Epoxy Resin Market Share, Size, Trends, Industry Analysis Report By Formulation Type (DGBEA, DGBEF, Novolac, Aliphatic, Glycidylamine, Others); By Application (Paints & Coatings, Adhesives, Composites, Electrical & Electronics, Wind Turbines, Others); By Region, Segments & Forecast, 2021 - 2029

- Published Date:Nov-2021

- Pages: 101

- Format: PDF

- Report ID: PM1503

- Base Year: 2020

- Historical Data: 2017 - 2019

Report Summary

The global epoxy resin market was valued at USD 6.10 billion in 2020 and is expected to grow at a CAGR of 6.4% during the forecast period. The epoxy resin market is driven by its growing demand in the paints & coatings industry. In addition, the rising use of epoxy in the electronics & electrical industry as an insulator and shield components from dust, short-circuiting, and moisture is expected to drive demand.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Epoxy resin is widely used as an adhesive for laminating wood. Laminated wood is majorly used in the construction industry for floors, windows, roofs, walls, and decks. As a result, the rising use of timber in the construction industry is expected to drive the demand for epoxy resins over the forecast period.

The epoxy resin market share is increasing in the aerospace industry as the demand for composite components is growing to reduce the wind resistance and weight of the aircraft. In addition, the high-performance characteristics of epoxy resin as an adhesive with composites are expected to drive market demand.

Furthermore, composites and fiber-reinforced plastics are growing for wind turbine manufacturing and components associated with wind energy. As a result, the demand for epoxy resins in the industry is growing as it is used as a reinforcing agent. In addition, the growing use of the product in arts & decorative items and kitchen countertops is likely to complement industry growth.

Market Dynamics

Growth Drivers

Over recent years, the utilization of epoxy resin has increased. The epoxy resin industry share has increased as a result of its high oxidation and corrosion resilience. Its thermoplastic resin elasticity and chemical stability offer it a competitive advantage over other types of resin. Furthermore, the increasing demand for epoxy-based materials in the transport industry and the building industry's steady rise drive the market size.

The increased market demand for accessible and processed foods and drinks is driving up packing demand in both established and developing nations. Epoxy resins have been used in can interior coatings to extend the shelf life of tinned food and drinks. These are generally used to maintain and preserve the flavor, texture, and color of F&B goods and corrosion protection.

Furthermore, the rising usage of glass packaging, which employs epoxy resin to avoid rust in jars and containers, considerably contributes to market development. The implementation of different severe food safety rules by various countries raises the demand for epoxy resin, thereby fueling market expansion.

Report Segmentation

|

By Type |

By Application |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Type

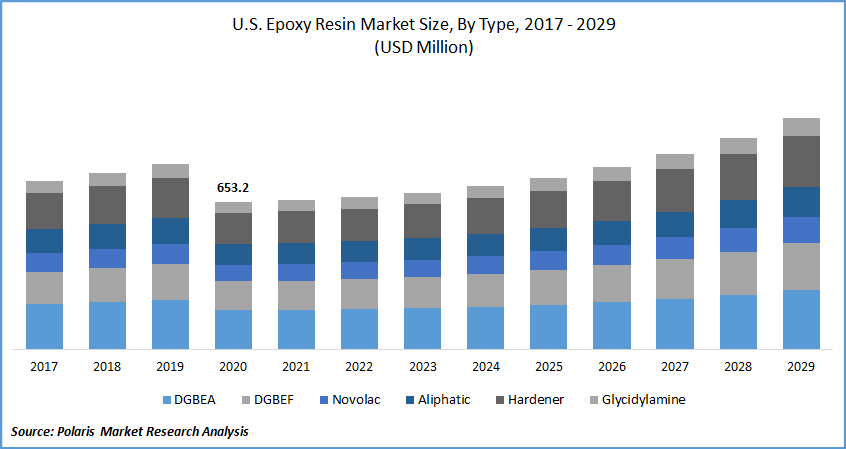

In 2020, the DGBEA segment was estimated to account for the largest revenue share of 26.6%. The growing demand for DGBEA resin in the construction and manufacturing industries is expected to drive the segment growth over the forecast period. Nevertheless, due to the widespread usage of novolac in surface applications, adhesives, and plastics, the novolac category is expected to grow considerably over the forecast period.

Insight by Application

The paints & coatings segment is expected to grow at a CAGR of 6.6% over the forecast period. Adhesives and sealants, but on the other hand, are expected to develop at the fastest rate in the worldwide epoxy resin industry, owing to their widespread use in the building, automotive, energy, and electronic industries.

Geographic Overview

Asia Pacific is expected to witness a substantial growth of 7.0% over the forecast period owing to the constant expansion of the construction industry in India and China. The region's growing car manufacturing operations are driving up the consumption of the product.

Furthermore, the rise of the consumer electronics sector in nations such as India, South Korea, China, and Japan is boosting the market growth. Aside from that, North America sees a significant expansion due to increased expenditures in the chemical sector in the U.S., which is assisting the market growth.

The region's increased demand for consumer products due to high per-capita wealth is also boosting the expansion of the epoxy resin market. As the emphasis on clean, renewable energy grows, epoxy resins are employed as an adhesive in solar cells while preserving them from adverse weather situations, hence fueling market expansion.

Competitive Landscape

Key market players are operating in the global market include 3M, Aditya Birla Chemicals, Atul Ltd (India), Ciech S.A., Chang Chun Group, China Petrochemical Corporation, Covestro AG, Dow, Hexion, Huntsman International LLC, Kolon Industries, Kukdo Chemical Co., Ltd, Macro Polymers, Nan Ya plastics corporation, Olin Corporation, and Spolchemie.

Epoxy Resin Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 6.10 billion |

|

Revenue forecast in 2029 |

USD 10.22 billion |

|

CAGR |

6.4% from 2021 - 2029 |

|

Base year |

2020 |

|

Historical data |

2017 - 2019 |

|

Forecast period |

2021 - 2029 |

|

Quantitative units |

Volume in kilotons; Revenue in USD million/billion; and CAGR from 2021 to 2029 |

|

Segments covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

3M, Aditya Birla Chemicals, Atul Ltd (India), Ciech S.A., Chang Chun Group, China Petrochemical Corporation, Covestro AG, Dow, Hexion, Huntsman International LLC, Kolon Industries, Kukdo Chemical Co., Ltd, Macro Polymers, Nan Ya plastics corporation, Olin Corporation, and Spolchemie. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Private Tutoring Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Particle Counters Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Burn Care Centers Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Gene Therapy Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- High Performance Thermoplastic Market Research Report, Size, Share & Forecast by 2019 - 2026