EPDM Market Share, Size, Trends, Industry Analysis Report, By End-Use (Building & Construction, Electrical & Electronics, Automotive, Manufacturing, Others); By Region; Segment Forecast, 2021 - 2028

- Published Date:Oct-2021

- Pages: 101

- Format: PDF

- Report ID: PM2125

- Base Year: 2020

- Historical Data: 2016 - 2019

Report Summary

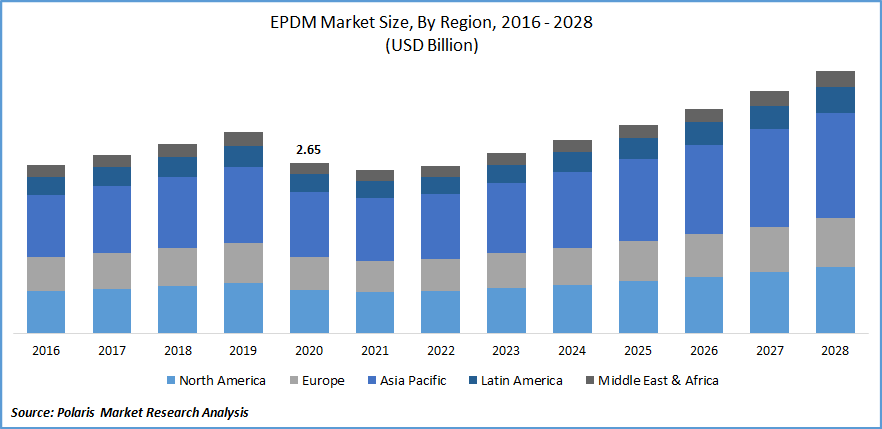

The global EPDM market size was valued at USD 2.65 billion in 2020 and is expected to grow at a CAGR of 7.0% during the forecast period. EPDM is a synthetic rubber offering properties such as excellent water resistance, elasticity, and high UV & ozone resistance. EPDM also provides high electrical insulation, low-temperature properties, fair physical strength, and aging resistance.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

EPDM (Ethylene Propylene Diene Monomer) is used in various applications such as window and door seals, electrical gaskets, and waterproofing sheets. Some common applications in the automotive sector include radiator and heater hoses, wire and cable connectors, and diaphragms. EPDM is used in diverse industries such as construction, manufacturing, industrial, and electronics.

The COVID-19 outbreak has negatively impacted the EPDM industry due to supply chain disruption, operational challenges, transportation delays, and travel restrictions. The manufacturing of automotive, construction and electronics components takes place in the Asia Pacific region, which has been severely affected by the pandemic and has experienced reduced demand and workforce impairment. Restrictions on imports of goods to curb the spread of the virus have further restricted market growth. Manufacturing activities have also been halted due to various government regulations across the globe.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Rising industrialization and urbanization across the globe, especially in the emerging economies, have increased the demand for EPDM has increased over the years. Growing investment in the construction industry, development of public infrastructure, and application in the automotive sector are driving the market growth for EPDM.

Increasing use in electric vehicles coupled with stringent regulations regarding emissions is expected to increase the application of EPDM. The economic growth in countries such as China, Japan, and India have led to growth in the manufacturing and electronics industries resulting in increased demand for EPDM. Technological advancements and rising investments in R&D further aid the market growth.

EPDM is used in the automotive industry owing to its wearability, resiliency, and flexibility. It is used in wire and cable harnesses, vehicle weather stripping, sealant, and brake systems. The growing need to improve performance in automobiles and the growing electrification of vehicles has increased the applications of EPDM in the automotive sector.

The utilization of EPDM in the building and construction sector is expected to increase during the forecast period. The product offers properties such as insulation, water resistance, durability, tear resistance, and high tensile strength, which proves beneficial in applications such as green roofs, pond liners, solar roofs, expansion joints, and garage door seals.

Report Segmentation

The market is primarily segmented on the basis of end-use, and region.

|

By End-Use |

By Region |

|

|

Know more about this report: request for sample pages

Insights by End-Use

On the basis of the end-use industry, the market is segmented into building and construction, electrical and electronics, automotive, manufacturing, and others. The automotive segment dominated the global EPDM market in 2020. Increasing market demand for passenger vehicles, stringent regulations, and rising adoption of electric vehicles boost the demand for the product. Governments around the world are investing heavily in the development of electric vehicles and offering incentives and schemes to encourage their adoption, increasing the application of the product in the automotive sector.

Geographic Overview

Asia-Pacific dominated the global EPDM market in 2020. Growing research and development activities, increasing urbanization, technological advancements, and expansion of international players in this region are some factors driving the growth of the market.

The industrial growth in countries such as India, China, and Japan, rising automotive penetration, and increasing construction and development activities have resulted in greater demand for the product. Rising electronics and manufacturing applications, increasing awareness regarding the adoption of renewable energy sources, and initiatives to promote electric vehicles in developing countries of this region boost the demand growth.

Competitive Landscape

The leading players in the market include Arlanxeo, Carlisle Companies, DOW Inc., ExxonMobil Corporation, Jilin Xingyun Chemical, JSR Corporation, Lanxess, Lion Elastomers, LLC., Mitsui Chemicals, Inc., PetroChina Company Limited, PJSC, SABIC, SK Global Chemical Co., Ltd., Sumitomo Chemical Co., Ltd., Versalis S.p. A.

These players are expanding their presence across various regions and entering new markets in developing areas to expand their customer base and strengthen presence in the market. In order to meet the growing consumer demand, the companies are also introducing new innovative products to the market.

EPDM Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 2.65 billion |

|

Revenue forecast in 2028 |

USD 4.06 billion |

|

CAGR |

7.0% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By End-Use, and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Arlanxeo, Carlisle Companies, DOW Inc., ExxonMobil Corporation, Jilin Xingyun Chemical, JSR Corporation, Lanxess, Lion Elastomers, LLC., Mitsui Chemicals, Inc., PetroChina Company Limited, PJSC, SABIC, SK Global Chemical Co., Ltd., Sumitomo Chemical Co., Ltd., Versalis S.p. A. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Geotextile Market Research Report, Size, Share & Forecast by 2018 - 2026

- Oleochemicals Market Research Report, Size, Share & Forecast by 2018 - 2026

- 3D Food Printing Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Insulated Packaging Market Share, Size, Trends, & Industry Analysis Report: Segment Forecast, 2018 - 2026

- Shared Mobility Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030