Gas Insulated Switchgear Market Share, Size, Trends, Industry Analysis Report, By Installations (Indoor, Outdoor); By Insulation (SF6, SF6 Free); By Voltage Ratings; By Configuration; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Nov-2022

- Pages: 101

- Format: PDF

- Report ID: PM2726

- Base Year: 2021

- Historical Data: 2018-2020

Report Summary

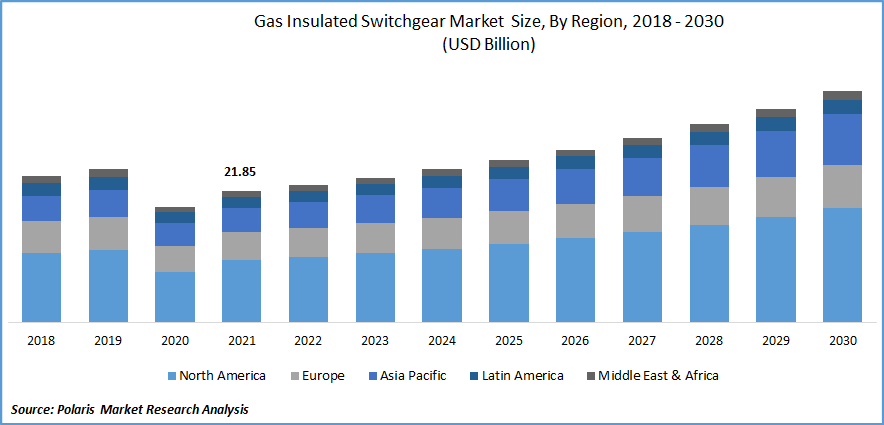

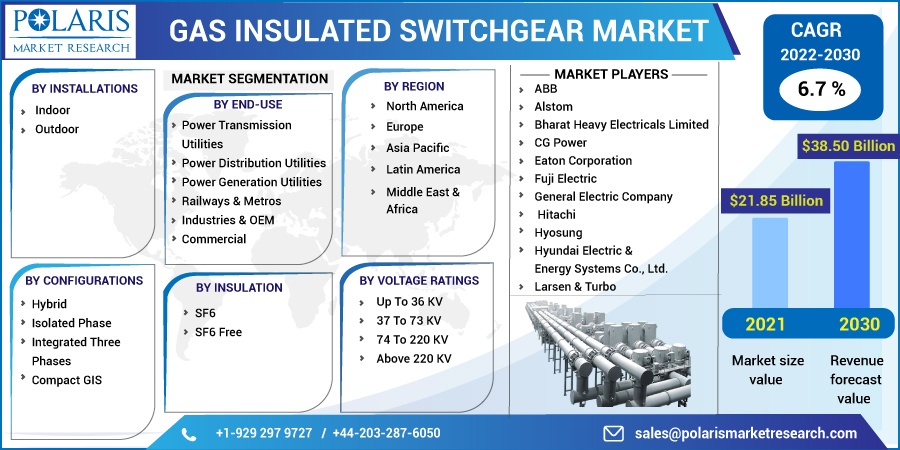

The global gas insulated switchgear (GIS) market was valued at USD 21.85 billion in 2021 and is expected to grow at a CAGR of 6.7% during the forecast period. The growing demand for gas insulated switchgear is expected to be driven by the rising energy demand across industrial, commercial, and residential sectors and the expansion of energy infrastructure to meet this demand.

Know more about this report: Request for sample pages

The rapid urbanization and growing number of IoT for home and smart building automation consume massive energy. Thus, monitoring and optimizing the use of energy for automation purposes is expected to drive market growth. Moreover, to optimize energy consumption adoption of renewable energy resources and the installation of solar panels are also bolstering the market growth.

The COVID-19 pandemic had a negative impact on the growth of the market. The lack of raw materials in the production units delayed the production of gas insulated components and led to disruption in the supply chains haltering the market growth. Moreover, many industrial and commercial projects were standstill owing to the global lockdown, which hampered market growth.

Many end-use industries are adopting GIS owing to cheap maintenance and high dependability. Still, this switchgear requires high equipment costs and emits Sulphur hexafluoride, which is harmful to the environment. Government stringent regulation on environmental and safety standards is restraining the market growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The global gas insulated switchgear is likely to be driven by the adoption of smart grids and innovative metering technologies. In addition, advancement in technologies such as artificial intelligence has led to the renovation of the updated electricity grid infrastructure, and government initiatives to innovate smart grid infrastructure is expected to drive market growth.

Furthermore, the adoption of smart grids leads to the rise of deployment of various electrical equipment propelling the market growth.

Increasing investment in transmission and distribution networks to meet the rising electricity demand is also expected to bolster market growth. For instance, Saudi Arabia is investing in its power sector to enhance its capacity and adopt renewable energy sources for electricity generation. The ministry of energy in Saudi Arabia announced spending $38 billion in energy distribution by 2030.

Report Segmentation

The market is primarily segmented based on installations, insulation, voltage ratings, configurations, end-use, and region.

|

By Installations |

By Insulation |

By Voltage Ratings |

By Configurations |

By End-Use |

By Region |

|

|

|

|

|

|

Know more about this report: Request for sample pages

Outdoor segment accounted for the largest share in 2021

The outdoor segment accounted for the highest revenue share in 2021 owing to its several outdoor applications, such as power transmission, development of large power units, and transmission of ultra-high voltage power to various end-use industries.

In addition, the deployment of this insulated switchgear is done in substations and switchyards where there is enormous space for installation, which is expected to drive market growth. Furthermore, the increasing electricity demand has led to investments in transmission and distribution networks supporting the segment’s growth.

SF6 free segment is expected to spearhead the market growth

The demand for the SF6 free is driven by the rising demand for environment-friendly products in various commercial and industrial sectors. In addition, rising consumer awareness about the damage caused by Sulphur hexafluoride led to development of reliable, efficient and sustainable switchgear expected to drive market growth.

Moreover, many key players focus on developing green solutions to meet present and future energy requirements. For instance, Schneider Electric launched its new green and medium voltage switchgear named SM AirSeT, which uses pure air and vacuum rather than SF6 for secondary electric distribution.

Above 220 kV is anticipated to lead the market over the forecast period

The growing demand for such ultra-high voltage power is expected to be driven by rapid urbanization and growing investments in electrical transmission. In addition, large thermal substations and nuclear power generation plants require voltage above 220kV for power transmission and distribution, which is expected to drive the segment growth. Moreover, growing power generation substations in various emerging nations are essential to the segment's growth.

Hybrid configuration is expected to witness fastest growth

The demand for hybrid configuration is expected to see a significant surge over the forecast period owing to its compact size and low maintenance. In addition, hybrid switchgear has both utilities that are air-insulated switchgear (AIS) interfaced with gas insulated switchgear (GIS) which has a simplified layout and is highly reliable, which is expected to accelerate the market growth.

Moreover, this condensed switchgear is used in the renovation and extension of AIS-based switchgear substations, which bolsters market growth.

Power distribution utilities is expected to account for the largest share in 2030

The power distribution utilities segment is expected to dominate the market over the forecast period owing to the increasing population growth and their rising electricity consumption and government investment to distribute power in underdeveloped rural areas. In addition, the adoption of both renewable and non-renewable sources of energy to meet the requirement of electricity is also expected to propel the segment growth.

Asia Pacific is expected to dominate and witness fastest growth over the forecast period

Asia Pacific is the largest region for gas insulated switchgear and is expected to witness faster growth over the forecast period owing to the rapid industrialization in the region, such as China, Japan, South Korea, and India.

In addition, increasing investment in transmission and distribution projects across developing nations is also supporting market growth. Moreover, replacing conventional insulated switchgear with clean power generation switchgear to improve efficiency is expected to drive market growth.

Competitive Insight

Some of the major players operating in the global market include ABB, Alstom, Bharat Heavy Electricals Limited, CG Power, Eaton Corporation, Fuji Electric, General Electric Company, Hitachi, Hyosung, Hyundai Electric & Energy Systems Co., Ltd., Larsen & Turbo, Meidensha, Mitsubishi Electric, Nisin Electric, Ormazabal, Powell Industries, Schneider Electric, Siemens, and Toshiba Energy Systems & Solutions Corporation.

Recent Developments

In April 2022, ABB partnered with Samsung electronics to develop technologies to save and manage energy. This partnership provides consumer access to home automation technology and improves device management, and also enables electrical load shifting.

In June 2021, Toshiba energy systems & solutions corporation collaborated with Meidensha corporation to develop gas insulated switchgear of 72kV or 84kV with no Sulphur hexafluoride due to the high demand for an eco-friendly product.

Gas Insulated Switchgear Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 22.93 billion |

|

Revenue forecast in 2030 |

USD 38.50 billion |

|

CAGR |

6.7% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments Covered |

By Installations, By Insulation, By Voltage Ratings, By Configurations, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

ABB, Alstom, Bharat Heavy Electricals Limited, CG Power, Eaton Corporation, Fuji Electric, General Electric Company, Hitachi, Hyosung, Hyundai Electric & Energy Systems Co., Ltd., Larsen & Turbo, Meidensha, Mitsubishi Electric, Nisin Electric, Ormazabal, Powell Industries, Schneider Electric, Siemens, and Toshiba Energy Systems & Solutions Corporation. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Cloud Performance Management Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Insect Pest Control Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Endoluminal Suturing Devices Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Smart Airport Market Research Report, Size, Share & Forecast by 2026

- Endometrial Ablation Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030