Drinking Water Adsorbents Market Share, Size, Trends, Industry Analysis Report, By Application (Industrial, Commercial, Others); By Product; By Region; Segment Forecast, 2021 - 2028

- Published Date:Sep-2021

- Pages: 101

- Format: PDF

- Report ID: PM1975

- Base Year: 2020

- Historical Data: 2016-2019

Report Summary

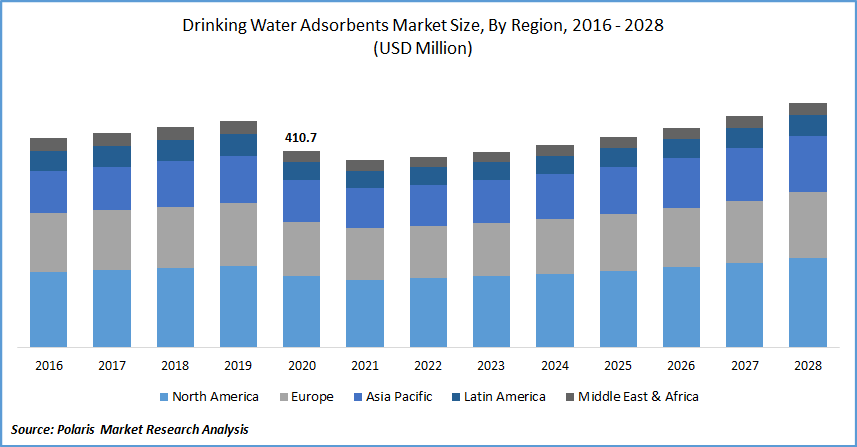

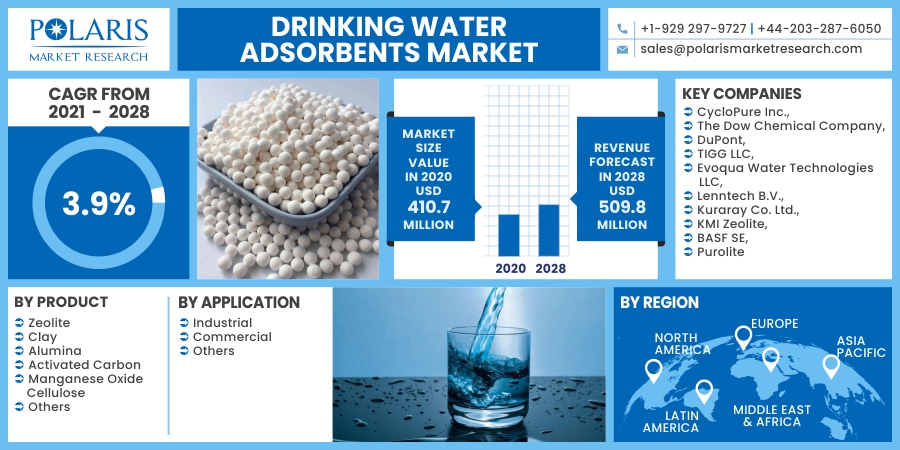

The global drinking water adsorbents market was valued at USD 410.7 million in 2020 and is expected to grow at a CAGR of 3.9% during the forecast period. Stringent quality regulations combined with government initiatives to invest in treatment industries drive demand for drinking water adsorbents.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The speedy urbanization, economic expansion, and increased demand for bio-adsorbents are other factors that propel the market forward. In addition, the rising private and government bodies’ investments in drinking water treatment plants are likely to boost the market for drinking water treatment chemicals like adsorbents in the future years.

The growing level of water pollution has compelled governments worldwide to enact stringent waste treatment and pollution control regulations to protect groundwater and resources. These rules and regulations force companies to use efficient and environment-friendly treatment and disposal techniques.

The surging focus on the use of natural materials like wood, coconut shell, and plant waste in the activated carbon production to develop environmentally friendly products is expected to generate drinking water adsorbents market growth.

COVID-19 pandemic is expected to slow down the growth of the global market due to the lockdown imposed in many countries to contain the pandemic has resulted in the shutting down of manufacturing industries that will affect the production of the adsorbents. The disruption in the supply chain due to transport restrictions will affect the growth of the global drinking water adsorbents market.

Industry Dynamics

Growth Drivers

The global market for drinking water adsorbents will be mainly driven by factors such as increasing population across the globe along with increased pollution of freshwater bodies due to rapid industrialization and urbanization. The stringent initiatives taken by the government to invest in treatment industries and the advancement in technology are expected to drive the global market for drinking water adsorbents during the forecast period.

Globally, 785 million individuals do not have access to basic drinking facilities and nearly, 2 billion population drinking H2O contaminated with various diseases such as cholera, dysentery, diarrhea, and typhoid. All these elements contribute to the demand for purified drinking H2O which is driving the growth of the global market for drinking H2O adsorbents.

There is a rapid increase in underground H2O pollution due to rapid industrialization in many countries. In India, more than 50% of districts have groundwater with high nitrate content above the permissible limit due to the discharge of toxic elements by industries in an unscientific manner and hence many countries are adopting stringent measures for pollution control by mandating industries to introduce efficient treatment and disposal methods. These developments will augment the growth of the global market.

The advancement in technology will also significantly contribute to the growth of the market in the coming years. For instance, new generation nano-adsorbents are being developed using nanoparticles that have the ability to remove new emerging pollutants such as pharmaceutical residues even at low concentrations independent of temperature and pH.

Companies are launching new adsorbent products and are developing innovative products based on new technologies. For instance, Cyclopure, Inc., launched the home PFAS Water Test for the U.S. market, in November 2019. PFAS Water Test Kit is the first product developed using the company’s patented DEXSORB adsorbents.

Know more about this report: request for sample pages

Report Segmentation

The market is primarily segmented on the basis of product, application, and region.

|

By Product |

By Applications |

By Regions |

|

|

|

Know more about this report: request for sample pages

Insight by Product

The activated carbon segment dominated the market for drinking H2O adsorbents and generated the highest revenue in 2020. The increased adoption of these materials in removing organic pollutants is driving the segment's market growth. Activated carbon comprises a group of compounds as well as a variety of carbonaceous compounds with adsorptive characteristics.

These materials have unique physical features that aid in reducing dissolved pollutants, as well as color, odor, taste, and hazardous toxins. Stringent regulations by the government and a substantial focus on R&D activities are likely to boost the industry for activated carbon over the forecast period.

The zeolite segment of the drinking H2O adsorbents industry report is anticipated to grow at the highest growth rate during the projected timeframe due to the product's greater performance in the exclusion of ammonia and heavy metals from the drinking H2O.

Geographic Overview

North America dominated the market for drinking H2O adsorbents and generated the highest revenue in 2020, owing to a strong industrial base and leading manufacturers, speedy urbanization, availability of advanced adsorbents technology, an increased need for fresh and potable H2O.

Raw material availability and easy accessibility are other factors that propel industry growth in the region. The strict measures such as Safe Drinking Water Act (SDWA) introduced by countries like the U.S. will further contribute to the industry growth in the region.

Asia Pacific is expected to be the fastest-growing region for the global industry for drinking H2O adsorbents during the forecast period due to the huge population and rapid industrialization in countries like India and China.

Increased level of harmful pollutants such as nitrate, arsenic, and fluoride in the groundwater of countries like India leads to strict environmental policies for treatment, which will propel the industry growth. In addition, the rising demand for environmentally friendly and cost-effective adsorbents from key end sectors such as chemicals/petrochemicals, petroleum refining, and gas refining have led to industry growth in the region.

Competitive Insight

The major players in the industry for drinking water adsorbents are developing innovative technologies by investing heavily in research and development. Companies are also collaborating, acquiring, and merging to strengthen their global market presence.

Major players operating in the market include CycloPure Inc., The Dow Chemical Company, DuPont, TIGG LLC, Evoqua Water Technologies LLC, Lenntech B.V., Kuraray Co. Ltd., KMI Zeolite, BASF SE, and Purolite.

Drinking Water Adsorbents Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 410.7 million |

|

Revenue forecast in 2028 |

USD 509.8 million |

|

CAGR |

3.9% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million and CAGR from 2021 to 2028 |

|

Segments covered |

By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Key Companies |

CycloPure Inc., The Dow Chemical Company, DuPont, TIGG LLC, Evoqua Water Technologies LLC, Lenntech B.V., Kuraray Co. Ltd., KMI Zeolite, BASF SE, and Purolite |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Cell-free Protein Expression Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Waterjet Cutting Machine Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Surgical Masks Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- M-Commerce Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Global Medical Plastics Market Research Report, Size, Share & Forecast by 2018 - 2026