Industrial Automation and Control Systems Market Share, Size, Trends, Industry Analysis Report, By Component; By Control System; By End-use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Dec-2022

- Pages: 101

- Format: PDF

- Report ID: PM2945

- Base Year: 2021

- Historical Data: 2018-2020

Report Summary

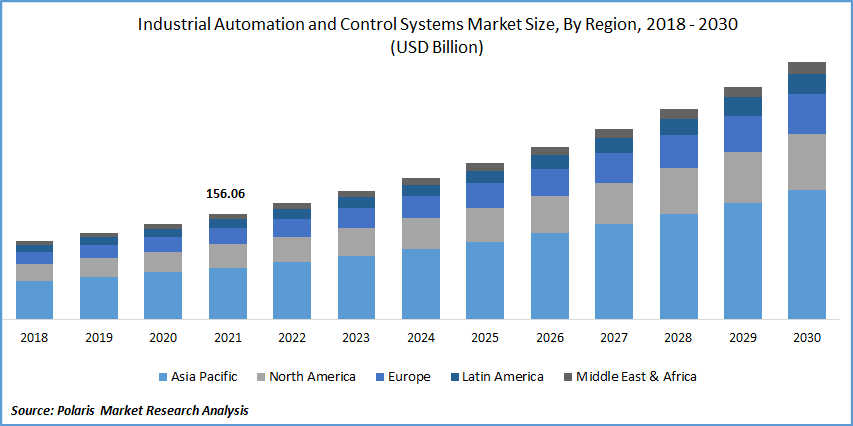

The global industrial automation and control systems market was valued at USD 156.06 billion in 2021 and is expected to grow at a CAGR of 10.4% during the forecast period.

The market's promising growth potential is attributed to the continuous introduction of advanced technologies like robots, artificial intelligence, and others; the industrial sector has been swiftly evolving. Additionally, automation allows production and material handling processes to be completed quickly using intelligent manufacturing infrastructure.

Know more about this report: Request for sample pages

Industries are implementing industrial automation and control systems to boost efficiency and save labor costs. In addition, the industrial industry has been quickly adopting new technologies and enhanced networking architectures due to Industry 4.0.

Small standalone units to several linked, expansive work cells dispersed around the manufacturing floor make up the automation systems. Every system is made to perform a specific duty, which lowers costs, improves quality, increases operator safety, and increases output. Technologies like analytics, cloud computing, and mobility assist businesses in effectively achieving their goals. Additionally, the expansion of smart manufacturing, which embraces and adopts the benefits of internet connectivity, is driven by the penetration of the Internet of Things (IoT) in factory automation.

Additionally, technological advancement, expanding infrastructure opportunities, and increased operational efficiency demands all influence factory automation. This approach is anticipated to improve nations and businesses by ushering in a new stage of economic prosperity.

For instance, in February 2020, Rockwell Automation, Inc. disclosed that it had struck an agreement to acquire ASEM, S.p.A., an Italian company pioneer in digital automation technologies. As well as a wide range of Industrial PCs (IPCs), secure Industrial IoT gateway solutions, and remote access capabilities, ASEM also offers HMI software and hardware.

It is anticipated to substantially impact various companies, shareholders, business strategies, and helpful government policies to encourage adoption across industries globally. Due to rising knowledge of cloud computing platforms' use and advancements in semiconductor and electronic device technology, the automation sector is anticipated to develop over time.

Important end-user industries became firmly reliant on automation as a result of the COVID-19 pandemic, minimizing operational and other long-term economic effects. Manufacturers were forced to alter automated procedures to prevent foreclosures while workforces could not operate owing to government-issued lockdowns. Global market actors started automating their processes on their own or through partnerships, at least to some level. In March 2020, Epson Robots collaborated with Air Automation Engineering (AEE) to offer technical support in the Midwest of the United States.

Additionally, it is projected that the increase would aid the rise of the market leaders in investment and continued development in the manufacturing sector. The production process in several sectors, such as automotive, aerospace, and heavy engineering, is becoming more digitalized. Integrating IIoT into manufacturing facilities is essential for linking systems and devices to a network. New automated developments are aided by artificial intelligence (AI), machine learning, cloud computing, etc.

Automakers worldwide are aware of the game-changing potential of the next generation of robots and automation technology to raise standards of productivity, quality, safety, and cost in the sector. The need for robot automation systems is also anticipated to increase due to greater robotic automation expenditure year over year.

Automated equipment requires a higher initial investment in automation technology (automated systems can cost millions of dollars to design, manufacture, and install). Additionally, they have less product flexibility than a manual system, require more maintenance than a manually operated machine, and are expected to hurt market growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

For market participants in providing automation, robotics, intelligent control systems, and IIoT technologies to the manufacturing sector, Industry 4.0 has created significant potential. Leading manufacturers of automation control systems include cutting-edge technologies in their product lines to make users' daily tasks easier.

In order to lower production costs, increase productivity with enough resources, and standardize processes, businesses are also concentrating on developing innovative, bespoke solutions tailored to specific industries. The pandemic's devastating effects exposed severe flaws in the manufacturing industry.

To lessen the future impact of the crisis on the production lines, businesses are nevertheless rebuilding their sustainability strategies and reinventing their supply chain models. Automation's goals have changed from cost reduction, innovation, and customer visibility in the pre-COVID era to survival and damage control.

Report Segmentation

The market is primarily segmented based on component, control system, end-use, and region.

|

By Component |

By Control System |

By End-use |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Sensors segment dominated the market in 2021.

Due to its use and necessity in the operations and processes of automation and control systems, the sensors component type sector had the highest revenue in 2021, totaling over USD 35 billion. Sensors are crucial in automation processes because they are compact and provide real-time, reliable data and readings. With an emphasis on precision, consistency, and more, these sensors help industrial automation robots or make the production process and operation intelligent and, thus, automatic.

Moreover, the industrial robots component type segment is anticipated to dominate and grow rapidly. Manufacturing organizations use the extensive use of industrial robots and cutting-edge equipment to optimize processes that call for quickness, sturdiness, and accuracy is the cause of this increase. Robotic industrial automation lowers labor costs, energy consumption, and waste of raw materials. Industrial robots also provide an efficient and continuous workflow throughout the manufacturing process.

The demand in Europe is expected to witness significant growth.

From 2022 to 2030, Europe is anticipated to grow at a high CAGR. Increased competition and increased end-user demand force manufacturing facilities in the region to adopt the latest technological advancements and digital transformation skills to streamline their business operations. This has resulted in a considerable expansion. For instance, the automotive sector can quickly adapt to market demands, reduce manufacturing downtime, increase supply chain efficiency, and increase productivity. Significant corporations are putting industrial automation goods on the market and are also being used in many regional sectors, including the automobile, healthcare, manufacturing, and others.

Asia Pacific region dominated the industrial automation and control systems market. Key market players and developing businesses are present, which are responsible for this robust expansion. Additionally, this region’s market expansion is driven by the rising need for improved industrial plant management systems in China and India. It's a common tendency for traditional manufacturing facilities to be incorporated into smart factories, which helps to increase public acceptance of industrial automation.

Competitive Insight

Some of the major players operating in the global market include ABB Ltd., Emerson Electric Co., Honeywell International, Inc., Kawasaki Heavy Industries, Ltd., Mitsubishi Electric Corporation, OMRON Corporation, Rockwell Automation, Inc., Schneider Electric, Siemens AG, Yokogawa Electric Corporation

Recent Developments

- In March 2021: Suez and Schneider Electric announced the creation of a joint to provide cutting-edge digital solutions for water cycle management. The new venture is anticipated to bring together EcoStruxure and SUEZ's technical know-how in the water business.

Industrial Automation and Control Systems Market Report Scope

|

Report Attributes |

Details |

|

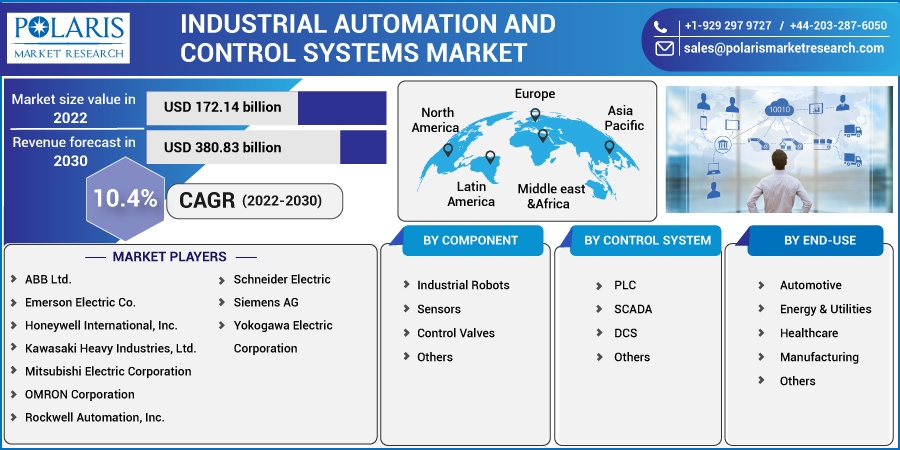

Market size value in 2022 |

USD 172.14 billion |

|

Revenue forecast in 2030 |

USD 380.83 billion |

|

CAGR |

10.4% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Component, By Control System, By End-use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

ABB Ltd., Emerson Electric Co., Honeywell International, Inc., Kawasaki Heavy Industries, Ltd., Mitsubishi Electric Corporation, OMRON Corporation, Rockwell Automation, Inc., Schneider Electric, Siemens AG, Yokogawa Electric Corporation. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Smart Cities Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Commercial Aircraft Aftermarket Parts Market Research Report, Size, Share & Forecast by 2019 – 2026

- Carrageenan Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- 1,3 Propanediol Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Diaphragm Pacing Therapy System Market Share, Size, Trends, Industry Analysis Report, 2020-2027