Ethylene Market Share, Size, Trends, Industry Analysis Report By Feedstock (Naphtha, Ethane, Propane, Butane); By Application (Polyethylene, Ethylene Oxide, Ethyl Benzene, Ethylene Dichloride); By End-Use; By Region, Segment Forecast, 2021 - 2029

- Published Date:Nov-2021

- Pages: 101

- Format: PDF

- Report ID: PM1516

- Base Year: 2020

- Historical Data: 2017 - 2019

Report Summary

The global ethylene market size was valued at USD 101.1 billion in 2020 and is expected to grow at a CAGR of 5.5% during the forecast period. The increasing use of ethylene in manufacturing PE, which is used in the packaging industry, is expected to boost the ethylene market growth over the forecast period.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The quick shift in preference for bio-based products is projected to impact the development of the ethylene industry. In connection with this, the sudden increase in spending in building and infrastructural advancement, as well as the rise in the global working population, has led to increased demand for processed food & beverages, which is already functioning as a key determinant favoring the expansion of the market over the predicted period. Furthermore, the fluctuation in ethylene prices is also expected to restrain growth.

The COVID-19 pandemic has restricted the market growth for the product owing to the complete lockdowns of manufacturing facilities and trade restrictions across the globe. Furthermore, the global economic slowdown and reduction in the demand for products are expected to have a negative impact on market growth. The pandemic scenario significantly impacted the businesses such as packaging, construction, automotive, textiles, materials, and consumer goods that rely heavily on ethylene. However, among the aforementioned businesses, the detergent and sanitizer production units have managed to maintain a semblance of profitability despite the losses.

Market Dynamics

Growth Drivers

The growing working population throughout the world has created a need for packaged meals and refreshments, which is expected to propel the market for PE. Another element driving the growth of this business is the expanding automotive sector. PE is often used in the manufacturing of vehicle exteriors, electrical insulation, gasoline tanks, wires & cables, among others. Furthermore, increasing investment in the building and infrastructure sectors is driving up demand for PE and related materials in construction operations which in turn is expected to boost the market growth for ethylene over the forecast period.

Report Segmentation

The market is primarily segmented on the basis of feedstock, application, end-use, and region.

|

By Feedstock |

By Application |

By End-Use |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Application

Polyethylene (PE) led the application category in 2020 with a 54.5% revenue share and is expected to maintain its dominance over the forecast period. The increasing demand for HDPE in packaging and transportation applications is expected to drive the product demand, complementing the market growth for the product. The increasing use of polyethylene in plastic containers in the foodservice market, as well as the consumer products, is benefiting segment growth.

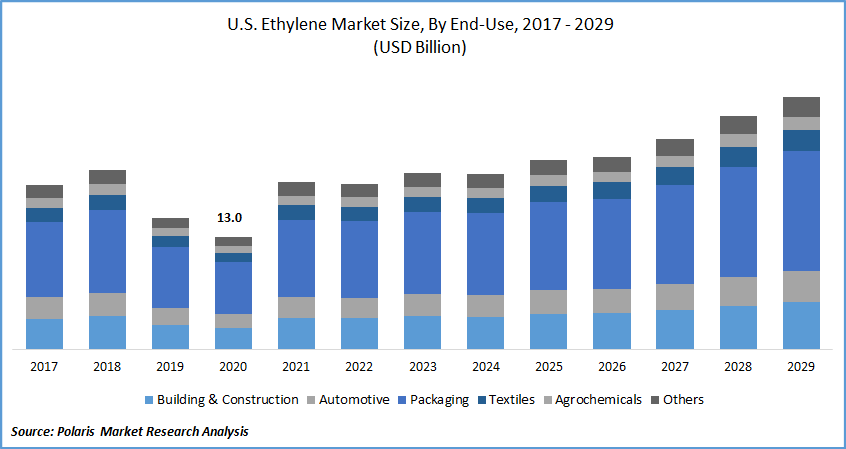

Insight by End-Use

The packaging industry dominated the end-use segment in 2020 accounting for 50.78% and is expected to increase considerably throughout the forecast period. Lightweight and robust compression capabilities of the product have led to its demand in the packaging sector for the manufacturing of ethylbenzene and polyethylene, which aids in protecting packaged goods in the event of being smashed or crushed.

The construction market has grown tremendously in regions such as the Asia Pacific and Latin America due to massive activities in countries such as India and China. Rapid urbanization in these countries, a huge population base, and increased government spending on construction are some of the reasons favoring the segment growth. These trends are, in turn, expected to drive the growth of ethylene-based products for usage in the construction industry.

Geographic Overview

In 2020, Asia Pacific led the market and is expected to grow a CAGR of 6.3% over the forecast period owing to the rising demand for polyethylene from the plastics industry and compounds from the chemical sector from growing nations such as India, China, and Japan. The industrial progress of these nations has increased consumer lifestyle, resulting in a significant demand for performance-based plastic for everyday vital use items. Furthermore, the expanding middle-class population is driving up demand for buildings and vehicles.

Competitive Landscape

Key players operating in the global ethylene market outlook are Borealis, Chevron Phillips Chemical, Dow Chemical, Equistar Chemicals, ExxonMobil, Huntsman, INEOS, LG Chem, LyondellBasell Industries, Mitsubishi Chemical, Mitsui Chemicals, National Iranian Petrochemical, Nova Chemicals, Royal Dutch Shell, Sasol, SABIC, Showa Denko, Sinopec Shanghai Petrochemical, Tosoh, and Total. Saudi Basic Industries Corporation (SABIC) announced the merging of its entirely subsidiary, Saudi Petrochemical Company, and Arabian Petrochemical Company (Petrokemya), in October 2019. The combination is designed to improve SABIC's operational productivity and profitability.

These players are expanding their presence across various geographies and entering new markets in developing regions to expand their customer base and strengthen their presence in the market. For instance, Sinopec launched an expansion proposal to manufacture about 1 million tons of the product and oil each year Hainan Free Trade Zone in June 2020. The initiative is expected to stimulate the development of end-user businesses by more than RMB 100 billion (USD 14.10 billion).

Ethylene Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 101.1 billion |

|

Revenue forecast in 2029 |

USD 230.7 billion |

|

CAGR |

5.5% from 2021 - 2029 |

|

Base year |

2020 |

|

Historical data |

2017 - 2019 |

|

Forecast period |

2021 - 2029 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2029 |

|

Segments covered |

By Feedstock, By Application, By End-Use, and, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Borealis, Chevron Phillips Chemical, Dow Chemical, Equistar Chemicals, ExxonMobil, Huntsman, INEOS, LG Chem, LyondellBasell Industries, Mitsubishi Chemical, Mitsui Chemicals, National Iranian Petrochemical, Nova Chemicals, Royal Dutch Shell, Sasol, Saudi Basic Industries Corporation, Showa Denko, Sinopec Shanghai Petrochemical, Tosoh, and Total. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Gout Therapeutics Market Research Report, Size, Share & Forecast, 2022 - 2029

- Thermal Barrier Coatings Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Global Polypropylene Market Research Report, Size, Share & Forecast by 2017 - 2026

- Dimethyl Carbonate Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Global Catheters Market Research Report, Size, Share & Forecast by 2017 - 2025