Frozen Dessert Market Share, Size, Trends, Industry Analysis Report, By Product (Ice-cream, Frozen Yogurts, Confectionary & Candies, Others); By Distribution Channel; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 101

- Format: PDF

- Report ID: PM2471

- Base Year: 2021

- Historical Data: 2018-2020

Report Summary

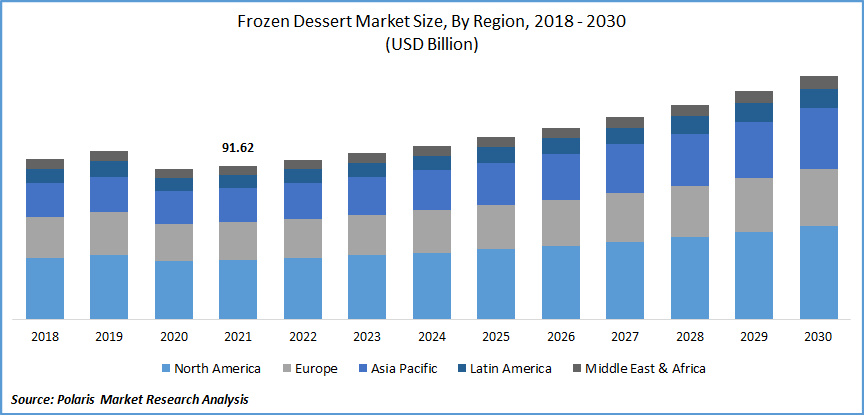

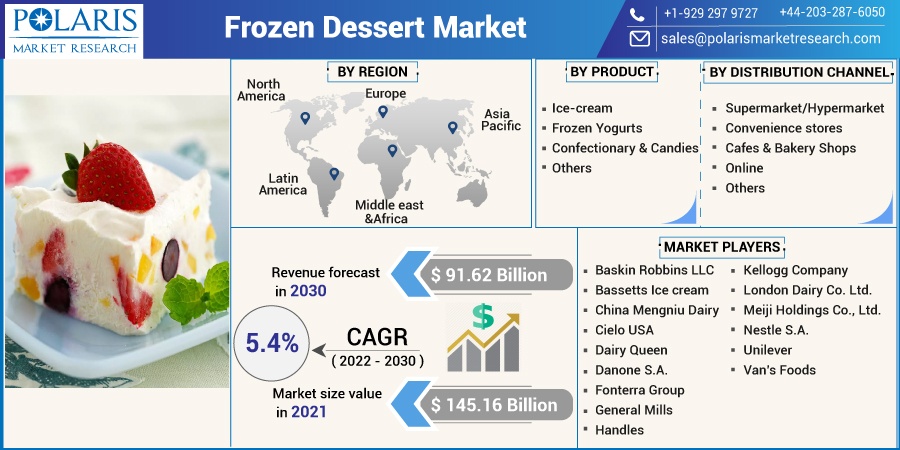

The global frozen dessert market was valued at USD 91.62 billion in 2021 and is expected to grow at a CAGR of 5.4% during the forecast period. Frozen desserts are made up of milk compounds and vegetable trans fats, combined with dry fruits and available in different flavors.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

There is an increasing trend of consuming the desserts after a meal which in turn boosts the growth of the frozen dessert market. Moreover, the rising standard of living and disposable income of people, along with the shift in tastes preferences, is also expected to fuel the market growth.

The outbreak of the COVID-19 pandemic has significantly impacted the industry growth of frozen desserts. This has affected businesses throughout industries briefly by increasing the demand for cold food and food supply chains. Also, during the lockdown, consumers have become health conscious and, therefore, have shifted their preferences to healthy products.

Therefore, the rising demand for sugar-free and low-calorie desserts is expected to drive market growth. Further, there has been a cultural shift within people wherein consumers have become open-minded and ready to try new and innovative products based on flavors and packaging.

Further, the food and beverage market has launched various innovative products in the cold bakery and desserts category in the past few years. Customers are willing to pay more for healthy products as their preferences have shifted towards their health and wellness. Due to such circumstances, the emergence of new and innovative flavors, gluten-free, and low-fat products are expected to impact the market growth over the forecast period.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The industry is propelled by growing disposable incomes, the introduction of innovative and new flavors, rising purchasing parity, and enormous demand for frozen desserts among consumers worldwide. According to Organization for Economic Co-operation and Development (OECD) data, there has been a massive increase in living standards due to a rise in disposable income across developed and developing countries. Therefore, consumers are more likely and openly spend on consumable goods, including cold desserts, resulting in substantial growth.

Further, the introduction of low-fat and gluten-free products has also impacted the growth of the frozen desserts market. The shift of consumer preferences towards a healthy lifestyle, owing to rising awareness about healthy well-being and easy availability of the same on social and digital platforms, has contributed to the growth of the frozen desserts market.

Moreover, low-fat ice cream has been termed the second most popular product in the dairy food segment by the International Dairy Foods Association, resulting in an upsurge in offering by vendors of the product category to provide low-fat & gluten-free products, therefore, garnering more growth.

Moreover, several businesses are considering expanding their product portfolio in this segment due to the rising attractiveness of frozen desserts in the food & beverage industry. For instance, a beverage giant like Coca-Cola extended its business operations in frozen desserts in India.

Report Segmentation

The market is primarily segmented based on product, distribution channel, and region.

|

By Product |

By Distribution Channel |

By Region |

|

|

|

Know more about this report: Request for sample pages

Ice-creams accounted for the largest market share in 2021 under product category

Based on product, the industry is categorized into ice cream, confectionery, candies, and frozen yogurt. The ice cream segment accounted for the largest revenue share in 2021, and this is due to the increasing demand for ice cream on a large scale owing to its rising popularity and acceptance among all age groups.

Factors such as low-fat contents, variation in flavors, and sugar-free, among others, are driving the growth of ice cream products. Sugar-free ice creams are especially gaining enormous popularity due to their health benefits.

Moreover, ice creams categorized into non-dairy products contain high levels of lipids, vitamins, carbohydrates, albumin, and casein that offer substantial health benefits. Therefore, a transitional shift towards vegan lifestyles is propelling the industry and shifting consumers' preferences toward low-fat products. Also, it has been observed that high per capita consumption, predominantly in the U.S. and European countries, has boosted the desserts demand.

Supermarket/hypermarket is expected to hold the significant revenue share

Based on the distribution channel, the report has been segmented into supermarket/hypermarket, convenience stores, café and bakery shops, and online. The supermarket/hypermarket segment accounted for the largest revenue share in 2021. It is also estimated to be the fastest-growing segment during the forecast period. This is due to the increased usage of the desserts by consumers, along with other grocery items, resulting in increased demand for the product.

Further, the increased tendency to buy products from specialized stores has resulted in the opening of cafes and bakery shops for frozen dessert products. Additionally, numerous online delivery partners have devised innovative ideas to deliver frozen desserts at various locations as fresh as their source points. This has resulted in a boom in the online buying of frozen desserts.

The North America region lead the global frozen dessert market by 2030

North America's frozen dessert market is expected to be the highest revenue during the forecast period due to increased demand for ice-cream desserts in this region. In 2021, the U.S. accounted for around 90% of the North American. The factors boosting the market's growth are lifestyle changes and increasing people's health consciousness.

Frozen yogurt is one of the most popular commodities in the frozen dessert segment. It has over 400 brands offering various flavors to customers. Considering the healthy lifestyle and adoption of well-being, the United States Department of Agriculture (USDA) has introduced several projects to encourage the consumption of yogurt and related products across the region. Furthermore, an increase in urban population, lifestyle changes, increasing disposable income, and changing climate conditions are also some of the major factors driving the industry in this region.

Competitive Insight

Some of the major players operating in the global market include Baskin Robbins LLC, Bassetts Ice cream, China Mengniu Dairy, Cielo USA, Dairy Queen, Danone S.A., Fonterra Group, General Mills, Handles, Kellogg Company, London Dairy Co. Ltd., Meiji Holdings Co., Ltd., Nestle S.A., Unilever, and Van’s Foods.

Recent Developments

The Caterforce Group launched numerous products in frozen cakes and desserts in the UK in 2021 under the 'Chefs' Selections by Caterforce' brand.

In 2021, Yasso Frozen Greek Yogurt, the world's first frozen Greek yogurt bar, unveiled its first snackable offering named Yasso Poppables in Boulder, Colorado. This product is a creamy frozen Greek yogurt with a chocolate coating and includes quinoa.

Further, General Mills Inc revealed an investment of $65 million for its Pillsbury refrigerated and frozen dough products plant and Yoplait yogurt plant in Murfreesboro, Tennessee.

Frozen Dessert Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 91.62 billion |

|

Revenue forecast in 2030 |

USD 145.16 billion |

|

CAGR |

5.4% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Baskin Robbins LLC, Bassetts Ice cream, China Mengniu Dairy, Cielo USA, Dairy Queen, Danone S.A., Fonterra Group, General Mills, Handles, Kellogg Company, London Dairy Co. Ltd., Meiji Holdings Co., Ltd., Nestle S.A., Unilever, Van’s Foods |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Ophthalmic Loupes Market Share, Size, Trends, Industry Analysis Report, 2020 - 2027

- Point-of-Sale (POS) Terminals Market Research Report, Share and Forecast, 2017 – 2026

- Paper and Paperboard Packaging Market Research Report

- Ball Valves Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Asthma Treatment Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030