Food Inclusions Market Share, Size, Trends, Industry Analysis Report, By Type (Chocolate, Fruit & Nut, Cereal, Flavored Sugar & Caramel, Confectionery, Others); By Application; By Form; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 101

- Format: PDF

- Report ID: PM2633

- Base Year: 2021

- Historical Data: 2018-2020

Report Summary

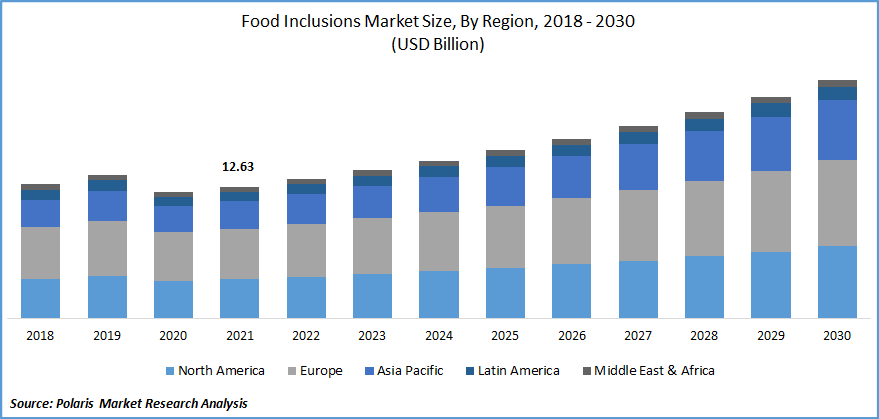

The global food inclusions market was valued at USD 12.63 billion in 2021 and is expected to grow at a CAGR of 7.0% during the forecast period. The growing demand for food inclusions is expected to be driven by the rising consumer trend for convenience foods, growing adoption of clean label, gluten-free and non-GMO products, and technological advancements in food industry.

Know more about this report: Request for sample pages

Additionally, increasing urbanization with high disposable income, and improving cold storage facilities that upgrade the storage of food inclusions for a longer duration of time make the market more reliable to grow over the forecast period.

Consumer shift towards food products that provide total transparency with more product labels and no artificial ingredients is driving the market growth. Also, inclusions that offer nutrition-rich food along with a crave-worthy snack experience create a lucrative opportunity for the manufacturer to develop innovative products that have a balance of healthy and tasty food, which is expected to drive market growth.

The COVID-19 pandemic had a negative impact on the growth of the food inclusion market. Manufacturing facilities being closed due to lockdowns and faces supply chain disruption. However, as the activities resumed, healthy diets were gaining popularity, and manufacturers developed a product that is both natural and organic, which are beneficial and meet the needs of the consumer.

Consumer buying behavior also is an essential factor in supporting market growth. Manufacturer experiment with sweet and savory combinations to deliver a mouthfeel experience. In addition, food inclusions adapt to any temperature and enhance the flavor and texture of the food, which is likely to complement market growth over the forecast period.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The global food inclusions market is likely to be driven by food & beverage industry due to increasing demand for healthy snacking and consumer willing to explore appealing products with variety of flavors. In addition, food inclusions are used to improve and enhance the existing products and considered cost-efficient and economical way to innovate the product quality. Moreover, they have a wide application in confectionaries, convenience snacks, dairy, frozen foods and many more which is likely to accelerate the market growth for the product.

Furthermore, changing lifestyle, rising urbanization and eased trade restrictions has boosted the processed food and value addition in food product contributing to grow the food inclusion market. Moreover, to meet the growing demand for natural beverages manufacturers are inclining more towards food inclusions to include exotic fruits, chocolates and nuts in the drinks which is expected to fuel the market growth.

Report Segmentation

The market is primarily segmented based on type, application, form and region.

|

By Type |

By Application |

By Form |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Fruit and nut accounted for the largest share in 2021

The fruit and nut segment accounted for the highest revenue share in 2021, owing to consumer shift toward the nutritional content of food and beverages. In addition, organic fruits are the new trend that has shifted consumer preference from packaged fruits. Moreover, many fruits are used for making smoothies, yoghurt, and even dried fruits are an integral part of breakfast. Thus, this segment show growth at good pace.

Additionally, the nut segment is gaining popularity as it has become a part of consumer diet and is used in breakfast cereals, snack bars, and for daily consumption. Moreover, the antioxidants in fruits and nut help to combat heart and bone-related disorder and keeps the skin healthy which is likely to complement market growth over the forecast period.

Chocolate is also expected to grow over the forecast period owing to its huge demand in the younger age groups for chocolate powder, chocolate syrup, and Choco butter. In addition, major applications are in culinary uses such as cookies, muffins, cakes, and confectioneries.

Dairy and frozen desserts is expected to witness faster growth

The insistence for dairy and frozen desserts is expected to see a significant surge over the forecast period owing to many ingredients incorporated in producing dairy products and frozen desserts. Dairy inclusion flavors include blue cheese, cream cheese, cheesecake, and many more. In addition, many flavor inclusions such as flavored raisins, marshmallows, fruits & nuts are used to prepare ice cream, ice lollies, and flavored yogurts, which is driving the market growth.

Solid and semi-solid segment is expected to account for the largest share in 2030

The solid and semi-solid form is expected to dominate the market over the forecast period. owing to the increasing adoption of food products that has the same texture and flavor. This form allows customization and offers chunks, nuggets, balls, and various shapes without changing the color, taste, and flavor. In addition, semi-solid foods are consumed after major bypass surgeries, which creates a lucrative opportunity for manufacturers to develop food products that influence revenue growth over the forecast period.

North America is expected to dominate and witness fastest growth over the forecast period

North America is the largest region for food inclusions and is expected to witness faster growth over the forecast period. The rising health concerns, and consumers shift towards plant-based food into their diets is expected to drive the market growth. In addition, rising disposable income, changing diet, and presence of major key players with an innovative product is accelerating the demand for the food inclusion market in this region.

Europe is anticipated to be the second largest region followed by North America for food inclusions on account of changing consumer preferences and tastes. In addition, the growing demand for organic, gluten-free, and vegan consumers across countries like France and Russia is expected to drive the demand during the forecast period. Moreover, manufacturers are focusing on developing vegan and gluten-free products incorporated with food inclusions which fuel the market growth.

Competitive Insight

Some of the major players operating in the global market include ADM, Agarna Beteiligungs-AG, Balchem Inc., Barry Callebaut, Cargill, Chaucer Foods Ltd, Dawn Foods Products,Inc., Foodflo International, Georgia Nut Company, Inc., IBK Tropic, Kerry Group PLC, Nimbus Foods Ltd, Orchard Valley Foods Limited, Orkla, Puratos, Sensient Technologies Corporation, Sunopta Inc., Tate And Lyle, Taura Natural Ingredients Ltd., Trufoodmfg

Recent Developments

In February 2022, ADM acquired Comhan, to develop its nutrition business in the emerging markets. Both of the company will work on developing portfolio with fruits and chocolate flavors which would be applied in bakeries and confectioneries.

In January 2021, Nimbus foods made an agreement with Herza, to develop new products that involve chocolates and extend their product range in UK.

Food Inclusions Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 12.63 billion |

|

Revenue forecast in 2030 |

USD 22.92 billion |

|

CAGR |

7.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Application, By Form, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

ADM, Agarna Beteiligungs-AG, Balchem Inc., Barry Callebaut, Cargill, Chaucer Foods Ltd, Dawn Foods Products,Inc., Foodflo International, Georgia Nut Company, Inc., IBK Tropic, Kerry Group PLC, Nimbus Foods Ltd, Orchard Valley Foods Limited, Orkla, Puratos, Sensient Technologies Corporation, Sunopta Inc., Tate And Lyle, Taura Natural Ingredients Ltd., and Trufoodmfg |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Plastic Resins Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Salmon Fish Market Share, Size, Trends, Industry Analysis Report, 2023 - 2032

- Empty Capsules Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- In-flight Entertainment and Connectivity Market Research Report, Share and Forecast, 2018 – 2026

- Industrial Crystallizers Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030