Industrial Cleaning Chemicals Market Share, Size, Trends, Industry Analysis Report, By Ingredients Type; By Product Type; By Application (Manufacturing & Commercial Offices, Healthcare, Retail & Foodservice, Hospitality, Automotive, Aerospace, Food Processing, Others); By Region; Segment Forecast, 2022 - 2030

- Published Date:May-2022

- Pages: 101

- Format: PDF

- Report ID: PM2398

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Summary

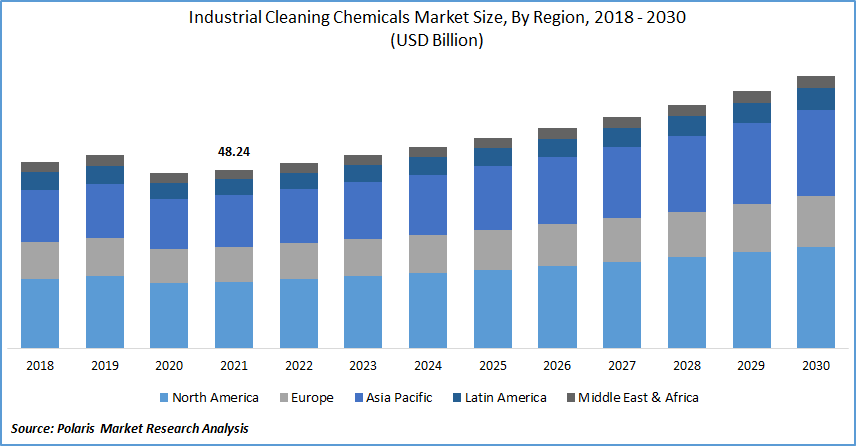

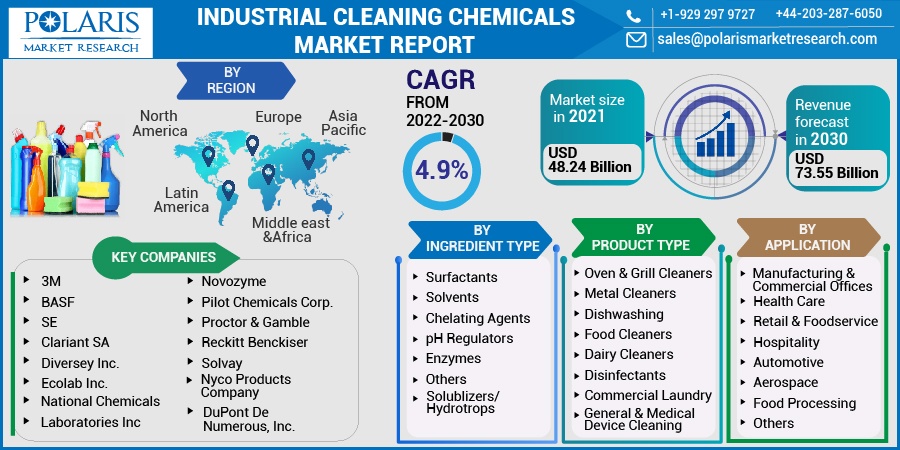

The global industrial cleaning chemicals market was valued at USD 48.24 billion in 2021 and is expected to grow at a CAGR of 4.9% during the forecast period. Increased demand from various end-user industries such as hospitality and healthcare is expected to drive the global market. Cleaning is essential to the growth of the healthcare, hotel, and retail businesses. As these occupations involve direct client touch, they emphasize cleanliness.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Better hygiene in the manufacturing, automotive, and food processing industries leads to higher-quality products and keeps workers safe, boosting productivity. These businesses are likely to grow healthy, resulting in increased demand for industrial chemicals in these sectors.

Further, compared to the pre-pandemic period, the frequency of industrial cleaning and the volume of industrial cleaning products used increased dramatically during the COVID-19 pandemic. Disinfectant sprays and wipes, surface and toilet cleaners, and hand sanitizers have boosted demand.

According to the European Cleaning & Facilities Services Industry (EFCI2020)'s study, the European industry's overall sales increased by 8% to Euro 120 billion (USD 135 billion) in 2018, employing 4.1 million people. France, Germany, Italy, Spain, and the United Kingdom have the most significant market share in Europe, accounting for 70% of total income, followed by Belgium, the Netherlands, and Sweden, which have annual revenues of over euro 4 billion (USD 4.5 billion).

The number of companies in the European Cleaning market increased, reaching 283,506. The rise is primarily attributable to increased company numbers in Germany, Italy, and the UK. The number of companies in the UK increased by almost 1,500, with the majority being small businesses with fewer than ten employees. Germany also saw a high increase of 1,300 businesses, most of which were self-employed. Belgium (-909) and Greece (-909) had a significant drop in the number of companies (-757). Thus, the product demand has expanded the industrial cleaning chemicals market growth during the forecast period.

However, compounds such as sodium hydroxide and tetrachloroethylene are poisonous and cause various health problems. The chemicals, including sodium hydroxide, are used to clean process tanks and storage tanks, triclosan in the healthcare market, and tetrachloroethylene for dry cleaning. All have negative health impacts when they come into contact with drinking water sources, restraining the industrial cleaning chemicals market growth.

Industry Dynamics

Growth Drivers

The market has observed extensive developments in the last few decades supported by various factors such as the new product launches to flourish the market and the primary player's contribution to the growth. For instance, in February 2022, Clariant announced the launch of Vita 100% bio-based surfactants and poly-ethylene glycols, which will indirectly address climate change. Clariant creates ethylene oxide from 100% bio-ethanol generated from sugar cane or corn for its new surfactants and PEGs.

The bio-based substance is separated from the field to the end consumer product along the value chain. The ingredients have a reduced carbon footprint than their fossil-based counterparts as only bio-based feedstocks are employed. Compared to their fossil analogs, Vita surfactants can help save up to 85% of CO2 emissions.

Furthermore, in April 2021, BASF enhanced its EcoBalanced offering for detergents and cleaners. The enhanced EcoBalanced portfolio from BASF Home Care, I&I, and Industrial Formulators is aimed to assist customers in Europe in developing solutions that differentiate them in the marketplace while also fulfilling consumer demand for ecologically friendly products.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on ingredient type, product type, application, and region.

|

By Ingredient Type |

By Product Type |

By Application |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Ingredients Type

Based on the ingredients type segment, the surfactants segment is expected to be the most significant revenue contributor. Surfactants are organic substances that lower the surface tension of water, changing its characteristics.

Surfactants allow the industrial cleaning solution to moisten a surface, including clothes, dishes, and counters, faster, allowing the soil to be loosened and removed more easily with the help of mechanical action. Every washing product contains surfactants, which are the most extensively used ingredient. Surfactants are in high demand owing to their superior performance in industrial cleaning products.

Geographic Overview

In terms of geography, North America had the largest revenue share. Presence of key players, strong focus on research and development, and high disposable income of heavy industries in the region seeking industrial chemicals for smooth functioning of their manufacturing plants. Equipment and other equipment manufacturers are the key customers of such sectors.

Moreover, Asia Pacific is expected to witness a high CAGR in the global industrial cleaning chemicals market due to increasing demand from the industrial and automotive industries. Further, the region has become a hub for international investments and flourishing industrial sectors due to the low cost of workers, easy availability of raw resources, increased use of contemporary technology inventions, and the easy availability of inexpensive land.

Competitive Insight

Some of the major players operating in the global industrial cleaning chemicals market include 3M, BASF SE, Clariant SA, Diversey Inc., DuPont De Numerous, Inc., Ecolab Inc., Henkel AG & Co, National Chemicals Laboratories, Inc., Novozyme, Nyco Products Company, Pilot Chemicals Corp., Proctor & Gamble, Reckitt Benckiser, Solvay, The Dow Chemicals Company, and Trans Gulf Industries.

Industrial Cleaning Chemicals Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 48.24 Billion |

|

Revenue forecast in 2030 |

USD 73.55 Billion |

|

CAGR |

4.9% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Ingredient Type, By Product Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

3M, BASF SE, Clariant SA, Diversey Inc., DuPont De Numerous, Inc., Ecolab Inc., Henkel AG & Co, National Chemicals Laboratories, Inc., Novozyme, Nyco Products Company, Pilot Chemicals Corp., Proctor & Gamble, Reckitt Benckiser, Solvay, The Dow Chemicals Company, and Trans Gulf Industries |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Human Augmentation Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Food Waste Management Market Share, Size, Trends, Industry Analysis Report, 2022 - 2029

- Parabolic Flight Tourism Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Location Analytics Market Research Report, Size, Share & Forecast, 2020 – 2026

- Animal Feed Antioxidants Market Research Report