Industrial Hemp Market Share, Size, Trends, Industry Analysis Report, By Product (Seeds, Fiber, Shives); By Type; By Source; By Application (Animal Care, Textiles, Automotive, Furniture, Food & Beverages, Paper, Construction Materials, Personal Care, Others); By Region; Segment Forecast, 2022 - 2030

- Published Date:Feb-2022

- Pages: 101

- Format: PDF

- Report ID: PM2296

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Summary

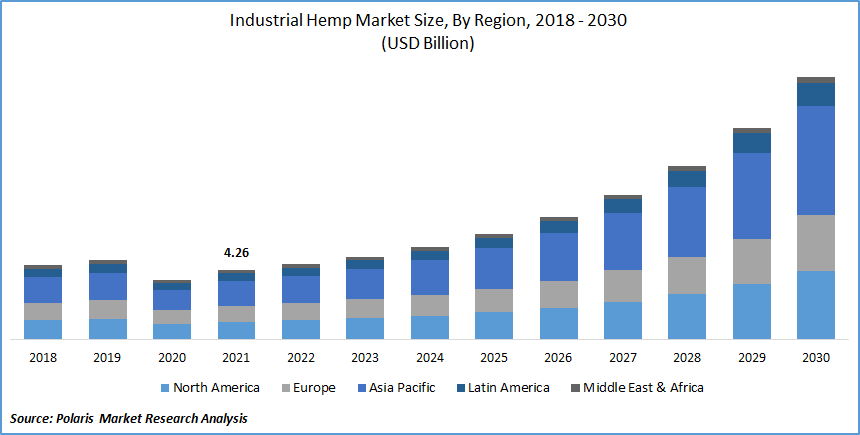

The global industrial hemp market was valued at USD 4.26 billion in 2021 and is expected to grow at a CAGR of 16.9% during the forecast period. The factor such as hemp seed and hemp seed oil's functional characteristics, their various benefits, and their expanding use in commercial applications are boosting the industrial hemp market growth during the forecast period.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industrial hemp is a sort of Cannabis sativa plant strategically positioned for commercial use. Industrial cannabis is a low-cost, fast-growing species that is environmentally beneficial. It is also one of the world's most versatile crops. Hemp, commonly known as cannabis, produces psychotropic drugs derived from cannabis plants. Hemp is utilized for both medicinal and recreational uses. Hemp aids in pain reduction by modifying pain perception circuits in the brain.

Further, the rising consumption of hemp-based products due to their different health advantages and higher occurrences of illnesses such as epilepsy and other sleep disorder contributes to this market's growth. Only tiny tetrahydrocannabinol (THC) levels are found in hemp seeds derived from the plant "Cannabis sativa." They include two crucial fatty acids, linoleic and linolenic. They're also high in vitamin E, B1, vitamin B2, vitamin B6, vitamin D, calcium, magnesium, and potassium.

Few plant-based foods are whole protein sources; on the other hand, seeds provide enough protein to be regarded as a valuable supplement to a vegan diet. As humans cannot generate critical fatty acids, seeds, high in linoleic (omega-6) and linolenic acid (Omega-3), may benefit. They are also low in saturated fat and contain no trans-fat. These are some critical elements that are likely to fuel the future growth of the cannabis industry. However, the complex regulations for cannabis use in many nations are projected to hamper the expansion of the industrial hemp market.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The major players in the market are continuously launching products to stay competitive. Market players face fierce competition, especially from the market's top companies, which have a large consumer base, and substantial distribution networks and are constantly expanding in the emerging markets.

For instance, in February 2021, Premium Jane, a CBD supplier based in the United States, recently launched a high-potency product line. High strength 3 Kg and 5 Kg broad-spectrum oils, as well as 1.5 Kg CBD gummies and other products, will be introduced as part of this development. In addition, in December 2021, Koru Pharmaceuticals raised Mesohemp for a skincare line that comprises green hemp, a Korean species of hemp.

All products contain Hemp Oil, which contains essential fatty acids such as Omega 3, 6, and 9, anti-aging properties, anti-inflammatory properties, skin problems caused by stress. Hemp has anti-inflammation properties, aids in treating acne, and alleviates skin problems caused by stress. Antioxidants help to minimize water and soil loss, which helps prevent wrinkles. Thus, the product launches with their health benefits, such as skin-related disorders and anxiety treatment, are propelling the growth in the market.

Report Segmentation

The market is primarily segmented based on product, type, source, application, and region.

|

By Product |

By Type |

By Source Type |

By Application |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Application

Based on the application segment, the food and beverages segment held the most significant revenue contributor in the global market in 2021 and is expected to retain its dominance in the foreseen period. The segment dominated due to the widespread use of hemp seeds and oil for their high vitamin, protein, and fatty acid content. These seeds are eaten raw or topped for cereals and yogurt. The growing public awareness of the benefits of consuming cannabis-based goods is propelling the market for its use in food.

Geographic Overview

In terms of geography, Asia-Pacific had the largest industrial hemp market share in 2021. Growing global demand for cannabis and advancements in technology make collecting easier for producers, transforming the face of cannabis farming in the region. China is the world's leading producer and supplier of industrial cannabis, hemp products, and end-use items such as paper and textiles. The existence of prominent manufacturers and the use of cannabis in industrial activities are anticipated to support product demand.

Moreover, North America is expected to witness a high CAGR in the global industrial hemp market over the forecast period. Due to the region's growing elderly population and increased customer perception, demand for cannabis has surged in Canada and the U.S. The increased worry about skin disorders and an increase in chronic diseases will likely drive up demand for cannabis.

For instance, as per the American Academy of Dermatology Association, Acne is a common problem in the U.S., impacting up to 50 million people each year. Acne typically appears during adolescence and affects many teenagers and young adults. Every day, roughly 9,500 people in the U.S. are diagnosed with skin cancer. Nonmelanoma skin cancer (NMSC) affects more than 3 million Americans each year. During the projection period, the causes mentioned above and government backing increased the need for cannabis.

Competitive Insight

Some of the major players operating in the global industrial hemp market include American Cannabis Company, Inc., American Hemp, Bombay Hemp Company, Boring Hemp Company, Botanical Genetics, LLC, CBD Biotechnology Co., Dun Agro Hemp Group, Ecofiber Industries Operations, Global Hemp Group Inc., Hemp, Inc., HempFlax Group BV, HempMeds Brasil, Industrial Hemp Manufacturing, LLC, Marijuana Company of America Inc., North American Hemp & Grain Co. Ltd., Parkland Industrial Hemp Growers Cooperative Ltd., Plains Industrial Hemp Processing Ltd., Terra Tech Corp., and Valley Bio Limited.

Industrial Hemp Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 4.26 billion |

|

Revenue forecast in 2030 |

USD 16.06 billion |

|

CAGR |

16.9% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Type, By Source, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

American Cannabis Company, Inc., American Hemp, Bombay Hemp Company, Boring Hemp Company, Botanical Genetics, LLC, CBD Biotechnology Co., Dun Agro Hemp Group, Ecofiber Industries Operations, Global Hemp Group Inc., Hemp, Inc., HempFlax Group BV, HempMeds Brasil, Industrial Hemp Manufacturing, LLC, Marijuana Company of America Inc., North American Hemp & Grain Co. Ltd., Parkland Industrial Hemp Growers Cooperative Ltd., Plains Industrial Hemp Processing Ltd., Terra Tech Corp., and Valley Bio Limited. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Car Care Products Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Postal Automation System Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Smart Locks Market Research Report, Share and Forecast, 2017 – 2026

- Technical Textiles Market Research Report, Size, Share & Forecast by 2018 - 2026

- Recombinant Proteins Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030