Blood Transfusion Diagnostics Market Share, Size, Trends, Industry Analysis Report, By Product (Instruments, Reagents & Kits, Others); By Application (Blood Grouping, Disease Screening); By End Use (Hospitals, Blood Banks, Diagnostic Laboratories, Others); By Regions; Segment Forecast, 2020 –2027

- Published Date:Dec-2020

- Pages: 101

- Format: PDF

- Report ID: PM1316

- Base Year: 2019

- Historical Data: 2016 - 2018

Report Summary

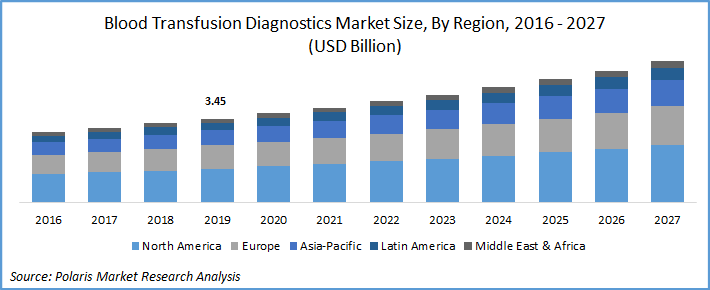

The global blood transfusion diagnostics market was valued at USD 3.45 billion in 2019 and is expected to grow at a CAGR of 6.7% during the forecast period. The rising cases of organ transplantation and surgeries requiring transfusion increases the demand for donor screening are major factors driving market growth. Surge in prevalence of chronic disorders such as kidney problems, sickle cell anemia, hemophilia, and thrombocytopenia is also favoring the uptake of transfusion diagnosis.

Blood transfusion diagnosis enables practitioners to prevent the spread of different plasma borne risks such as allergic reactions, viral infections, iron overload, and hemolytic reactions. Timely diagnosis also detects the presence of Hepatitis B, C, AIDS, Syphilis, and West Nile virus. According to the National Heart, Lung, and Blood Institute, reduction in RBC count is the most common disorder, with majority of cases due to deficiency in iron. Thus, with the rising RBC transfusions, the demand for the blood transfusion diagnostics is bound to witness growth.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Increasing hospital admissions due to surgeries, road traffic accidents, blood-related disorders, trauma cases, and injuries due to recreational activities, led to significant demand in the transfusions, thus driving the global market. In addition, the increasing demand for blood transfusion for complex surgeries across the developed economies in North America and Europe is likely to complement market growth.

Increasing need for donor screening owing to the possibility of Transfusion-Transmitted Infections (TTIs) is expected to drive the demand for transfusion diagnostics across the regions. In addition, the growing road accidents have led to the rising demand for blood transfusion. According to WHO, around 20 to 50 million people suffer from non-fatal injuries with need for transfusion driving market growth.

Blood Transfusion Diagnostics Market Report Scope

The market is primarily segmented on the basis of product, application, end-use, and region.

|

By Product |

By Application |

By End Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Product

Based upon product, the blood transfusion diagnostics market is categorized into instruments, reagents & kits, and others. Reagents & kits accounted for the largest market share in 2019 owing to repetitive usage of transfusion diagnostics in screening both donor and recipient samples. The easy availability of wide portfolio of offerings in blood grouping, donor screening, and reagents by both local and global players is also fostering the segmental growth.

Moreover, technologically advanced donor blood screening systems such as MosaiQ by Quotient for grouping and TTI donor sample screening and Roche’s Cobas 201 automated system use real time PCR technology, ensuring improved blood screening of donor samples.

Insight by Application

On the basis of application, the global market is segmented into blood grouping, and disease screening. The disease screening segment is expected to hold a majority revenue share and is projected to register highest growth over the forecast period. The routine blood typing and cross matching performed for the transfusion therapy is driving the segment’s share over the forecast period.

Insight by End Use

On the basis of end-use, the global blood transfusion diagnostics market is segmented into hospitals, blood banks, diagnostic laboratories, and others. Blood banks segment accounted for the largest revenue share in 2019 owing to large screening process being carried out before surgeries. Blood banks usually perform standard tests which include RBC antibody screening, infectious disease screening, Rh typing, and compatibility tests in between donor and recipient.

Geographic Overview

North America was the largest revenue contributor in 2019 to transfusion diagnostics on account of the presence of major key players in the country, people awareness regarding blood donations and associated disorders, presence of advanced healthcare infrastructure, and the availability of different assays to check donor compatibility.

Asia Pacific is projected to register highest growth rate over the forecast period. This increase is due to several government sponsored blood donation campaigns, especially in India and South Korea. However, China has been characterized with low donation rate, i.e., 1 donor per 100 populations, in 2016, which is well below to the world average of 3 to 4 donors per 100 populations. Despite, stricter laws of blood donation, there is a strong regional variation, posing difficulties for nationwide campaigns, which is likely to restraint market growth.

Competitive Insight

Some of the major players operating the market include Grifols S.A.; Immucor Inc.; Ortho Clinical Diagnostics; Diamond Diagnostics, Abbott Laboratories; Electro Medical Technologies, Bio-Rad Laboratories, Inc.; Diagnostica Stago, F. Hoffmann-La Roche Ltd; and Quotient Ltd. The companies are focusing on new product development and launch, for instance, in September 2019, Roche received approval for COBAS Babesia test to be used in the company’s COBAS 6800/8800 systems to screen donation.

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Network as a Service Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Automotive Digital Cockpit Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Medical Adhesives Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Fencing Market Trend Analysis Research Report, Size & Forecast, 2017 - 2026

- Interactive Kiosk Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030