District Cooling Market Share, Size, Trends, Industry Analysis Report, By Production Technique (Free Cooling, Absorption Cooling, Electric Chillers); By Application (Commercial, Residential, Industrial); By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 101

- Format: PDF

- Report ID: PM2432

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Summary

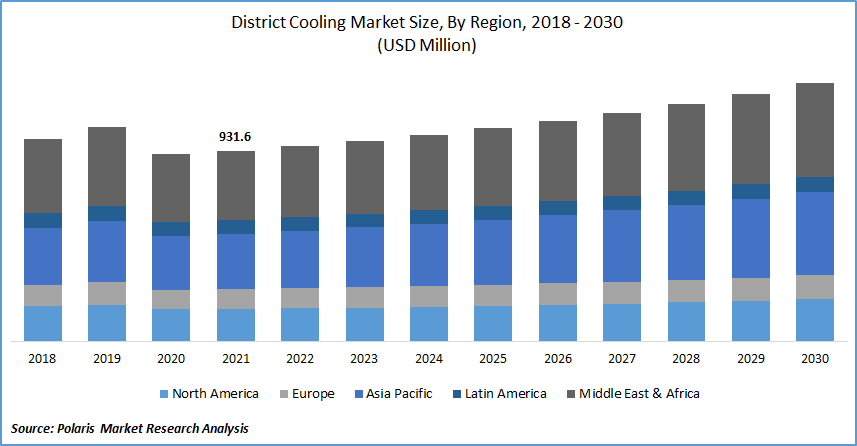

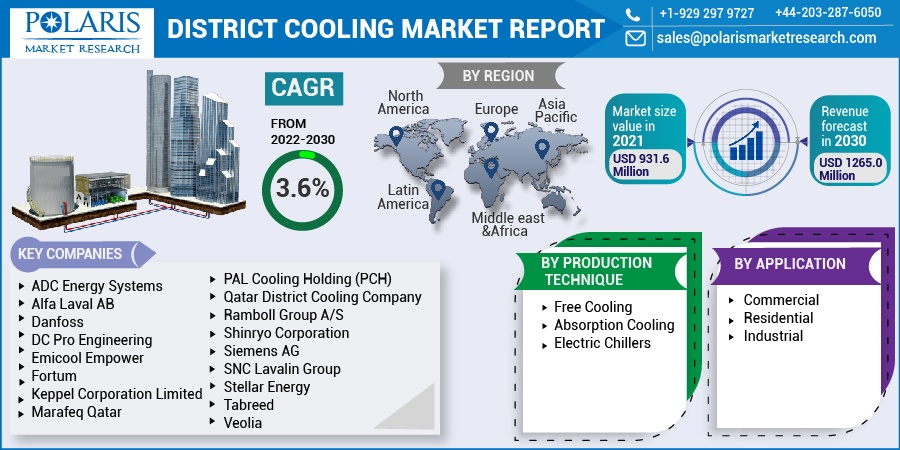

The global district cooling market was valued at USD 931.6 million in 2021 and is expected to grow at a CAGR of 3.6% during the forecast period. The key factors such as rising market demand for energy-efficient, sustainable technologies used in district cooling systems, strict government regulation, and rapid climate change are among the primary factors boosting the district cooling market growth.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

There is an increasing requirement to construct the latest buildings to reduce their energy consumption under the new building codes. In Europe, Eurocodes ensure that buildings are both sustainable and follow the applicable codes. The International Code Council's International Energy Conservation Code also requires buildings to be energy-efficient.

The popularity of chilling is growing due to increased income and urbanization. Rising energy prices, stringent environmental regulations, and increased market demand for low-cost chilling systems will drive district chilling market demand. District cooling plants use much less water and energy, resulting in more significant environmental benefits. Cooling is generated in a centralized plant, which is more efficient than individual air conditioners.

Furthermore, the government regulation to reduce greenhouse gas emissions and the rapid change in climatic conditions are expected to drive the market over the forecast period. Also, evaluating the current toward energy-efficient conditioning optimization will boost the business outlook. For instance, in full compliance with its Vision 2030, the Abu Dhabi government established the "Estidama" program, which governs the building, villas, and communities' construction, design, operation, and performance.

However, the rise in capital cost is the factor restraining the market growth during the forecast period. District cooling is capital-intensive, and centralized air conditioning plants are time-consuming, necessitating extensive planning. The distribution network's installation is also costly. District chilling necessitates a large-scale centralized chilling manufacturing and distribution grid.

Industry Dynamics

Growth Drivers

Important factors such as the increasing infrastructure investment in emerging economies by the major players and their partnerships for the investment in these projects are driving the district cooling market growth during the forecast period. For instance, in March 2021, Tabreed, the UAE's National Central Cooling Corporation, and the International Finance Corporation (IFC) announced an investment of $400 million in India and South-East Asian countries to establish chilling infrastructure.

Tabreed and the IFC have established a joint venture to confirm Singapore's district energy investment scheme. The JV will spend on district chilling, trigeneration, and chilling as a service offering, with a central emphasis on India and other South-East Asian countries.

In August 2021, Empower, also known as "Emirates Central Cooling Systems Corporation," one of the nation's biggest district chilling service suppliers, has agreed to acquire Nakheel's cooling unit. This agreement states that Empower will obtain all of the investments of the concerned chilling systems, which serve over 18,000 consumers across Dubai through its 19 colling plants. The unit has a capability of 110,000 refrigeration tonnes and is worth AED 860 million. Thus, the rising infrastructure investment by key players operating in the market boosts market growth during the forecast period.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on production technique, application, and region.

|

By Production Technique |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

Insight by Application

Based on the application segment, the commercial segment is expected to be the most significant revenue contributor. Healthcare, instructional, retail, government, office, and airport are all sub-segments of the commercial segment. The commercial segment is estimated to be the leading segment in the market over the forecast period. The development of new infrastructure projects in Middle Eastern countries and the growing need for businesses to reduce their carbon footprint are anticipated to propel the segments' market growth.

Geographic Overview

In terms of geography, Middle East & Africa had the largest market share. The region dominates due to a growing affluent population and increased construction activity, particularly in countries such as the United Arab Emirates (UAE), Saudi Arabia, and Qatar. Technological advances will increase the overall capacity of existing plants and continuing construction projects. Intense construction activities, projects, and corporation partnerships for technological advancement across the country will boost the district cooling market outlook in the UAE.

For instance, in March 2022, Empower was awarded a USD 52.5 million contract to construct a district chilling plant in Dubai, which will provide eco-friendly district chilling services to the Dubai Land Residence Complex (DLRC) province in the amount of 23,500 refrigeration tonnes (RT). In November 2021, Empower agreed to acquire Dubai International Airport's district chilling, with a total capacity of 110,000 refrigeration tonnes (RT), for AED 1.1 billion, using a pair of internal accruals and debt financing from domestic and international banks in which Empower has connected strategic relationships.

Further, due to the associated cost-efficiency and decades of service, many business owners in the region are implementing these systems. These systems use 50% less electricity than air conditioners, lowering the initial investment and the maintenance expenses. These systems are best suited for large establishments like airports, commercial buildings, schools and universities, and residential towers in the UAE. Rapid industrialization, urbanization, and rising energy price increases will drive the UAE district chilling in the residential segment.

Moreover, North America is expected to witness a high CAGR in the global market throughout the forecast period. A district chilling network links many organizations and airports in the U.S. This, combined with the growing market demand for ACs, is expected to create market expansion opportunities. The increasing replacement of traditional chilling systems with sustainable DC units will push the size of the district cooling market in the US. Applying stringent guidelines for effective carbon emission monitoring will improve the business landscape.

Competitive Insight

Some of the major market players operating in the global district cooling market include ADC Energy Systems, Alfa Laval AB, Danfoss, DC Pro Engineering, Emicool, Empower, Fortum, Gas District Cooling (M) Sdn. Bhd, Keppel Corporation Limited, Marafeq Qatar, PAL Cooling Holding (PCH), Qatar District Cooling Company, Ramboll Group A/S, Shinryo Corporation, Siemens AG, SNC Lavalin Group, Stellar Energy, Tabreed, and Veolia.

District Cooling Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 931.6 Million |

|

Revenue forecast in 2030 |

USD 1,265.0 Million |

|

CAGR |

3.6% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Production Technique, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

ADC Energy Systems, Alfa Laval AB, Danfoss, DC Pro Engineering, Emicool, Empower, Fortum, Gas District Cooling (M) Sdn. Bhd, Keppel Corporation Limited, Marafeq Qatar, PAL Cooling Holding (PCH), Ramboll Group A/S, Shinryo Corporation, Siemens AG, SNC Lavalin Group, Stellar Energy, Tabreed, and Veolia. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Antimicrobial Coatings Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Cleaning Robot Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Computer Numerical Control Machine Market Research Report, Share and Forecast, 2019 – 2026

- Cell-based Assay Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- 5G Infrastructure Market Share, Size, Trends, Industry Analysis Report, 2020-2027