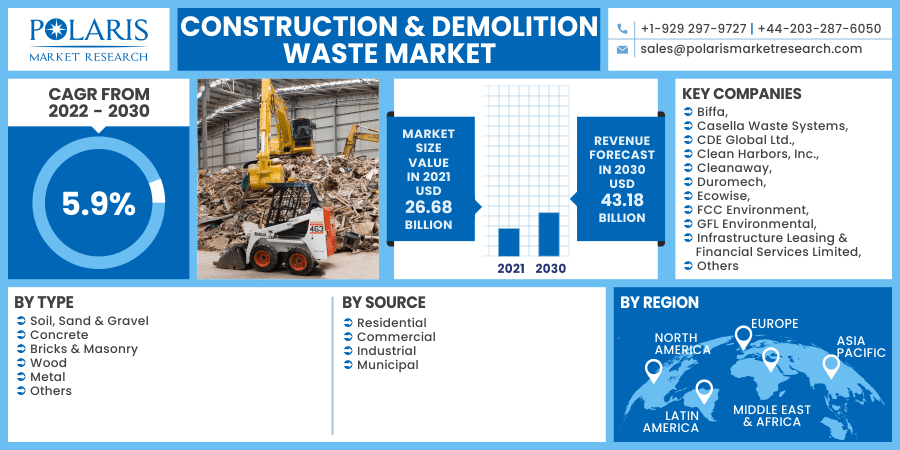

Construction & Demolition Waste Market Share, Size, Trends, Industry Analysis Report, By Type (Soil, Sand & Gravel, Concrete, Bricks & Masonry, Wood, Metal, Others); By Source (Residential, Commercial, Industrial, Municipal); By Region; Segment Forecast, 2022 - 2030

- Published Date:Jan-2022

- Pages: 101

- Format: PDF

- Report ID: PM2185

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Summary

The global construction & demolition waste market was valued at USD 26.68 billion in 2021 and is expected to grow at a CAGR of 5.9% during the forecast period. The rising government inclinations towards the reduction of illegal dumping along with growing infrastructural activities are accelerating the market demand globally.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Besides, the support of the various NGOs and social welfare organizations for sustainability also contributes to construction & demolition waste market development. Furthermore, growing urbanization is also leading to the production of C&D debris as well as the introduction of green buildings also acts as a catalyzing factor for industry growth around the world.

The outbreak of COVID-19 has affected every sector of the global economy, including the construction & demolition waste market. The industry was very badly struck by the COVID-19. The pandemic shows a huge impact on key costs components of the infrastructure projects as well as both materials and labors segment. Thus, this hampers the working of several projects across various regions owing to the social distancing policy and stringent lockdowns. Therefore, all these factors may cause disruption in the supply chain, which in turn, exhibits a negative impact on the industry. The gradual opening of all industries may fuel the construction & demolition waste market growth in the near future.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The rising number of regulatory policies regarding construction & demolition waste may impel industry demand across the globe. Construction & demolition waste is the chief, prominent debris streams generated every year in the European Union. Construction & demolition debris recorded for approximately 0.85 billion tons each year, or more than 25% to 30% of total debris created in the European Union, and comprises different types of components such as gypsum, asbestos, plastic, concrete, wood, metals, bricks, and glass, most of them be repurposed or recycled. Various construction & demolition debris is being discarded unprocessed across the landfills. These activities carry out a negative impact on the environment.

However, regulatory norms and policies have made it mandatory to reuse and recycle above half of the construction & demolition waste production. The debris guidelines and landfill legislations are prime factors in modern ways of smart management of construction & demolition waste. This helps in the development and continuation of service suppliers that present proficient services, products, and solutions to managing construction & demolition waste. Thus, these factors may accelerate the construction & demolition waste market growth in the impending period.

Report Segmentation

The market is primarily segmented on the basis of type, source, and region.

|

By Type |

By Source |

By Region |

|

|

|

Know more about this report: request for sample pages

Insight by Type

The sand, soil, & gravel segment are the leading segment in terms of revenue generation in the year 2020. As per the European Cement Association, gravel, sand, and soil comprise the overall salvage from construction & demolition sites around the world. The considerable output of sand, soli, and gravel in the total recycled debris contributes to being a chief segment in the overall industry. The growing adoption of the recycled and composted soil, gravel, and sand debris at new building sites and demolition sites supports the dominance of the segment over the forthcoming scenario.

The bricks & masonry segment is the fastest-growing segment in the global industry. The direct application of salvaged bricks in new buildings and demolition sites, as well as the penetration of the masonry as raw materials for coarse aggregate and manufacturing sites, may accelerate the segment growth.

Insight by Source

The industrial segment is accounted for the highest revenue share in the global industry and is expected to rise in the approaching years. The robust development of the industrial segment is leading the more production of scraps at building and demolition sites and debris in the development process. Thus, vertical integration of assets like landfills, transfer stations, and recycling operations may lead to operating margins and higher margins for improving the cash flow, profitability, which in turn, may boost the segment growth.

The commercial segment is holding is likely to grow at the highest CAGR in the global market over the forthcoming scenario. The increasing number of commercial activities, as well as the growing population, may propel the segment growth. In addition, the implementation of various government policies for debris management is projected to show the increasing demand for the segment in the forthcoming scenario.

Geographic Overview

Asia Pacific is the largest contributor of revenue in 2020 and is expected to dominate the global market in the forecasting period. The growing prominence of the government on infrastructural development in emerging economies such as China, Japan, and India, along with the continuous creation of various building & construction projects, may contribute to the market demand.

For instance, the Indian Ministry of Housing and Urban Affairs (MoHUA) is targeting advancing the construction segment in India with the help of several favorable regulatory policies. Besides, the production of debris across the country is adequate for supplying raw material to recycling centers; thus, this may participate in green buildings and eco-friendly construction. Therefore, these factors may drive market growth across the region.

Moreover, North America is projected to grow at the highest CAGR across the globe in the approaching years. The robust investments by the leading market players for establishing and managing various new recycling building projects in the region may attribute to the market demand. Additionally, the growth of the emergence of technology in scrap management as well as high economic development in North America may create lucrative opportunities for the segment. Hence, these factors are propelling the market growth across North America.

Competitive Insight

Some of the major players operating in the global market include Biffa, Casella Waste Systems, CDE Global Ltd., Clean Harbors, Inc., Cleanaway, Duromech, Ecowise, FCC Environment, GFL Environmental, Infrastructure Leasing & Financial Services Limited, Metso Outotec, Nswai, Ramky Enviro Engineers Ltd, Remondis Se & Co. KG, Renewi, Republic Services, Rubicon, Shanghai Zinth Mineral Co., Ltd., Suez, Veolia, Waste Management, and Westart India.

Construction & Demolition Waste Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 26.68 billion |

|

Revenue forecast in 2030 |

USD 43.18 billion |

|

CAGR |

5.9% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Source, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Biffa, Casella Waste Systems, CDE Global Ltd., Clean Harbors, Inc., Cleanaway, Duromech, Ecowise, FCC Environment, GFL Environmental, Infrastructure Leasing & Financial Services Limited, Metso Outotec, Nswai, Ramky Enviro Engineers Ltd, Remondis Se & Co. KG, Renewi, Republic Services, Rubicon, Shanghai Zinth Mineral Co., Ltd., Suez, Veolia, Waste Management, and Westart India. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Bioethanol Market Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Alcoholic Beverages Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Virtual Clinical Trials Market Share, Size, Trends, Industry Analysis Report, 2020-2027

- Virtual Payment (POS) Terminals Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- e-KYC Market Share, Size, Trends, Industry Analysis Report, 2022 - 2029