Cold Chain Monitoring Market Share, Size, Trends, Industry Analysis Report, By Component (Hardware, Software); By Logistics ((Storage (Warehouse, Cold Container), Transportation (Airways, Waterways, Railways, Roadways)); Application; By Region; Segment Forecasts, 2022 - 2030

- Published Date:Apr-2022

- Pages: 101

- Format: PDF

- Report ID: PM2363

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Summary

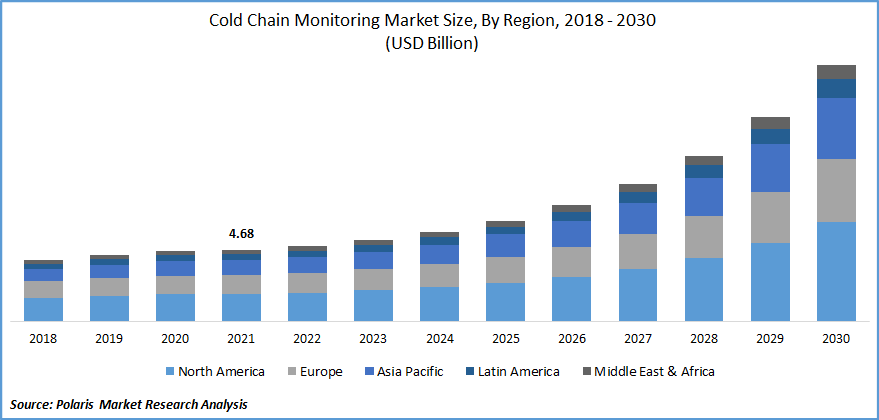

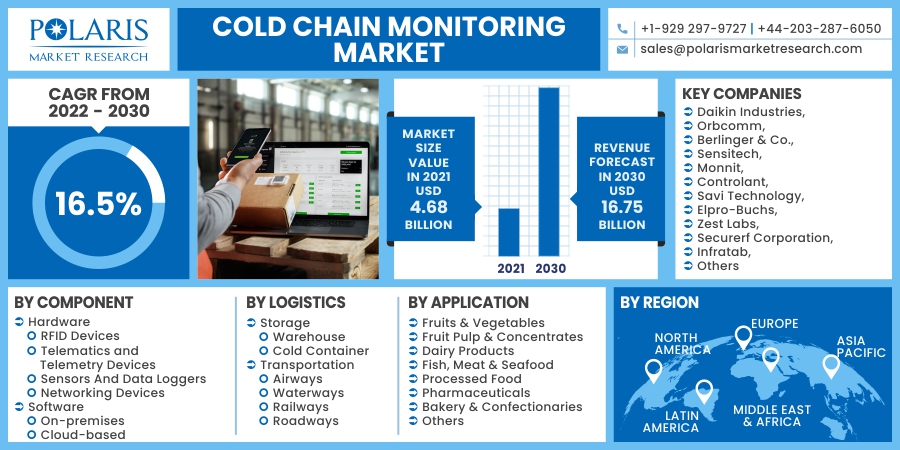

The global cold chain monitoring market was valued at USD 4.68 billion in 2021 and is expected to grow at a CAGR of 16.5% during the forecast period. An increase in the demand for cold chain monitoring products in the pharmaceutical and healthcare supply chain (for vaccines and other biological products), increased private and government investments in refrigerated warehouse development, as well as government attempts to prevent spoiling of food and other temperature-sensitive items, are expected to become key market growth factors.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Cold chain monitoring uses internet of things (IoT) technology to monitor and regulate temperature-sensitive products shipped in a cold chain. It is a supply chain containing consumable and temperature-sensitive products such as drinks, food, pharmaceuticals, and biologics. Inadequate circumstances during shipping and storage can harm the quality of these products if not adequately monitored.

This can endanger people's health and safety and harm a company's brand, consumer loyalty, and bottom line. Thus, various manufacturers are focusing on IoT technology to better cater to the market's growing demand. For instance, in February 2021, Sensitech has released IoT cold chain monitoring devices that feature air-carrier authorized and non-lithium battery variants for real-time cargo tracking when traveling by airline.

The COVID-19 vaccines have drawn international attention to cold chain logistics. The bulk of shipments and the temperatures at which vaccinations must be delivered and stored have presented difficulties, particularly in low-income countries with limited cold chain infrastructure.

Industry Dynamics

Growth Drivers

Temperature-sensitive medications, such as vaccines and items that rely on specific temperature ranges for chemical stability are in high demand. According to the International Institute of Refrigeration (IIR), the global market demand for heat-sensitive health products such as pharmaceuticals, vaccines, insulin, derived blood products, and oncology products increase each year.

As a result, because of the risk of unforeseen environmental fluctuations, the transit of these medications is the essential phase in the cold chain. Any temperature change during transportation might cause medicines to lose their power to cure the conditions for which they are intended, resulting in ineffective treatment in many circumstances.

Modern cold chain monitoring technologies track and monitor goods across the transportation and distribution cycles. They can track temperature-sensitive products in real-time, such as processed foods, frozen foods, and other eatables. At this point, the increasing commerce of perishable goods between developed and emerging nations will augment the market's growth.

Smart sensing labels, Radio Frequency Identification (RFID), and the Internet of Things (IoT) are the advances in connected device technologies expected to develop innovative cold chain monitoring solutions. For instance, in March 2021, Cold Chain Technologies and Cloudleaf have teamed up to offer Cold Chain Technologies Smart Solutions.

Based on Cloudleaf's Digital Visibility Platform, the new offering will provide real-time, holistic, and relevant information on the location and status of temperature-sensitive drugs. The COVID-19 vaccines are transported in this smart technologies' thermal shipping containers.

Know more about this report: request for sample pages

Report Segmentation

The market is primarily segmented based on component, logistics, application, and region.

|

By Component |

By Logistics |

By Application |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Component

The importance of software and hardware components in the proper administration of cold chain monitoring is significant. Over the projection period, the hardware telematics & telemetry devices are anticipated to grow at the fastest CAGR. Telematics systems provide managers with complete control over cold chain fleets by tracking trucks and monitoring refrigerated cargo temperature and humidity levels during transit.

Over the projected period, the cloud-based component is expected to register the fastest growth in the market. With the implementation of cloud-based supply chain monitoring software, tremendous growth has been witnessed in the pharmaceutical supply chain due to its automation, simplified integration, continuous upgrades, and is easily scalable.

The temperature, humidity, pressure, and others are easily trackable with the help of sensors and the addition of Internet of Things (IoT) technology that offers real-time information on product quality. Thus, suppliers are more dependable on cloud-based cold chain monitoring software's modern, flexible, end-to-end supply chain.

Geographic Overview

In 2021, North America market was predicted to have the largest global revenue share. The increasing market demand for frozen and chilled food products in North American countries is projected to fuel the region's need for cold chain monitoring solutions.

The processed food exports by Canada amount to around $28.0 billion, one of the highest among North American countries. The central government of Canada aims to enhance agri-food exports by approximately 27% by the end of the year 2025, resulting in pushing the demand and surge higher for the market.

Asia Pacific is expected to contribute to sustainable growth due to the surging demand for the cold chain monitoring market. Over the projection period, China market is expected to increase significantly. The expansion can be ascribed to various factors, including the sudden rise in pharmaceutical products and other medical necessities. The Chinese government's rigorous regulations to protect food quality encourage cold chain operators to install temperature monitoring technologies.

Governments across the world are taking initiatives for cold chain monitoring logistics. For instance: As the world continues to suffer COVID-19 vaccine shortages, the Japanese government is working hard to supply vaccines and contribute to "Last One Mile Support" by constructing cold logistics infrastructure in developing nations and providing equitable vaccination access in every corner of the globe.

According to the United Nations Children's Fund (UNICEF), in May 2021, the Japanese government has provided approximately 210 million KES to UNICEF to boost Kenya's cold chain capability for the rollout of COVID-19 vaccinations as part of a USD 11 million donation to 11 countries in the East and Southern African region. The fund will be further used to install new equipment and training programs for healthcare personnel on how to use it.

Competitive Landscape

Daikin Industries, Orbcomm, Berlinger & Co., Sensitech, Monnit, Controlant, Savi Technology, Elpro-Buchs, Zest Labs, Securerf Corporation, Infratab, Lineage Logistics Holdings, Klinge Corporation, Temperature Monitor Solutions Africa, and others are some of the market players operating in the cold chain monitoring market.

Cold Chain Monitoring Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 4.68 billion |

|

Revenue forecast in 2030 |

USD 16.75 billion |

|

CAGR |

16.5% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Component, By Logistics, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Daikin Industries, Orbcomm, Berlinger & Co., Sensitech, Monnit, Controlant, Savi Technology, Elpro-Buchs, Zest Labs, Securerf Corporation, Infratab, Lineage Logistics Holdings, Klinge Corporation, Temperature Monitor Solutions Africa. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Desktop Virtualization Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Organic Personal Care Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Saudi Arabia Bus Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Autonomous Forklift Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Global Breast Implants Market Research Report - Trend, Analysis and Forecast till 2025