Ready to Drink Tea & Coffee Market Share, Size, Trends, Industry Analysis Report, By Packaging (Glass Bottle, Canned, Pet Bottle, Fountain/Aseptic, Others); By Distribution Channel (Off-trade, On-trade), By Type; By Price Segment; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 101

- Format: PDF

- Report ID: PM1147

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Summary

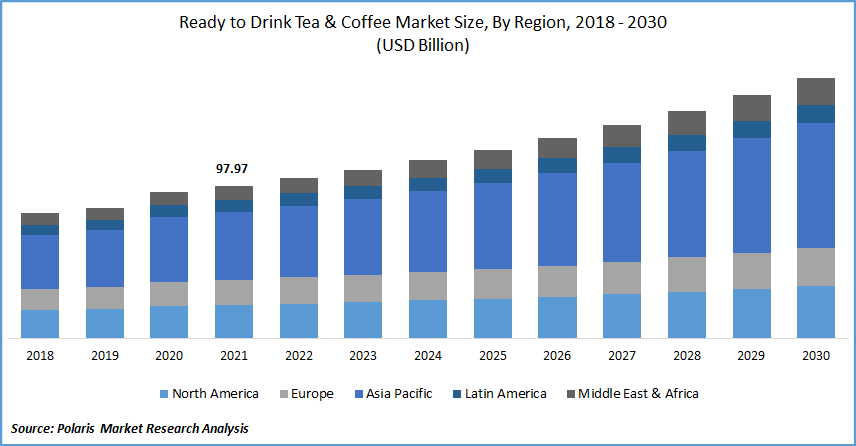

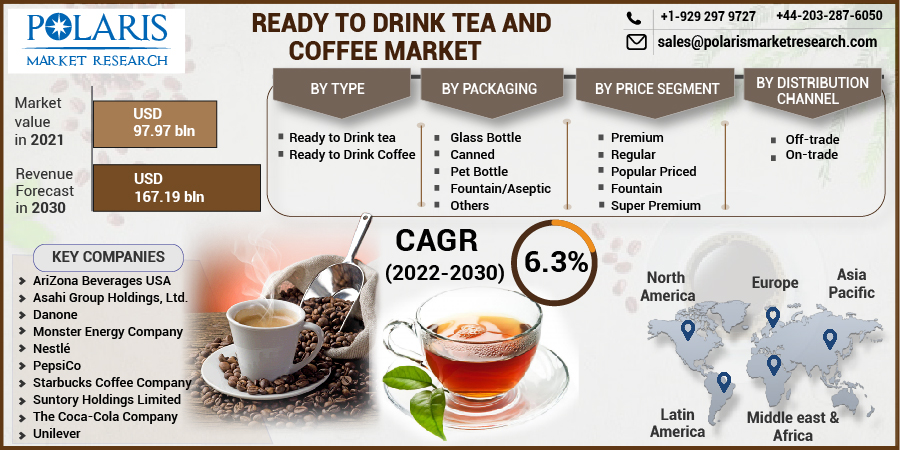

The global ready to drink tea & coffee market was valued at USD 97.97 billion in 2021 and is expected to grow at a CAGR of 6.3% during the forecast period. The fast-paced lifestyle has driven demand for readymade tea & coffee as a substitute for carbonated beverages. Increasing consumer awareness related to the health hazards of carbonated drinks is fueling the demand for readymade tea and coffee.

Know more about this report: Request for sample pages

Basically, coffee is a major source of antioxidants in the diet and has various health benefits, such as a lower risk of several diseases and improved brain function. In addition, the consumers are primarily looking for functions in ready to drink tea and other beverages including antioxidants, promoting brain health, anti-inflammatory, and added probiotics.

On the other hand, innovative business expansion strategies of the key industry players are projected to fuel the growth of the market. For instance, in March 2022, Procter & Gamble, one of the leading industry players, invested $110 million in an expansion of its consumer products manufacturing facility located in Greensboro, a city in North Carolina.

During Covid-19, the demand for the ready-to-drink tea & coffee market increased significantly during the pandemic due to the positive impact on the overall food & beverage industry. In addition, the rising awareness among people to adopt a healthy lifestyle during the pandemic has skyrocketed green tea consumption. It is seen as ‘good for you’ with its consumption being primarily encouraged by registered nutritionists/dietitians, the fitness community, the specialty tea community, and the medical community.

Industry Dynamics

Growth Drivers

Increased urbanization and demanding work schedules including long, wearying hours, pin people down. Hence, growth in the working population, as well as hectic schedules, has boosted the demand for the consumption of RTD beverages due to their convenience. In addition, the industrialization integrated with the expansion of vending machine business has become one of the major reasons for workers to prefer such beverage products as the perfect ready to drink in the middle of a hard day’s work.

In addition to this, the youth across different developing and developed countries are rapidly moving towards RTD beverages as an alternative of synthetic sports drinks for an immediate increase in energy. Also, consumers' switch from carbonated drinks towards a combination of RTD products to meet the demand for instant energy has further boosted the growth of the global ready to drink tea & coffee market.

Moreover, the business expansion strategies adopted by key industry players are expected to create lucrative growth opportunities for the market. For instance, in March 2022, HY BTS Coffee, a premium ready-to-drink coffee beverage Brand in South Korea, partnered with the 24Seven Convenience Stores for its product placement in the stores. 24Seven is a premier organized retail chain. Furthermore, rising per capita income in developing economies such as China, India, and Indonesia, among others, is expected to be opportunistic for the growth of the market.

Know more about this report: Request for sample pages

Report Segmentation

The global ready to drink tea & coffee market is primarily segmented on the basis of type, packaging, price segment, distribution channel, and region.

|

By Type |

By Packaging |

By Price Segment |

By Distribution Channel |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Type

The ready-to-drink tea segment dominated the global market. Growing awareness associated with the health benefits of the segment has primarily encouraged consumers to focus on the adoption of a healthy lifestyle. For instance, readymade tea helps in weight loss, decreased cholesterol levels, reduction of headaches & body pain, and reduced risk of chances of heart attacks. In addition, the introduction of new RTD products is expected to create lucrative growth opportunities for this segment.

For instance, in March 2021, Suntory PepsiCo, a joint venture between two leading food and beverage companies, launched Suntory TEA, RTD oolong tea from Thailand. However, ready to drink coffee segment is expected to witness the highest growth rate during the forecast period as the consumers are increasingly looking for these products with functional benefits such as brain health, enhanced metabolism, decreased diabetes risk, and improved liver health. On the other hand, increased per capita spending on ready-to-drink coffee is seeing significant growth in Asian countries such as Japan and South Korea.

Insight by Packaging

The canned segment is expected to witness considerable CAGR during the forecast period owing to the benefits such as enhanced product shelf-life and flavor preservation. In addition, this type of packaging adds to the convenience of consumers and accentuates the image of the brand in the minds of consumers.

However, the PET bottles segment dominated the global market in 2021 owing to the ease of handling and low manufacturing cost of such bottles. In addition, such types of bottles can be molded in various shapes and sizes. Hence, the manufacturers are using PET bottles as an attractive packaging solution to grab consumer attention.

Insight by Distribution Channel

The off-trade segment dominated the global ready to drink tea & coffee market. This segment includes distribution channels such as independent retailers, supermarkets/hypermarkets, convenience stores, and others. The varying retail landscape along with the increasing number of supermarket chains, especially across the densely-populated countries such as China and India, are boosting sales of RTD products through the off-trade sales channel.

However, the on-trade segment is expected to witness the highest growth rate during the forecast period. This segment comprises food service and vending sales channels. The food service distribution channel involves a network of distributors that supply RTD tea and coffee products to industrial caterers, hotels & restaurants, and cafeterias, among others.

Geographic Overview

Asia Pacific is the largest revenue contributor in the global market due to the extensive development of the F&B industry across the countries such as India, China, and Japan. The aforementioned countries have a high number of coffee and tea plantations. Moreover, the expansion of modern grocery retail chains across the ASEAN countries, such as Thailand, Malaysia, Indonesia, and the Philippines, is further projected to boost sales of RTD products.

Moreover, Middle East & Africa is anticipated to witness the highest growth rate in the global market. This is attributed to the high consumption of RTD beverages, along with the changing retail landscape in the region. In addition, this region is seeing an outgrowing foodservice sector, which fuels demand for ready-to-drink products.

Competitive Insights

Some of the major players operating the market include AriZona Beverages USA, Asahi Group Holdings, Ltd., Danone, Monster Energy Company, Nestlé, PepsiCo, Starbucks Coffee Company, Suntory Holdings Limited, The Coca-Cola Company, and Unilever.

Ready to Drink Tea & Coffee Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 97.97 Billion |

|

Revenue forecast in 2030 |

USD 167.19 Billion |

|

CAGR |

6.3% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Packaging, By Price Segment, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

AriZona Beverages USA, Asahi Group Holdings, Ltd., Danone, Monster Energy Company, Nestlé, PepsiCo, Starbucks Coffee Company, Suntory Holdings Limited, The Coca-Cola Company, and Unilever |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Mammography Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Spa Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Piperidine Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Disposable Gloves Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Firefighting Foam Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030