Command and Control Systems Market Share, Size, Trends, Industry Analysis Report, By Platform (Land, Maritime, Space, and Airborne); By Solution; By Application; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jan-2023

- Pages: 101

- Format: PDF

- Report ID: PM2997

- Base Year: 2022

- Historical Data: 2019-2021

Report Summary

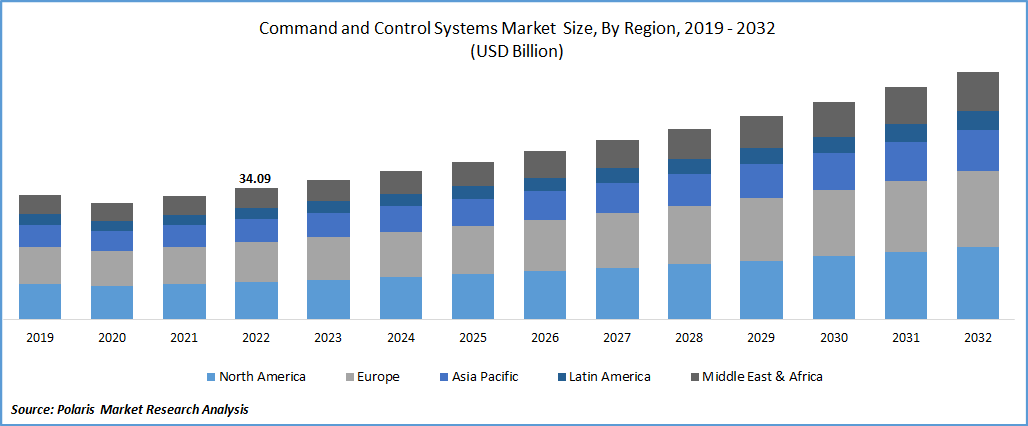

The global command and control systems market was valued at USD 34.09 billion in 2022 and is expected to grow at a CAGR of 6.6% during the forecast period.

Increasing demand for situational awareness across security, military, law enforcement, utilities, and manufacturing industries, a significant rise in terrorist activities, and growing geopolitical conflicts between the Middle East and Asia Pacific countries are primary factors boosting the market growth. The C2 technology is widely used in commercial and defense sectors, as it brings various disciplines together and builds interconnection between them for the practical performing of operations. The advent of numerous next-generation defense technologies and the rise in military budgets in developed and developing nations are key factors attributed to the growing demand.

Know more about this report: Request for sample pages

For instance, in June 2022, Milrem Robotics announced the launch of its new command & control system for several intelligent unmanned systems at the “Eurosatory.” Many unmanned aerial & ground assets are being integrated into a composite design and further merge sensor & effector data.

Furthermore, there has been tremendous growth in the adoption of command and control systems across various airports and manufacturing plants, oil and gas installation plants, power plants, and research labs due to increased awareness regarding technological benefits like situation assessment, operational control, and information exchange. Moreover, introducing advanced technologies such as the Internet of Things, Artificial Intelligence, and Cloud Computing in C2 systems for making better strategic decisions will likely create lucrative market growth opportunities soon.

The rapid emergence of the deadly coronavirus has caused a very large-scale impact on economies worldwide owing to shutdowns and lockdowns that affected the manufacturing and supply chains. The manufacturing of space launch vehicles, components, and assembly have been significantly impacted, and many countries also reduced the budget allotted for the defense sector due to the COVID-19 pandemic.

Industry Dynamics

Growth Drivers

Rising proliferation and the need for enhanced decision-making ability to identify, process, and analyze various critical information from different sources across the globe that plays a key role in military, air, and naval operations is likely to drive the market to grow rapidly over the coming years. Surveillance, advanced intelligence, and reconnaissance technologies come with command and control systems providing ground, air, and maritime solutions with real-time SA information, which is propelling the adoption and growth of these systems market.

In addition, increasing demand for advanced integrated command and control systems in transportation, healthcare, and law enforcement sectors is also expected to fuel the market growth over the anticipated period. A rise in traffic and population has led to significant demand for efficient transportation and accident-safe technologies. New-generation communication-based command and control technologies are capable of managing traffic very efficiently. Thus several metro and high-speed train systems are adopting this to manage their traffic.

Report Segmentation

The market is primarily segmented based on platform, solution, application, and region.

|

By Platform |

By Solution |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Land-based segment accounted for the largest market share in 2022

The land-based segment accounted for a considerable market share in 2022. The growth of the segment market is mainly driven by the increasing number of programs associated with military modernization and procurement of various advance and innovative defense systems by defense forces worldwide. Extensively growing hostile and terrorist activities that have fueled the demand for building new fixed-base control centers and land-based headquarters, especially in developed countries like the United States and Germany, are likely to augment segment market growth over the coming years. For instance, in December 2021, the United States Army awarded a contract worth USD 1.4 billion to Northrop Grumman Corporation for both low-rate initial production and full-rate production of their future battle command system.

Moreover, the maritime segment is projected to witness the highest growth during the forecast period, which is mainly driven by the rapid increase in investment in naval development-related activities and a surge in the number of maritime trade activities that further need complete control over many critical shipping activities.

Software segment is expected to register fastest growth

The software segment is anticipated to exhibit the fastest market growth throughout the anticipated period on account of its ability to enable the efficient functioning of intelligent sensors, GPS, and much other software used across command centers. Additionally, software for command and control centers is easily adaptable and scalable as well to communicate with a variety of external systems in a seamless information flow and could be easily integrated with the database maintained by the government like GPS, maps, passports, unified ID, prison systems, fire departments, and criminal database.

The hardware segment dominated the market, in 2022, with a holding of significant market revenue share. The extensive rise in the usage of sensors, displays, peripherals, video walls, video screens, radar systems, and much other hardware used in the control and command centers, coupled with the continuous focus by key market players on developing more advanced products are the major reason behind the growth of the segment market.

The defense segment held the largest market revenue share in 2022

The defense segment held the maximum market share in 2022 and is expected to grow at a considerable growth rate over the coming years due to the ability of these systems to allow users to make better and more accurate decisions for the completion of many mission-critical operations. Real-time information is very important and provides precise & up-to-date information regarding battlefield conditions, thereby being widely adopted by defense agencies across the globe.

The commercial segment is anticipated to grow significantly at a healthy CAGR over the forecast period, which is mainly an accelerated rising need for these advanced systems in various industrial operations associated with transportation and manufacturing. These systems have gained high popularity among various industries owing to their innovated features and customization to meet individual industry requirements to effectively manage their operations and are fueling the segment market.

The North America region dominated the market in 2022

The North America region led the industry for command and control systems in 2022 and is projected to maintain its dominance over the estimated period. Rapidly surging technological developments and a high concentration of major C2 system providers, along with the numerous collaborative multinational military operations implied by the US Government with other local governments in the Middle Eastern region, are key factors contributing to the growth of the regional market. Furthermore, the large presence of critical infrastructure like airports, power plants, and manufacturing units, among others, is also augmenting the demand and growth.

Asia Pacific region is likely to show remarkable growth during the anticipated period, which is mainly attributed to the increase in defense expenditure and growth in military modernization and development programs by countries like India, China, and Indonesia. Additionally, rising geopolitical conflicts and tensions between India and China have led to a rise in defense sector spending in these countries that results in high demand for C2 systems and augment market growth in the region.

Competitive Insight

Some of the major players operating in the global market include Honeywell International, General Dynamics Corporation, Lockheed Martin Corporation, Leonardo S.p.A., BAE Systems, CACI International, Rockwell Collins, Elbit Systems, Northrop Grumman Corporation, General Dynamics Corporation, L3harris Technologies, Thales Group, Rolta India, & Siemens.

Recent Developments

In October 2022, Leonardo introduced the DSS-IRST system at the “Euronaval,” developed to provide the larger naval units such as Italian Navy’s “Trieste” & Pattugliatori Polivalenti d’Altrura along with its robust, established facilities.

In August 2022, Lockheed Martin Australia announced its partnership with Royal Australian Air Force & the Defense Science and Technology Group for the purpose of testing a new military control and command training system that leverages artificial intelligence to support rapid decision-making at tactical levels.

Command and Control Systems Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 36.21 billion |

|

Revenue forecast in 2032 |

USD 64.25 billion |

|

CAGR |

6.6% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2032 |

|

Segments covered |

By Platform, By Solution, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Honeywell International Inc., General Dynamics Corporation, Lockheed Martin Corporation, Leonardo S.p.A., BAE Systems, CACI International Inc., Rockwell Collins, Elbit Systems Ltd., Northrop Grumman Corporation, General Dynamics Corporation, L3harris Technologies, Thales Group, Rolta India Ltd., and Siemens AG. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- IoT Professional Services Market Share, Size, Trends, Industry Analysis Report, 2023 - 2032

- Aircraft Health Monitoring Systems Market Share, Size, Trends, & Industry Analysis Report: Segment Forecast, 2018 – 2026

- Postpartum Products Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Network as a Service Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Pet Meal Kit Delivery Services Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030