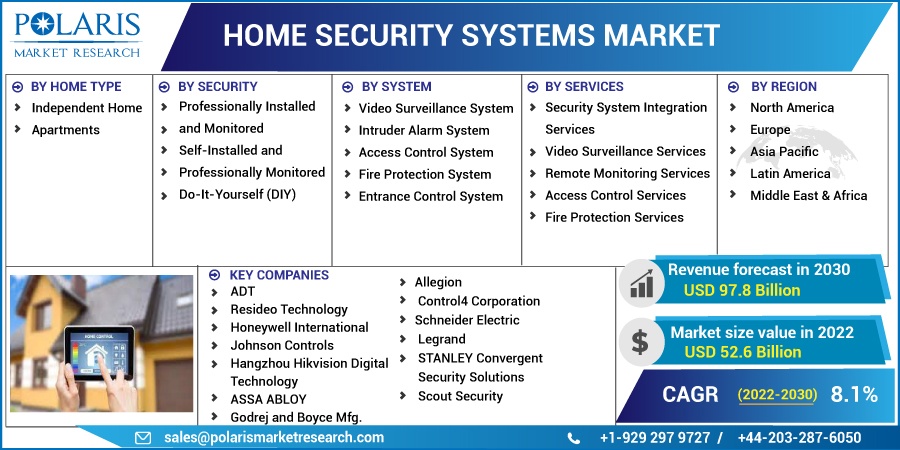

Home Security Systems Market Share, Size, Trends, Industry Analysis Report, By Home Type (Independent Home, Apartments); Security; Systems; Services; By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 101

- Format: PDF

- Report ID: PM2864

- Base Year: 2021

- Historical Data: 2018-2020

Report Summary

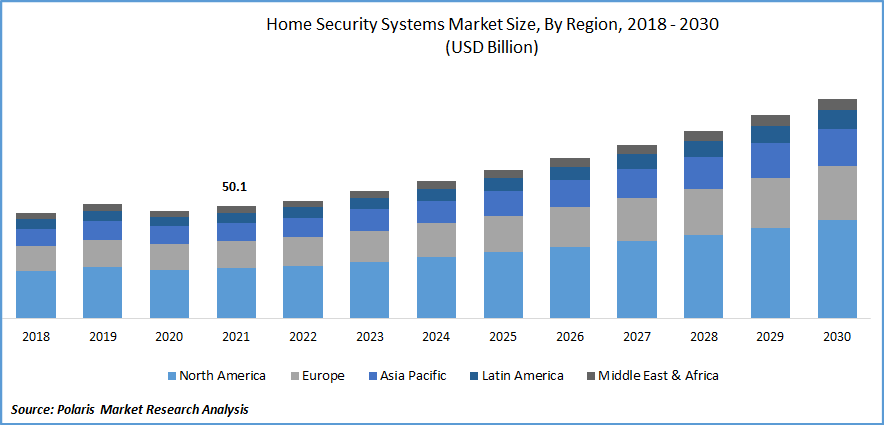

The global home security systems market was valued at USD 50.1 billion in 2021 and is expected to grow at a CAGR of 8.1% during the forecast period.

The global market is majorly driven by the advancement in the internet of things and wireless technologies. Rising theft activities and growing awareness towards the safety of homes and surroundings also increased the demand for a home security system. To protect the house from theft, home security systems are mainly comprised of different cameras or sensors, which are joined together with a central hub. It controls the whole security system, window and motion sensors, security cameras, and doors. These systems also have window stickers and alarms.

Know more about this report: Request for sample pages

With the aid of IoT, many companies are making these security systems to increase house security with monitoring. Integration of IoT makes houses more interconnected, smartphones controllable, and secure. The incorporation of cloud computing and IoT makes the system accessible from different areas and gives better efficiency and storage in data exchange. This cloud computing security system makes complex software simpler for residential users.

Nowadays, home security systems are compatible with Alexa or Google Assistants. Such systems are interconnected with intelligent locks, cameras, thermostats, doorbells, smartphone apps, and wall-mounted touchscreen displays. Additionally, they have features like fire alarms, smoke, flood, and freeze alarms. Therefore, these add-on features are spurring the demand for home security systems. Moreover, such systems also use Wi-Fi-enabled cameras so that any sound can be detected, as they are Z-Wave compatible. The use of home security systems increases with the adoption of advanced technologies and security systems.

The covid-19 pandemic severely affects the market’s growth for home security systems due to the decline in new construction projects and the shutdown of manufacturing industries. Due to disruptions in the construction business and the temporary shutdown of transportation of non-essential items, the sale has declined by 5- 10% globally.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

One of the most critical aspects favorably affecting the market is the increasing construction activities with growing need for homes and businesses. Additionally, the global demand for CCTV cameras, electronic alarm sensors, and upgraded home security systems is being fueled by the rising incidences of thefts, security threats, and breaches. On account of such factors, the market is expected to grow with increasing industrialization in conjunction with growing number of fire accidents and gas leakage instances across various industries. In addition, the expansion of the industry is being supported by the development of microprocessor-based home security systems that perform a wide range of tasks and provide a user-friendly interface.

Other factors propelling the industry include expanding internet penetration, rising consumer spending capacity, and shifting consumer reliance on smartphones, laptops, and personal computers (PCs). Additionally, major market players are continuously funding R&D initiatives to introduce more effective and technologically advanced security systems, which is projected to fuel market expansion. IoT-based and cloud computing ensure the security of homes. The intelligent sensors detect variations in heat, motion, and sound and send the signal to the user and make them alert. For example, high-definition cameras enabled with infrared and night vision keep the surveillance 24/7. Hence the introduction of wireless and IoT-based devices propels the growth of the global market.

Report Segmentation

The market is primarily segmented based on home type, security, system, services, and region.

|

By Home Type |

By Security |

By System |

By Services |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

The Independent Home segment accounted for the largest revenue share in 2021.

The market for home security systems increases for an independent home to secure their families and properties from theft and intruders. According to the FBI, the rate of burglaries in homes is one residential burglary every 13 seconds, four burglaries every 20 minutes, 240 in one hour, and approximately 6k daily. It is also stated that heist will occur in one in every three houses with no security systems, whereas in every 250 houses with security systems installed in their homes. Homeowners can access these devices remotely through their laptops or smartphones because these systems give accessibility and connectivity from anywhere, anytime. Such factors are projected to drive the segment growth over the forecast period.

The professional installed and monitor segment accounted for the largest revenue share in 2021

Many customers are willing to pay more for the professional installation of wireless sensors and security cameras. Customers also want to confirm that all equipment is situated correctly and that the system is properly maintained. Additionally, experts can help clients acquire the finest view when positioning security cameras, ensuring that equipment won't be easily stolen. This can include using ladders, drilling, and doing electrical work, which the average person might find challenging. Additionally, they will plan the system, install the sensors, test them, and troubleshoot any problems that arise—all of which are crucial elements driving this segment's revenue development.

The do-It-Yourself segment accounts for a moderate revenue share in 2021. A significant element in this segment's growth is the rising consumer desire for goods made from recyclable and reusable materials. Additionally, buyers wary of high-pressure sales prefer DIY since they want a clear image of expenses and want to avoid long-term contracts. Customers avoid commission-based salespeople that push unnecessary, pricey add-ons and convoluted contracts.

Video surveillance systems hold the highest market share among all the system type segment

In the system category, the video surveillance system segment dominated the market in 2021. The growth in this segment can be attributed to greater viewing angles and higher quality of digital video cameras for surveillance. The user-friendly characteristic of the system further creates lucrative product demand, as customers may view actions on their surveillance feeds using PCs, mobile devices, and tablets from anywhere in the world. Additionally, users may log in to their security system and view recorded or live feeds, which is another important feature boosting this segment's revenue growth.

The fire protection system segment is projected to grow at a high CAGR over the forecast period. The need for FPS via conventional methods, like smoke alarms, which help to protect both homes and the people who reside in them, is growing. Fire protection systems (FPS) are a cost-effective way to safeguard both the home's property and its occupants, while fire alarms significantly lower the chance of fire-related fatalities by 82%. Rising consumer awareness of the advantages of fire protection systems is anticipated to fuel market expansion in the extended run.

Security system integration segment dominated the global market in 2021

In terms of revenue, security system integration segment held the largest revenue share in 2021. The system involves the correct installation of hardware goods, such as controllers and readers, smart locks, as well as monitoring tools like PDAs and TVs. The system integration process comprises making it possible for all of these devices to link and send communication signals, depending on the circumstances. Bluetooth Smart, NFC, Wiegand 32-bit, and ZigBee, are among the different communication techniques utilized in security systems. Growing popularity of single comprehensive security system among corporate organizations is projected to further drive the segment growth.

North America is expected to witness the highest growth in the forecast period

Companies in this region are expanding their knowledge of access control systems to provide distinctive innovations and services in this market and acquire a competitive edge over rivals from other nations. Builders are now required to incorporate fire prevention systems into their building constructions as a result of mandated fire security and prevention standards. Smoke and flame detectors and fire alarms are just a few of the fire protection equipment and system options available in this area.

Asia Pacific accounted for the second-largest revenue growth during the forecast period. The rise in public spending on smart city projects like smart surveillance and monitoring are major drivers of the market expansion in this area.

Competitive Insight

Some of the major players operating in the global market include ADT, Resideo Technology, Honeywell International, Johnson Controls, Hangzhou Hikvision Digital, ASSA ABLOY, Godrej, Allegion, Control4 Corporation, Schneider Electric, Legrand, STANLEY Convergent Security Solutions, and Scout Security.

Recent Developments

In April 2022, Home safety product supplier First Alert was purchased by the Resideo Technologies. First Alert provides a wide range of detection and suppression tools, such as combination alarms, Carbon Monoxide alarms, connected fire, fire extinguishers, Carbon Monoxide devices, smoke alarms, CO alarms, and connected devices.

In March 2022, in a signed agreement, ASSA ABLOY agreed to purchase, JOTEC services, & Vertriebsgesellschaft. This acquisition aims to improve Assa Abloy's entrance automation offering.

In January 2022, Snap One bought Staub Electronics, a long-time Canadian distribution partner, to improve the partner experience in Canada and increase the company's local branch network across North America.

Home Security Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 52.6 billion |

|

Revenue forecast in 2030 |

USD 97.8 billion |

|

CAGR |

8.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Home Type, By Security, By System, By Services, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

ADT, Resideo Technology, Honeywell International, Johnson Controls, Hangzhou Hikvision Digital Technology, ASSA ABLOY, Godrej and Boyce Mfg., Allegion., Control4 Corporation, Schneider Electric, Legrand, STANLEY Convergent Security Solutions, Scout Security. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Floor Grinding Tools Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Cellulose Ether & Derivatives Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Automotive Battery Thermal Management System Market Research Report, Share and Forecast, 2018 – 2026

- Healthy Snacks Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Ball Valves Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030