Engineering Services Outsourcing (ESO) Market Size, Share, Trends & Industry Analysis Report, By Application (Automotive, Energy, Network & Communications, Industrial Automation, Medical Technology, Industrial Electronics & Automated Embedded Engineering Services, Consumer Electronics, Semiconductors, Construction, Aerospace); By Location; By Region; Segment Forecast, 2022 - 2029

- Published Date:Jan-2022

- Pages: 101

- Format: PDF

- Report ID: PM1030

- Base Year: 2021

- Historical Data: 2017 - 2020

Report Summary

The global Engineering Services Outsourcing (ESO) market was valued at USD 1,047.58 billion in 2021 and is expected to grow at a CAGR of 30.0% during the forecast period. One of the key drivers driving the deployment of ESO is the growing partnership between engineering solution companies and original equipment manufacturers.

Know more about this report: request for sample pages

Based on the end sectors and industrial verticals, the consequence of the COVID-19 virus and following lockdowns in several nations throughout the globe on the outsourcing marketplace varies. As part of the attempt to stop the transmission of the virus, manufacturing sites, industrial plants, and transportation were forced to close down.

Consequently, incumbents in sectors and market verticals, including automotive and building, have experienced a drop in demand. Nevertheless, in the aftermath of the COVID-19 outbreak, personal car sales are projected to rise in the foreseeable future as individuals want to shun public transportation.

Industry Dynamics

Growth Drivers

ESO provides technical, mechanical, and application software assistance throughout product development, life cycle administration, innovative products, plant setup, as well as other processes. Original equipment manufacturers have used ESO and application developer's suppliers to reduce total operation costs by eliminating labor and R&D expense. Many companies growing desire to reduce total operating cost spending primarily drives worldwide Engineering Services Outsourcing (ESO) market expansion.

OEMs are using intelligent manufacturing technologies, robots, and artificial intelligence (AI)-based technologies to enhance product design and details, which is further boosting the industry. Other reasons, such as the growing use of strategic outsourcing solutions by the manufacturing, marine, and offshore industries, as well as the advancement of 3D printing technologies, are likely to propel the Engineering Services Outsourcing (ESO) market even further.

Report Segmentation

The market is primarily segmented on the basis of application, location, and region.

|

By Application |

By Location |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Application

The industrial category had the most significant revenue share in the global ESO industry, and it is predicted to maintain its dominance during the projected period. Different exploration facilities, such as blasting, drilling, crushing, and tunnels, progressively embrace digitization. With the adoption of public, private, and hybrid platforms, industrial products manufacturing businesses are modernizing their IT infrastructure, driving automation, and simplifying old processes.

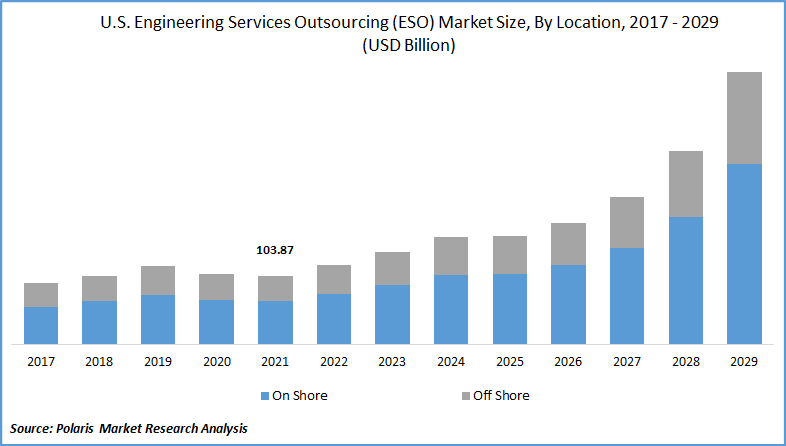

Insight by Location

The on-shore sector had the largest ESO share in the global industry. As automotive outsourcing vendors in emerging nations concentrate around OEMs, notably for modeling, development, and other private practices, it is projected to continue its leadership position.

The offshore segment entails the supply of ESO across international borders. Due to worldwide inflationary pressures, high turnover rates, training expenses, and an increasing preference for outsourced to on-shore partnerships, the offshore market is expected to develop more slowly than the on-shore segment.

Geographic Overview

Asia Pacific region had the largest Engineering Services Outsourcing (ESO) market proportion and is predicted to continue for the following years. Large automobile OEMs are outsourcing manufacturing and associated activities to countries like India, the Philippines, and China, owing to the accessibility of a low-cost workforce. As a consequence, outsourcing providers for the automobile industry are refocusing their efforts.

During the projection period, the Asia Pacific region is expected to have the fastest growth rate of more than 25%. For economic reasons, certain global firms establish their work hubs in Asian nations. As is the current trend, keeping operating costs low and assembling a talented pool helps ESO traders get a good bargain.

Competitive Insight

Key players operating in the global Engineering Services Outsourcing (ESO) market are Accenture Plc, Altair Engineering, Inc., ALTEN, Altran, Amazon Web Services (AWS), ASAP Holding GmbH, AVL List GmbH, Boston Engineering Corporation, Capgemini SE, Cybage Software Pvt. Ltd., EPAM Systems Inc., HCL Technologies Limited., Infosys Limited, International Business Machines Corporation, Microsoft Azure., QuEST Global Services Pte. Ltd., Sonata Software Limited, Tata Consultancy Services Limited, Tech Mahindra Limited (Mahindra Group), and Wipro Limited.

Leading market players have been working hard to develop alternatives that might aid manufacturers in incorporating cutting-edge technology into their engineering projects. Changes in customer tastes have raised the demand for OEMs to supply correct and timely products, necessitating the use of outsourcing in their business.

For Instance, in May 2019, Tech Mahindra has won a US$100 million outsourcing agreement with Vodafone in New Zealand, wherein the Mahindra Group claims it would absorb the telecom giant's 200 employees.

Engineering Services Outsourcing (ESO) Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1,047.58 billion |

|

Revenue forecast in 2029 |

USD 8,126.49 billion |

|

CAGR |

30.0% from 2022 - 2029 |

|

Base year |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2029 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2029 |

|

Segments covered |

By Location, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Accenture Plc, Altair Engineering, Inc., ALTEN, Altran, Amazon Web Services (AWS), ASAP Holding GmbH, AVL List GmbH, Boston Engineering Corporation, Capgemini SE, Cybage Software Pvt. Ltd., EPAM Systems Inc., HCL Technologies Limited., Infosys Limited, International Business Machines Corporation, Microsoft Azure., QuEST Global Services Pte. Ltd., Sonata Software Limited, Tata Consultancy Services Limited, Tech Mahindra Limited (Mahindra Group), and Wipro Limited. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Eosinophilic Esophagitis Drug Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Brachytherapy Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Vaccine Storage & Packaging Market Share, Size, Trends, Industry Analysis Report, 2020-2027

- Ocean Power Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Bathroom Cabinets Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030