Endoscopy Visualization Systems Market Share, Size, Trends, Industry Analysis Report, By Product; By Resolution Type (4K, FHD Resolution); By Region; Segment Forecast, 2021 - 2028

- Published Date:Sep-2021

- Pages: 101

- Format: PDF

- Report ID: PM1968

- Base Year: 2020

- Historical Data: 2016-2019

Report Summary

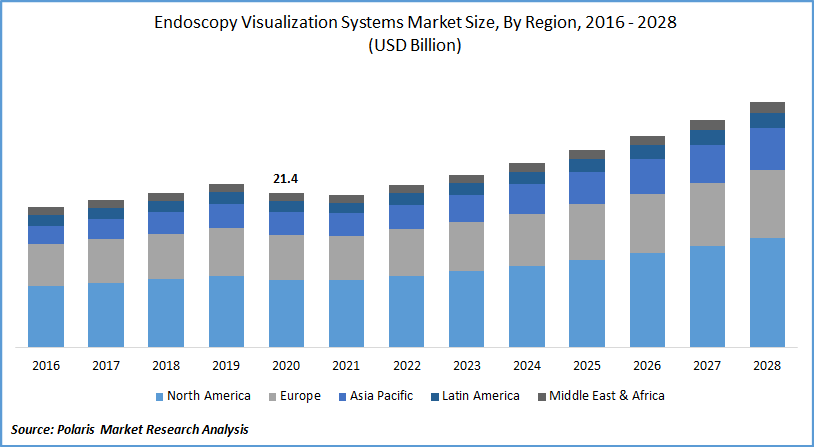

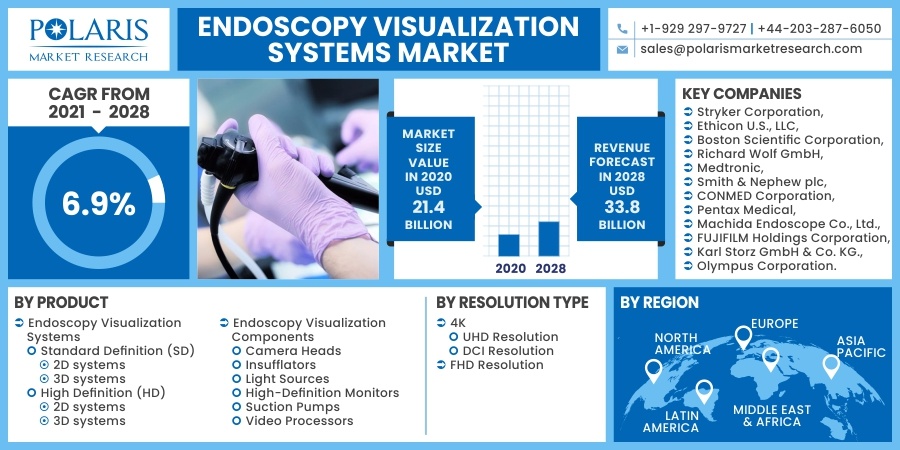

The global endoscopy visualization systems market was valued at USD 21.4 billion in 2020 and is expected to grow at a CAGR of 6.9% during the forecast period. The growing need for next-generation endoscope visualization systems is one of the key driving factors that boost the growth of the global market.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Furthermore, rising obesity rates, advancement in technology, better reimbursement status, growing elderly population, and an increase in the number of associated diseases are few prime factors favoring the endoscopy visualization systems market growth.

Growing awareness of physicians and patients towards the use and treatment of modern endoscopy technologies due to the multiple benefits these systems provide is also boosting the market growth for visualization systems. Similarly, a significant rise in the number of the aged population who are susceptible to ophthalmic, gastrointestinal, and orthopedic ailments and cancer is driving market expansion over the projected timeframe.

The increasing adoption of endoscopy procedures will give a significant boost to the growth of the market. Endoscopy procedures are associated with many medical benefits. In the U.S. alone, more than 17 million, and in the U.K., approximately 2 million operations are conducted each year.

COVID-19 pandemic is expected to slow down the growth of the global market during the forecast period, owing to the postponement of elective surgeries across the globe. Nearly 28 million elective surgeries were canceled during the pandemic.

Several reports indicate that half a million endoscopy procedures related to the diagnosis of gastrointestinal cancers, including colorectal cancers, were postponed during the pandemic. The market is expected to see upward growth once the pandemic stabilizes in the second half of the forecast period.

Industry Dynamics

Growth Drivers

Endoscopy procedures have many advantages over open surgeries due to their minimally invasive nature, lesser post-surgical complications, and faster recovery time. Hence, they are increasingly employed in the geriatric population who cannot undergo traditional surgeries because of post-surgical complications.

Approximately 700 million people are living across the globe aged 65 years or above in 2019, and the figure is anticipated to reach 1.5 billion by 2050. This rapidly growing geriatric population will result in the need for more endoscopy procedures over the coming years.

The companies are involved in product launches and acquisitions to capitalize on the demand for visualization systems in endoscopy procedures. For instance, Olympus launched EVIS X1 in April 2020, and this system supports the screening of gastrointestinal disorders.

It features Texture and Color Enhancement Imaging (TXI), Narrow Band Imaging (NBI), Extended Depth of Field (EDOF), and Red Dichromatic Imaging (RDI). In 2019, Intuitive Surgical acquired the robotic endoscope business of Schölly Fiberoptic’s. It is a major company involved in the development of visualization systems for endoscopy procedures.

Know more about this report: request for sample pages

Report Segmentation

The market is primarily segmented on the basis of product, resolution type, and region.

|

By Product |

By Resolution Type |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Product

The endoscopy visualization systems segment generated the highest market revenue in 2020. This is due to technological innovations that have improved imaging capabilities. The major market players such as FUJIFILM Holdings Corporation, Olympus Corporation, and many others are concentrating on offering next-generation systems, helping the industry's growth. For instance, Fujifilm Corporation unveiled the ELUXEO Surgical System in July 2020, allowing superior visualization while executing rigid and flexible procedures from a single tower.

The endoscopy visualization components segment is expected to have a steady growth rate during the forecast period. The growing elderly population and the increasing number of endoscopy treatments are two significant factors driving the segment's market growth.

According to WHO forecasts, the number of cases of gastric cancer is expected to surpass 1.4 million by 2030. This is expected to boost segment growth. Furthermore, the increasing investments by manufacturers to introduce enhanced visualization components will further drive the segment's market growth.

Insight by Resolution Type

The 4K segment in the report for endoscopy visualization systems dominated the market and generated the highest revenue in 2020. The segment is expected to grow significantly during the projected period. Images with 4K resolution have higher color repeatability than images with full H.D. resolution, enabling more surgical efficiency and more straightforward detection of the boundaries within blood vessels, lymph, nerves, and other structures. Additionally, monitors with 4K resolution may be observed even closer without spotting the individual pixels. All these benefits of 4K are propelling the market segment forward.

Furthermore, 4K monitors are the most expensive, as compared to full H.D. monitors. As a result, FHD resolution is a cost-effective option, particularly in emerging economies. This, coupled with the medicines' widespread availability and growing awareness among the patient group, is fueling the segment's growth in the visualization systems industry.

Geographic Overview

North America will be the most significant region for the global market for endoscopy visualization systems during the forecast period. The speedy adoption of minimally invasive surgical procedures, the rising rates of colorectal and gastric cancer, and the increasing need for improved diagnostic tools are some of the factors that influence the market revenue for the visualization systems in the region.

In 2021, the American Cancer Society predicted that around 45,230 new cases of rectal cancer and 104,270 new cases of colon cancer would be diagnosed in the U.S. alone. The rising number of cancer cases and the availability of reimbursement facilities will further fuel the region's prospects.

Asia Pacific endoscopy visualization systems industry is expected to be the fastest-growing region for the global market during the forecast period, owing to increased government and private sector investment in countries like China and India. The growing geriatric population in the region and the strategic presence of dominant industry players in the region will also favor the region's growth for visualization systems.

Competitive Insight

Companies are investing heavily in research and development and are raising funds through various sources to support the development of advanced endoscopy visualization systems. Major players adopt key strategies such as product launches, acquisitions, and collaborations to expand their influence in the market for endoscopy visualization systems.

Some of the key players functioning in the market for endoscopy visualization systems include Stryker Corporation, Boston Scientific Corporation, Ethicon U.S., LLC, Richard Wolf GmbH, Medtronic, Smith & Nephew plc, CONMED Corporation, Pentax Medical, Machida Endoscope Co., Ltd., FUJIFILM Holdings Corporation, Karl Storz GmbH & Co. KG., and Olympus Corporation.

Endoscopy Visualization Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 21.4 billion |

|

Revenue forecast in 2028 |

USD 33.8 billion |

|

CAGR |

6.9% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2028 |

|

Segments covered |

By Product Type, By Resolution, By Region |

|

Regional scope |

North America Europe Asia Pacific Latin America; Middle East & Africa |

|

Key Companies |

Stryker Corporation, Ethicon U.S., LLC, Boston Scientific Corporation, Richard Wolf GmbH, Medtronic, Smith & Nephew plc, CONMED Corporation, Pentax Medical, Machida Endoscope Co., Ltd., FUJIFILM Holdings Corporation, Karl Storz GmbH & Co. KG., and Olympus Corporation. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Otoplasty Market Share, Size, Trends, Industry Analysis Report, 2023 - 2032

- Personal Health Record Software Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Contact Center Analytics Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Food Service Equipment Market Research Report, Size & Forecast, 2018 – 2026

- Drip Irrigation Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030