Construction Adhesive Tapes Market Share, Size, Trends, Industry Analysis Report, By Type (Water-based, Hot Melt, Solvent-based, Pressure Sensitive, Others); By Application; By Region; Segment Forecast, 2022 - 2030

- Published Date:Oct-2022

- Pages: 101

- Format: PDF

- Report ID: PM2658

- Base Year: 2021

- Historical Data: 2018-2020

Report Summary

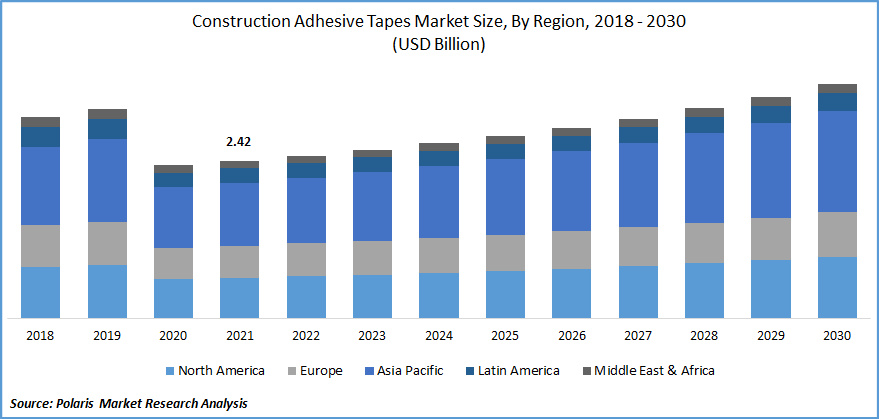

The global construction adhesive tapes market was valued at USD 2.42 billion in 2021 and is expected to grow at a CAGR of 4.6% during the forecast period. The safety and ease of application provided by construction adhesive tape and booming construction sector in developing countries drive the market. Additionally, Government schemes to improve public infrastructure and increase cost-effective non-residential construction drive the market. Many research & development activities by manufacturers also led to the rising demand for the products.

Know more about this report: Request for sample pages

The construction adhesive tapes are projected to extend application in educational buildings, retail outlets, healthcare facilities, metro stations, and hotels. Besides, it eliminates hollow space under a tile due to its small granules. Thus, it is a popular choice for flooring. Furthermore, the ability of adhesive tapes to sustain indoor applications such as buildings, hospitals, and schools is estimated to create a lucrative opportunity for market expansion.

The market is extremely competitive due to numerous recognized vendors and manufacturers. The companies involved in this market are extensively engrossed in the R&D of new products for specific applications and conditions. The attractiveness of the market is based on the current market size and expected growth prospects, investments required, cash output, research & innovation, and probable investment requirements.

The COVID-19 pandemic and governing issues have slackened the manufacturing of construction adhesive tapes due to lockdown. Delays in construction activities, supply chain disruptions, and limited availability of raw materials were some factors that hampered the market’s growth. Restrictions on movement of goods and limitations on import and export activities further limited the market growth. However, the situation is expected to recover with time as there has been growth in the construction industry.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The growth of the global construction adhesive tapes market is primarily driven by rise in urban population and strengthening industrial development. Moreover, improvements in economic condition in emerging countries such as India, China, and Brazil lead to improving standard of living. Further, with the increase in urbanization, housing and construction projects are on a rise.

According to United Nations, in 2021, about 56.6% of the global population lived in urban areas and has estimated to be 68% by 2050. Such rapid urbanization has affected the construction industry all over the globe. The growth in urban population is concentrated in emerging economies of the world, which leads to a high development rate for infrastructure.

Further, the global population is estimated to reach 9.8 billion by 2050 due to which the need for usage of energy-efficient materials is imminent. In addition, sustainable infrastructure is essential to the emerging economies of the world, as per the requirement for residential and industrial buildings.

Moreover, the rise in concern related to volatile organic compounds (VOC) is expected to exhibit growth in coming years; as VOC causes several issues such as air pollution and several other health issues, for instance, damage to the liver, kidney, and central nervous system, and others. Further, an increase in government support and promotion for low VOC, green and sustainable adhesives is expected to fuel the market growth.

Report Segmentation

The market is primarily segmented based on type, application, and region.

|

By Type |

By Application |

By Region |

|

|

|

Know more about this report: Request for sample pages

Hot melt segment is expected to hold a significant share in 2021

By type, the construction adhesive tapes market is segmented into water-based, hot melt, solvent-based, pressure-sensitive, and others. The hot melt segment accounted for a major market share in 2021.

Solid hot melt melts easily at ambient temperature, which in turn allows free flow and can be easily dispensed to the specific site in a precise and controlled manner. Moreover, after cooling turns into a solid form, that in turn leads to formation of stronger bonds between substrates.

Major advantage of hot melt adhesive tapes is its fast setup period as compared to other solvent or water based or curable pressure-sensitive adhesives. Hot melt adhesive tapes can be divided into two sub-segments such as non-formulated and formulated. Formulated tapes are made up of styrenic block co-polymers or EVA or amorphous poly olefins along with tackifiers and other additives. In contrast, non-formulated hot melt adhesive tapes are purposely synthesized without modifiers such as tackifiers.

Residential sector generated significant revenue

By application, the construction adhesive tapes market is segmented into commercial, residential, infrastructure, and others. The residential sector generated significant revenue in 2021. The main advantage of adhesive tapes for residential use is that they are easy to apply, and high-performance adhesive tapes can also be used for bonding on existing objects’ surface and other special surfaces.

Builders are inclined toward the use of water-based flashing tapes that are composed of pressure-sensitive adhesive tapes over primarily used flashing material such as metal pieces or plastic pieces. According to a survey by The National Association of Realtors, the sales of new homes grew by 11% in 2020. This factor is predicted to offer new opportunities for the adhesive tapes market in the building & construction sector.

In addition, adhesive tapes are employed and are an effective solution for the sealing of windows and doors of the building that are usually exposed to environmental conditions. Insulation tapes are usually employed with pressure-sensitive adhesive owing to their ability to offer resistance from environmental factors such as fluctuating temperature range, UV rays, expansion & contraction mechanism, and water vapor.

Asia Pacific dominated the use of construction adhesive tapes

The Asia Pacific region is expected to account for a major share of the construction adhesive tapes market. The demand for adhesive tapes is growing owing to high economic growth in developing economies, such as China, India, Japan, Malaysia, and Australia, and demand for residential construction.

Moreover, the demand is boosted in this region due to increasing infrastructural projects in China and India. The Asia Pacific region is projected to witness lucrative growth due to fast-growing construction industry and easy availability of raw materials & economies of scale.

In addition, rapid urbanization is fueling the substantial development of infrastructures such as townships, residential buildings, parks, and public spaces, further expected to fuel the market growth in Asia Pacific region during the forecast period.

Competitive Insight

Some leading companies operating in the global market include 3M Company, Advance Tapes International Ltd, Beery Global Inc., Bostik, DENSO-Holding GmbH & Co., HiCube Coating, Ideal Tape Company, Intertape Polymer Group, Lohmann GmbH & Co.KG, Nichiban Co., Ltd., Nitto Denko Corporation, Saint-Gobain Weber Co., Ltd., Scapa Group Ltd, Sika AG, and Tesa SE.

These prominent companies are launched new and highly efficient products to expand their customer base and cater to their growing requirements. They are also collaborating and merging with other players for technological advancements, geographic expansion, and introduction of advanced products.

Recent Developments

In May 2022, 3M Company expanded its product portfolio with 3M wear adhesive tapes.

In December 2020, Sika AG launched a new product Purform Polyurethane which has many applications in construction industry.

Construction Adhesive Tapes Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 2.50 billion |

|

Revenue forecast in 2030 |

USD 3.60 billion |

|

CAGR |

4.6% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

3M Company, Advance Tapes International Ltd, Beery Global Inc., Bostik, DENSO-Holding GmbH & Co., HiCube Coating, Ideal Tape Company, Intertape Polymer Group, Lohmann GmbH & Co.KG, Nichiban Co., Ltd., Nitto Denko Corporation, Saint-Gobain Weber Co., Ltd., Scapa Group Ltd, Sika AG, and Tesa SE. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Vascular Access Device Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- PPG Biosensors Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Digital Signature Market Share, Size, Trends, Industry Analysis Report, 2020-2026

- Food Fortifying Agents Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Petrochemicals Market Research Report, Size, Share & Forecast by 2018 - 2026