Fitness App Market Share, Size, Trends, Industry Analysis Report, By Type (Workout & Exercise, Disease Management, Lifestyle Management, Nutrition & Diet, Medication Adherence); By Platform; By Device; By Region; Segment Forecast, 2021 - 2029

- Published Date:Dec-2021

- Pages: 101

- Format: PDF

- Report ID: PM1571

- Base Year: 2020

- Historical Data: 2017 - 2019

Report Summary

The global fitness app market size was valued at USD 3.28 million in 2020 and is expected to grow at a CAGR of 22.1% during the forecast period. Increasing health issues among youth due to a sedentary lifestyle is one of the key factors propelling the market growth. In addition, the growing demand for fitness app for women is also likely to complement market growth. Furthermore, technology advancement with the implementation of artificial intelligence along with continuous research & development has increased the demand for online training regimes which is expected to have a positive impact on the fitness app market value.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The emergence of the COVID-19 pandemic has forced millions of individuals across the globe to explore alternative ways to keep themselves engaged in physical activities as clubs and training studios were closed due to country-wide lockdowns. This has resulted in a robust increase in fitness software downloads as people resorted to training at home. For instance, in 2020, as per the World Economic Forum, fitness and health software downloads have increased by 46% worldwide. Moreover, India has seen a rise of 156% growth in downloads that has created a massive boom for the industry expansion.

In addition, besides downloading, the daily active user percentage has also significantly increased by 24% during 2020, indicating increasing usage of the software owing to their compatibility, which has fueled the product market demand. Whereas the coronavirus danger has subsided in various regions of the globe, numerous health applications remain popular owing to their ease, commitment, interaction, and impressive analytics. Market players are continuously investing in research & development to provide advanced features.

For example, Strava, a fitness app, offers cross-training sessions and heart rate concentrated training according to the user capability training. Furthermore, HealthifyMe, in 2020, announced HealthifyMe Studio, which offers online interactive classes to increase its market presence. These factors are expected to propel the growth of the fitness apps market during the projected period.

Industry Dynamics

Growth Drivers

Increasing awareness regarding health software features such as personal training, activity tracking, yoga and meditation, diet and nutrition tips, and others has resulted in growth in demand for the software, which in turn will drive the fitness apps market growth. Fitness software is extremely successful in allowing people to achieve their health objectives at a lower cost and effort, which has created a positive outlook towards these apps, which in turn is anticipated to increase the demand for the software over the forecast period.

Fitness App Market Report Scope

The market is primarily segmented on the basis of type, platform, device, and geographic region.

|

By Type |

By Platform |

By Device |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Platform

Fitness apps for android market segment is expected to witness a high growth of 22.4% over the forecast period owing to vast android users across the Asia Pacific and advancements in the android technology for smartphones. However, iOS is expected to dominate the market in terms of revenue on account of the high demand for iOS products in North America and Europe.

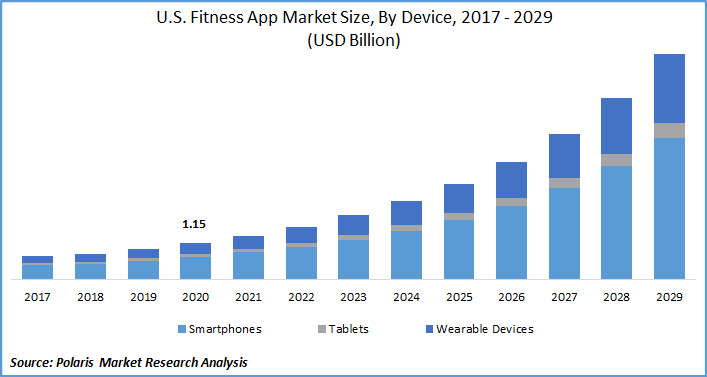

Insight by Device

The smartphones market segment is expected to account for 60.9% in 2021 and is expected to grow significantly over the forecast period due to rapidly increasing smartphone users around the globe. For instance, around 80.0% of the world population has a smartphone, which is expected to increase over the forecast period.

Geographic Overview

North America dominated the global fitness industry in 2020 and is expected to maintain its dominance over the forecast period due to rising health-related issues such as obesity, respiratory problems, among others, along with increasing health concerns due to the COVID-19 outbreak. However, the Asia Pacific region is expected to grow at a considerable pace over the forecast period owing to the outbreak of the COVID-19 pandemic that has led people to invest money in health and fitness. Furthermore, increasing disposable income among the population has led to an increase in the usage of smartphones which will fuel the industry expansion in this region.

Moreover, increasing disposable income, growing smartphone users, along with the rise in demand for smart watched and bands, are some other aspects expected to boost the demand for fitness software in this region. In addition, increasing partnership strategies among major players is also expected to positively influence market growth in this region. For instance, Google launched a google fit product for the iOS platform, which helps users to get fitness-related recommendations from World Health Organization.

Competitive Landscape

Some of the major market players operating in the global fitness app market include Aaptiv, Adidas, Appinventiv, Applico, Appster, Asics Corporation, Azumio, Inc., Fitbit, Inc., Google LLC, Grand Apps, Lenovo Group Limited, Nike, Noom, Samsung Electronics Co., Ltd., TomTom International BV, Under Armour, Inc., and Wahoo Fitness.

These major players are investing in research & development and undertaking strategies including mergers & acquisitions, new product launches, and different marketing strategies to increase their market share. Few popular fitness app names include RunKeeper, Strava, Yoga Studio, Sworkit, and Couch to 5K.

For instance, in January 2021, Andorfins, a new product launched by Andi Dorfman which offers advanced features such as different fitness challenges, goals, and workout plans. Furthermore, in Jan 2020, California-based fitness product Onyx was acquired by Cure.fit, an Indian startup. The acquisition was made by the company to increase its product offerings in India and abroad.

Fitness App Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 3.28 billion |

|

Revenue forecast in 2029 |

USD 19.33 million |

|

CAGR |

22.1% from 2021 - 2029 |

|

Base year |

2020 |

|

Historical data |

2017 - 2019 |

|

Forecast period |

2021 - 2029 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2029 |

|

Segments covered |

By Type, By Platform, By Device, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Aaptiv, Adidas, Appinventiv, Applico, Appster, Asics Corporation, Azumio, Inc., Fitbit, Inc., Google LLC, Grand Apps, Lenovo Group Limited, MyFitnessPal Inc., Nike, Noom, Samsung Electronics Co., Ltd., TomTom International BV, and Under Armour, Inc. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Organic Baby Food Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- High Temperature Insulation Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Workplace Stress Management Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Vertical Farming Market Research Report, Share and Forecast, 2017 – 2026

- Immuno Oncology (IO) Market Research Report, Market Size & Forecast, 2022 - 2029