Functional Proteins Market Share, Size, Trends, Industry Analysis Report, By Form (Liquid, Dry); By Source (Plant, Animal); By Type (Casein, Hydrolysates, Whey Protein, Soy Protein, Others); By Application; By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 101

- Format: PDF

- Report ID: PM2105

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Summary

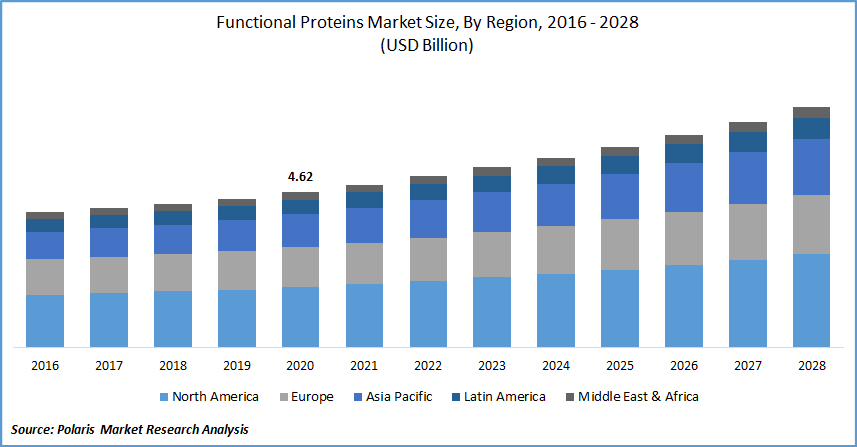

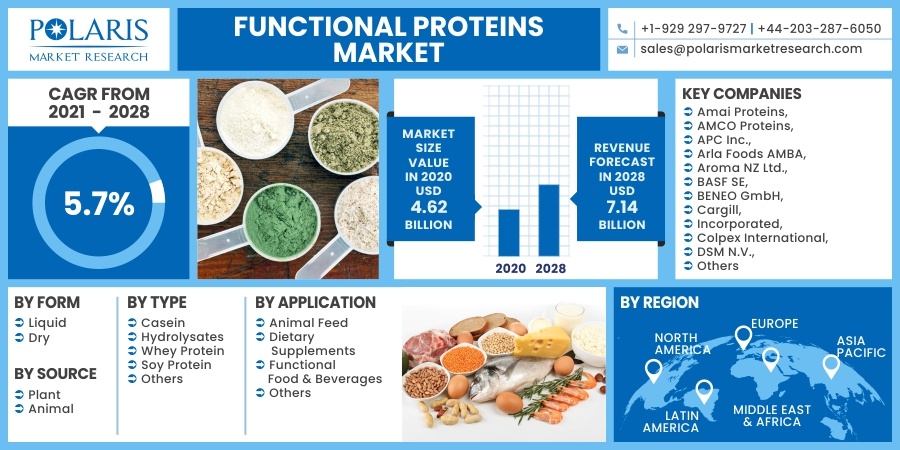

The global functional proteins market size was valued at USD 4.62 billion in 2020 and is expected to grow at a CAGR of 5.7% during the forecast period. The demand for functional proteins has increased over the years owing to their health benefits. Functional proteins support the body in performing biological activities and functions.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The different types of functional proteins include concentrates, isolates, hydrolysates, casein, and soy protein, among others. They are widely used in food & beverages to offer health benefits such as muscle growth, regulation of blood pressure, and moderation of blood sugar. They also assist in reducing inflammation and improving antioxidant defenses. These proteins also find application in dietary supplements and animal feed.

The major factors driving the market growth for functional proteins include increasing consumption of functional food products, naturally sourced ingredients, and growing awareness regarding the benefits of functional proteins. There has been growing consciousness among consumers regarding preventive healthcare and nutrition. The increasing occurrence of chronic diseases, growth in the geriatric population, changing lifestyle, and the increasing trend towards plant-based products support the proteins market's growth.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Increasing demand for nutraceuticals, rising disposable income, and growing popularity of sports nutrition have resulted in greater demand for functional proteins. Acquisitions and new product launches by leading players in the market and increasing animal nutrition applications are expected to offer growth opportunities for the protein during the forecast period.

The application of functional proteins has increased in dietary supplements. Growing incidence of health problems increased knowledge of good eating habits, and an increase in fitness and health awareness contributed to the growth of proteins. Consumers are more conscious of their nutritional intake, the advantages of physical activity, and the use of dietary supplements to satisfy the body's nutritional needs, which is boosting the sale of functional proteins.

Rising penetration of gyms and fitness centers and increasing public campaigns encouraging consumers to focus on health and fitness have increased the sale of dietary supplements. Advertising and marketing activities, lucrative monetary benefits, attractive subscription plans offered by market players to increase the sale of weight loss, and weight management supplements further boost the proteins market growth.

The demand for functional proteins has increased during the pandemic owing to increasing health awareness and the growing consumption of functional food and dietary supplements to increase immunity. Nevertheless, the COVID-19 outbreak has disrupted the supply chain across the globe. Lockdowns increased prices, and a limited workforce has severely impacted the proteins market. Countries around the world have regulated the movement of individuals and goods, resulting in decreased deliveries, roadblocks, and other logistic issues. However, the proteins market is expected to grow post the pandemic and attract investments and research initiatives to increase applications of the product.

Report Segmentation

The market is primarily segmented on the basis of form, source, type, application, and region.

|

By Form |

By Source |

By Type |

By Application |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Form

On the basis of form, the market is segmented into liquid and dry. The demand for the liquid form segment is expected to increase during the forecast period owing to increasing use in functional beverages and juices. It is cost-effective and easy to use in different applications. It is utilized in the animal feed sector due to its ease of use and storage.

Insight by Source

Based on the source, the market is a plant and animal. The demand for plant-based protein is expected to increase during the forecast period. Growing trend of vegetarianism and veganism coupled with food safety concerns associated with meat products drives the growth of this segment.

Growing incidences of health disorders have resulted in greater awareness regarding healthy eating habits and nutrition among consumers. Health and fitness consciousness has also increased in emerging economies such as China and India, thereby strengthening the growth of this segment.

Insight by Type

On the basis of type, the market is segmented into casein, hydrolysates, whey protein, soy protein, and others. There has been a high demand for hydrolysates during the forecast period. Protein hydrolysates are obtained by heating purified protein sources with acid or adding proteolytic enzymes, followed by several purification procedures. Protein hydrolysates increase plasma amino acid concentration and improve protein digestion. They are also responsible for improving the production of insulin in the body.

Insight by Application

The application segment has been divided into dietary supplements, animal feed, functional food & beverages, and others. The functional food & beverages segment accounted for a major revenue share of the global proteins market in 2020.

Consumers are increasingly turning towards functional food and beverages owing to their nutritional benefits and health advantages. Changing consumer behavior, hectic work lives, and the occurrence of chronic diseases drive the growth of this segment. The increasing popularity of sports nutrition has further supported the proteins market growth.

Geographic Overview

North America dominated the global functional proteins market in 2020. Increasing awareness regarding diet and nutritious eating habits, supportive government regulations, and the growing geriatric population are some factors attributed to the growth in this region. The presence of leading market players in the region, high disposable income, and changing lifestyles coupled with increasing cases of lifestyle-associated diseases have increased the demand for proteins.

Competitive Landscape

The leading players in the functional proteins market include Ingredion Incorporated, Glanbia PLC, APC Inc., Roquette Frères, The Archer-Daniels-Midland Company, Merit Functional Foods, Fonterra Co-Operative Group, Kerry Group, DuPont de Nemours, Inc., DSM N.V., Cargill, Incorporated, BASF SE, Essentia Protein Solutions, Arla Foods AMBA, and Omega Protein.

These players are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their presence in the industry. The companies are also introducing new innovative products in the market to cater to the growing consumer demands.

Functional Proteins Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 4.62 billion |

|

Revenue forecast in 2028 |

USD 7.14 billion |

|

CAGR |

5.7% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Form, By Source, By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Amai Proteins, AMCO Proteins, APC Inc., Arla Foods AMBA, Aroma NZ Ltd., BASF SE, BENEO GmbH, Cargill, Incorporated, Colpex International, DSM N.V., DuPont de Nemours, Inc., Essentia Protein Solutions, Fonterra Co-Operative Group, Glanbia PLC, Ingredia SA, Ingredion Incorporated, Kerry Group, Merit Functional Foods, MERIT Functional Foods Corporation, MGP Ingredients, Inc., Milk Specialties Global, Mycorena, Omega Protein, Plantible Foods, Inc., Protifarm, Roquette Frères, Royal FrieslandCampina N.V., Scanbio Marine Group, SunOpta, Inc., The Archer Daniels Midland Company |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Precast Concrete Market Research Report, Size, Share & Forecast by 2019 – 2026

- Industrial Crystallizers Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Cognac Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Automotive LiDAR Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Metal Print Packaging Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030