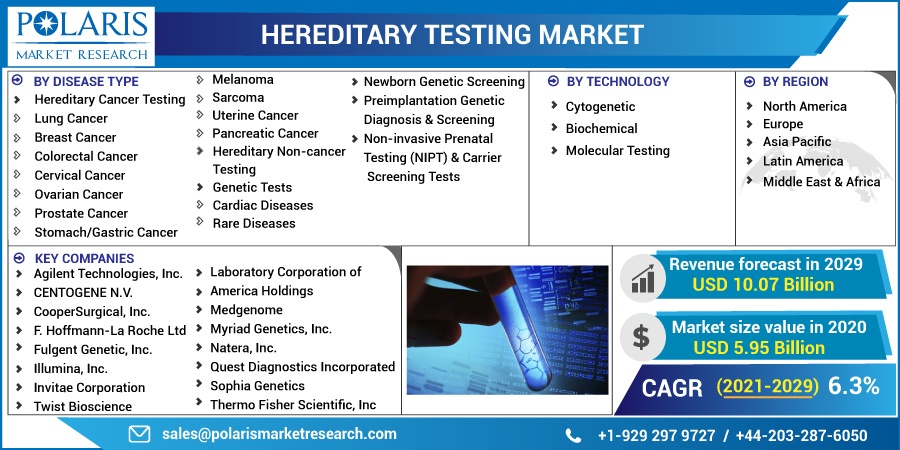

Hereditary Testing Market Share, Size, Trends, Industry Analysis Report, By Disease Type (Hereditary Cancer Testing, Hereditary Non-Cancer Testing); By Technology (Cytogenetic, Biochemical, Molecular Testing); By Region; Segment Forecast, 2021 - 2029

- Published Date:Nov-2021

- Pages: 101

- Format: PDF

- Report ID: PM1774

- Base Year: 2020

- Historical Data: 2017 - 2019

Report Summary

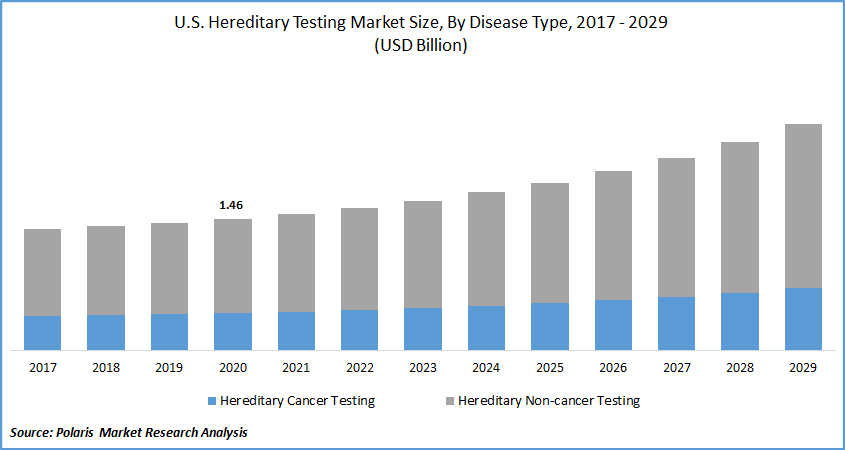

The global hereditary testing market was valued at USD 5.95 billion in 2020 and is expected to grow at a CAGR of 6.3% during the forecast period. The primary drivers driving market expansion include an increase in the frequency of hereditary disorders, increased public awareness of the negative consequences, advancements in genetic analysis, and the advent of uncommon diseases. Furthermore, the majority of the businesses are focused on women's healthcare inherited disorders and growing their presence in the ever-changing market area.

Know more about this report: request for sample pages

Furthermore, another primary market trend is the increasing reproduction genetic health arena. Natera, for example, has shown steady growth in test numbers in women 's health genetic analysis for hereditary disorders. This indicates the population's increased acceptance of hereditary testing, which is exacerbating revenue market growth.

The outbreak of COVID-19 had a negative impact on the market. For example, after the WHO classified COVID-19 as a pandemic, governments throughout the world implemented lockdowns to enforce social separation as a preventative precaution. This resulted in disruption, limitations, problems, and changes in every industry area. Likewise, the outbreak has a detrimental impact on the market for hereditary genetic analysis.

This is due to genetic counselors' inability to visit individuals in person, doctors' failure to provide guidance, and the laboratory's inability to execute the tests. Furthermore, regulatory entities such as the Centers for Medicaid Services (CMS) do not yet recognize genetic counselors as healthcare practitioners, therefore they are not excluded from working during shutdowns.

In addition, clinics curtailed face-to-face diagnostic tests to aid in the prevention of the disease's spread. Nevertheless, genetic testing behemoths like GeneDx offered a service in which they supplied clinician-ordered genetic screening. Likewise, clinics and healthcare practitioners, and individuals are now utilizing telemedicine to undertake genetic counseling.

Furthermore, because prenatal testing is so important, it is the least impacted of all forms of genetic analysis. Many perinatal genetic counselors, for example, reported delivering face-to-face assistance during the outbreak. As a result, the outbreak had a massively negative influence on the genetic testing market.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

A steady rise in market demand for genetic testing has resulted in an upsurge in DNA screening kit purchases. For example, in November 2019, the Virginia Department of General Services Division of Integrated Laboratory Facilities evaluated 7,867 babies for over 31 genetic and metabolic diseases. Increased use of newborn screening throughout the world is also helping to drive revenue market growth.

Changes in genetic testing protocols have resulted in the clinical use of multigene panel screening for hereditary diseases. The NCCN Clinical Practice Recommendations in Oncology for ovarian, breast, and colorectal malignancies include information on various cancer risk variables as well as treatment guidelines for individual and multiple genetic panels.

The hereditary genetic testing market is projected to gain from gradual changes in the distribution strategy. Technological suppliers are playing an important role in market expansion by boosting distribution services and increasing technical efficiency. Organizations are utilizing a cloud-based delivery approach to make bioinformatics technologies accessible to other institutions. As of March 2019, about 14 licensees started actively offering Non-invasive Prenatal Testing (NIPT) devices employing constellation software.

Report Segmentation

The market is primarily segmented on the basis of disease type, technology, and region.

|

By Disease Type |

By Technology |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Technology

The molecular hereditary testing segment accounted for 54.2% of the revenue market share in 2020 and is expected to continue its dominance over the forecast period. The market segment's rise can be ascribed to the reality that genetic analysis is the most widely utilized technique for hereditary genetic screening.

The genetic hereditary testing kits, for example, are utilized in carriers testing, medical tests, prediction & pre-symptomatic checking, and others. Moreover, genetic testing is preferable since it may be utilized to study DNA gains and losses which are not detected with the normal chromosomal examination.

Insight by Disease Type

The breast cancer hereditary testing segment is expected to witness a CAGR of 7.4% over the forecast period. The product and service choices for different hereditary cancer tests continue to grow. The sudden entry of big businesses, like Quest, into this category has dramatically fueled the genetic testing market. Businesses are focused on commercial methods to increase their position in this area, seeing breast cancer genomic screening as a valuable source of income.

One of the methods is to give hereditary testing at a lesser price than rivals. Color Genomics, for example, began selling their goods for USD 259, while Myriad's comparable goods cost over USD 4,000. Several of the primary drivers of such an industry is the growing accessibility of the examinations. Moreover, BRCA1 owners get an 80% chance of acquiring breast cancer, which has sped up innovations in the genetic hereditary cancer testing industry.

Geographic Overview

Europe is expected to contribute the highest revenue market share in 2021 and is expected to maintain its dominance throughout the projection timeframe. It can be ascribed to the existence of significant businesses offering genetic tests, the widespread use of modern therapies, and government guidelines to maintain the integrity of hereditary testing screening. North America market is anticipated to hold a significant market revenue percentage by the end of 2029. The region's expansion is attributed to numerous regulatory regimes, high incidence and consciousness of the negative effects and financial impact of genetic illnesses, and commercial acceptance of hereditary tests.

According to the National Institutes of Health (NIH), greater than 30 million individuals in the U.S. suffer from around 7,000 genetic disorders. Increasing income levels are bound to help regional market development as the number of people getting hereditary genomic testing increases. Blueprint Genetics, a Finnish firm, teamed with ARCHIMEDlife, a rare illness diagnostics business, in September 2019 to deliver biochemical screening for rare conditions in North America. Both companies intended to broaden their range of genetic illness diagnostic services through this collaboration in order to serve their clients better. Such activities are likely to boost the genetic screening scenario for hereditary illnesses in North America, resulting in faster regional income creation.

Competitive Insight

Some of the major market players operating in the global hereditary testing market are Agilent Technologies, Inc., CENTOGENE N.V., CooperSurgical, Inc., F. Hoffmann-La Roche Ltd, Fulgent Genetics, Inc., Illumina, Inc., Invitae Corporation, Laboratory Corporation of America Holdings, Medgenome, Myriad Genetics, Inc., Natera, Inc., Quest Diagnostics Incorporated, Sophia Genetics, Thermo Fisher Scientific, Inc, and Twist Bioscience.

Hereditary Testing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 5.95 billion |

|

Revenue forecast in 2029 |

USD 10.07 billion |

|

CAGR |

6.3% from 2021 - 2029 |

|

Base year |

2020 |

|

Historical data |

2017 - 2019 |

|

Forecast period |

2021 - 2029 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2029 |

|

Segments covered |

By Disease Type, By Technology, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Agilent Technologies, Inc., CENTOGENE N.V., CooperSurgical, Inc., F. Hoffmann-La Roche Ltd, Fulgent Genetic, Inc., Illumina, Inc., Invitae Corporation, Laboratory Corporation of America Holdings, Medgenome, Myriad Genetics, Inc., Natera, Inc., Quest Diagnostics Incorporated, Sophia Genetics, Thermo Fisher Scientific, Inc, and Twist Bioscience. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Autonomous Delivery Robots Market Share, Size, Trends, Industry Analysis Report, 2022 - 2029

- Drip Irrigation Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Lactoferrin Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Livestock Monitoring Market Share, Size, Trends, Industry Analysis Report, 2020 - 2027

- Modified Starch Market Share, Size, Trends, Industry Analysis Report, 2023 - 2032