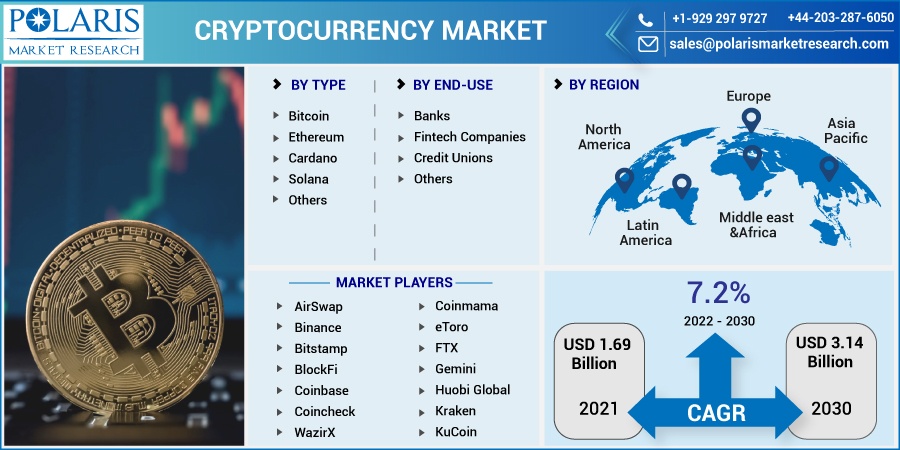

Cryptocurrency Market Share, Size, Trends, Industry Analysis Report, By Type (Bitcoin, Ethereum, Cardano, Solana, Others), By End-Use (Banks, Fintech Companies, Credit Unions, Others); By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 101

- Format: PDF

- Report ID: PM2234

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Summary

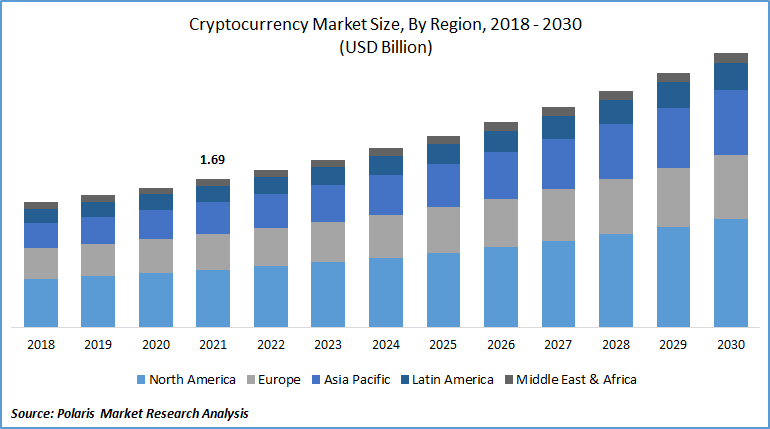

The global cryptocurrency market was valued at USD 1.69 billion in 2021 and is expected to grow at a CAGR of 7.2% during the forecast period. The substantial growth is attributed to the increasing demand for platforms to enable the trading of such currency. These platforms perform the task of intermediary between the seller and buyer and earn money through commissions and transaction fees.

Know more about this report: Request for sample pages

The worldwide cryptocurrency market is significantly impacted by the growing number of users of cryptocurrencies. The total number of cryptocurrency users worldwide hit 106 Mn in January 2021, according to crypto.com (a supplier of crypto exchanges). The increase in bitcoin exchange service providers, the adoption of DeFi, and the growing acceptance of cryptocurrencies by financial institutions worldwide are all factors contributing to the rise in cryptocurrency users.

For instance, in March 2021, Morgan Stanley, an American investment bank, started to offer access to bitcoin funds to its wealth management clients. This enabled the company to improve its offerings. A significant amount of funds that are being raised by various venture capital firms in the market are expected to offer lucrative growth opportunities.

Similarly, in October 2021, CoinSwitchKuber (crypto exchange platform) raised over USD 260 million through investors such as Andreessen Horowitz & Coinbase Ventures. Additionally, the growing number of developments by the key market player is anticipated to boost the cryptocurrency industry's growth.

The COVID-19 pandemic had a substantial negative impact on the global economy. As the virus spread, many businesses were shut down, out of which most were small businesses, but large firms were impacted too. However, against the uncertainty created by the virus spread, cryptocurrencies such as Bitcoin, Ethereum, and others gained massive attention. Amid the pandemic, even the banks started investing in crypto exchange platforms for the first time. Banks started creating their own systems (blockchain-based) in order to enable B2B cryptocurrency payments.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The increasing government initiatives for the development of blockchain payment gateway are anticipated to drive the growth of the cryptocurrency industry globally. For instance, in 2019, The UAE Ministry of Community Development launched a Blockchain payment gateway in partnership with Dubai Blockchain Center.

This payment processor accepts all cryptocurrencies. One of the key elements that significantly contribute to the market's growth is the increasing worldwide internet usage. Customers can use cryptocurrency trading platforms thanks to their cellphones, computers, and internet access.

The World Bank estimates that China's internet prevalence will rise from 64.56% in 2019 to 70.64% in 2020. Similarly, India's internet penetration rose from 20.08% in 2019 to 41 percent in 2019. Additionally, the widespread use of smartphones is anticipated to create enormous development potential for the cryptocurrency exchange network sector.

Due to the fact that many service providers are turning to cellphones to deliver their services. For instance, Kraken debuted its mobile application in the United States in June 2021, allowing users to buy and sell cryptocurrency tokens using smartphones.

Report Segmentation

The market is primarily segmented on the basis of type, end-use, and region.

|

By Type |

By End-Use |

By Region |

|

|

|

Know more about this report: Request for sample pages

Insight by Type

The bitcoin segment accounted for the largest share in the global cryptocurrency market. The most widely used digital money worldwide is bitcoin. According to Deutsche Bank AG, Bitcoin was the most popular digital currency worldwide in September 2017, and it is expected to maintain this position in the years to come. The prior opposition to Bitcoin, inflation, widespread acceptance as a form of payment, and institutional investments, among other factors, are all responsible for the segment's rise.

However, a sizeable portion of the whole cryptocurrency market comprises the Ethereum section. This is understandable given the cryptocurrency's significant market value. After BTC, this cryptocurrency is the most widely used digital token (Bitcoin). The rising interest in DeFi, the rapid industrial adoption of Ethereum, and the present relatively low market volatility era can all be linked to the development of the cryptocurrency platform.

Insight by End-Use

The Fintech companies segment is recorded with the most significant shares in 2021 and is expected to lead the market in the forecasting years. The lucrative market share of the segment can be attributed to the emerging cryptocurrency FinTech companies across the European market. Fintech innovation is driven by non-bank entities and promotes a more interactive approach to banking and financial services. Recent developments in the analytical tools of financial technology are further anticipated to provide growth opportunities to the segment.

The bank segment is also projected to experience considerable growth across the globe. This growth can be attributed to the growing acceptance of cryptocurrency exchange platforms by banks across the world. Moreover, JP Morgan, an American investment bank, started its digital currency in 2019. Additionally, significant banks globally are embracing cryptocurrencies. For instance, a U.S. bank announced on 5th October that it would offer cryptocurrency custody services to money managers.

Geographic Overview

Geographically, Asia Pacific holds the highest shares in the global cryptocurrency market in 2021 and will likely dominate the market in the forecast period. This is due to the rising number of cryptocurrency exchange platforms across developing nations such as India and China, among others. The government in China is pushing the use of blockchain technology to combat fraud in the financial sector. Furthermore, the rising number of cryptocurrency exchange platforms such as WazirX, BuyUcoin, Kuber, and others, is anticipated to drive the market's growth across the region.

According to Chainalysis, crypto activity in southern & central Asia increased by over 706% in 2021. This increase in crypto activity is anticipated to drive industry growth. Further, the increasing per capita income of the population and the growing awareness regarding cryptocurrencies in the region are expected to provide lucrative market growth opportunities.

Moreover, the market in North America is anticipated to grow with a progressive CAGR during the forecast period. Existential companies are expected to promote growth across the region. The presence of major players and large FinTech companies such as Paypal and others is further anticipated to offer huge market growth opportunities. The growth in DeFi (decentralized finance) is driving the industry's growth in North America. Furthermore, the considerable mining hash rate of the region is projected to drive market growth of cryptocurrency.

Competitive Insight

Some major market players operating in the global cryptocurrency market include AirSwap, Binance, Bitstamp, BlockFi, Coinbase, Coincheck, Coinmama, eToro, FTX, Gemini, Huobi Global, Kraken, KuCoin, and WazirX.

Cryptocurrency Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1.69 billion |

|

Revenue forecast in 2030 |

USD 3.14 billion |

|

CAGR |

7.2% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

AirSwap, Binance, Bitstamp, BlockFi, Coinbase, Coincheck, Coinmama, eToro, FTX, Gemini, Huobi Global, Kraken, KuCoin, and WazirX . |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Otoplasty Market Share, Size, Trends, Industry Analysis Report, 2023 - 2032

- Medical Alert Systems Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- OTR Tires Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Active Electronic Components Market Research Report, Share and Forecast, 2018 – 2026

- Oleochemicals Market Research Report, Size, Share & Forecast by 2018 - 2026