendary US jeweler's acquisition will profoundly enhance LVMH's Watches & Jewelry segment and complement LVMH's 75 distinct Maisons.

Tiffany is a renowned brand and a recognizable symbol of the global industry. Also, in January 2020, Chow Tai Fook Jewellery Group announced that it has acquired "the full equity interests" in Enzo Jewelry Inc., accelerating industry growth in mainland China and other markets. Enzo has over 60 stores in China, which has benefited the company in producing higher-quality products. Enzo will maintain its special position as a natural-colored gem specialist to support the Group's multi-brand strategy, allowing us to expand into the colored gemstone sector.

Further, a growing trend of cross-cultural ornaments is likely to drive jewelry market expansion to a greater level. Increased advertising budgets and new international campaigns will enable a diverse range of these products to be distributed globally throughout the predicted period. During the projected period, e-commerce is expected to play a significant role in pushing the volumetric sales of the industry. Raising customer knowledge regarding the quality of gemstones and metals used in creating high-end ornaments is predicted to move the global jewelry market forward. However, e-commerce fraud and a lack of understanding about hallmark requirements and ornaments purity are projected to stifle market expansion to some extent.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The industry's huge client base allows manufacturers to serve a large jewelry market while still profit. Customers are drawn in by the implementation of novel designs and growing fashion trends. Manufacturers are taking advantage of the simple changes in fashion to create new products and designs to attract customers. For instance, in March 2021, Nirwaana, a top-quality online store, has launched their newest couple collection titled "I STILL DO." Nirwaana's jewelry is modern, mostly handcrafted in sterling silver, and produced in small quantities, making each purchase nearly exclusive to its buyer.

Further, in September 2021, JewelOne, the rising retail jewelry brand from the Emerald Jewel Industry India Limited, released a new diamond jewelry collection inspired by waterfalls. The collection's name has been established NIRJHARA, which signifies gorgeous waterfalls and something eternal, like diamonds. In addition, the rising disposable income among developed and developing countries is boosting the demand for the product that is driving the market growth. For instance, according to the Office for National Statistics, compared to 2018, the development in gross disposable household income (GDHI) per head in the UK was 2.5 percent in 2019.

Scotland and Northern Ireland out-performed with 2.8 and 2.6 percent, respectively, while England grew at the same rate as the rest of the UK grew by 1.1 percent. In 2019, London had the greatest GDHI per head of any country or region defined by International Territorial Levels, with an average of £30,256 afford to invest or save per person; the North East had the least, with £17,096, compared to a European average of £21,433. Also, Gross National Disposable Income (GNDI) at current valuations is anticipated to be 206.98 lakh crore in 2019-20 in India, up from 191.78 lakh crore in 2018-19, representing a 7.9 percent increase in 2019-20 compared to a 10.8 percent rise in 2018-19. Thus, the rise in disposable income and launches of innovative designs drive jewelry market growth during the forecast period.

Report Segmentation

The market is primarily segmented based on product, material type, category, distribution channel, and region.

|

By Product |

By Material Type |

By Category |

By Distribution Channel |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Material Type

Based on the material type segment, the gold segment is expected to be the most significant revenue contributor in the global jewelry market in 2021 and is expected to retain its dominance in the foreseen period. The demand for engagement and wedding rings increased the demand for gold ornaments, boosting the segmental growth. One of the primary causes for the growth of gold ornaments is the increase in the GDP of developing countries such as India and China. In 2019, China was the greatest consumer of gold, followed by India and the United States. Furthermore, gold is seen as a hard currency that may be transformed into cash in times of emergency. For everyday use, Chinese youngsters choose low-purity gold ornaments. This is projected to stimulate large-scale gold imports in China, driving market demand.

Geographic Overview

In terms of geography, Asia-Pacific had the highest share in 2021. This is due to strong demand from China and India, where gold is widely used. For instance, India's gold consumption climbed by 37% year on year in the first three months of 2021 to 140 tonnes, corresponding with a decline in Covid-19 infections, which prompted buyers to go shopping. Gold ornaments are quite popular due to their high demand for weddings and celebrations.

Furthermore, the expansion of the jewelry market in developing countries and new branches of these companies is boosting regional growth. In December 2021, PMJ Jewels opened its first store in Kompally, North Hyderabad. According to the brand's ambitious planned expansion at Kompally. It will provide a diverse range of diamonds, gold, and solitaires designs. The store will also offer a diverse range of the most recent, nicest, and never-before-seen luxury diamond bridal accessories in the Kompally area.

Moreover, the Middle East and Africa are expected to witness a high CAGR in the global market in 2021. The ornaments designs in the UAE and Saudi Arabia are relatively exceptional and world-renowned, projected to enhance the market growth in this area. Furthermore, due to the presence of mining sites and the advent of the UAE as the largest diamond trading post, this region is likely to contribute considerably to market growth throughout the projection period.

Competitive Insight

Some of the major players operating in the global market include Buccellati, Cartier, Chow Tai Fook Jewelry Company Limited, LVMH Group, Malabar Gold & Diamonds, PANDORA JEWELRY LLC, SHR Jewelry Group, Swarovski, Tata Sons Private Ltd, The Swatch Group AG, among others.

Jewelry Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 237.65 billion |

|

Revenue forecast in 2030 |

USD 459.43 billion |

|

CAGR |

7.7% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Material Type, By Category, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Buccellati, Cartier, Chow Tai Fook Jewelry Company Limited, LVMH Group, Malabar Gold & Diamonds, PANDORA JEWELRY LLC, SHR Jewelry Group, Swarovski, Tata Sons Private Ltd, The Swatch Group AG |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Data Center Infrastructure Management Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- M-Commerce Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Contact Center Analytics Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Net-Zero Energy Buildings Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Enteral Feeding Formulas Market Share, Size, Trends, Industry Analysis Report, 2021-2028