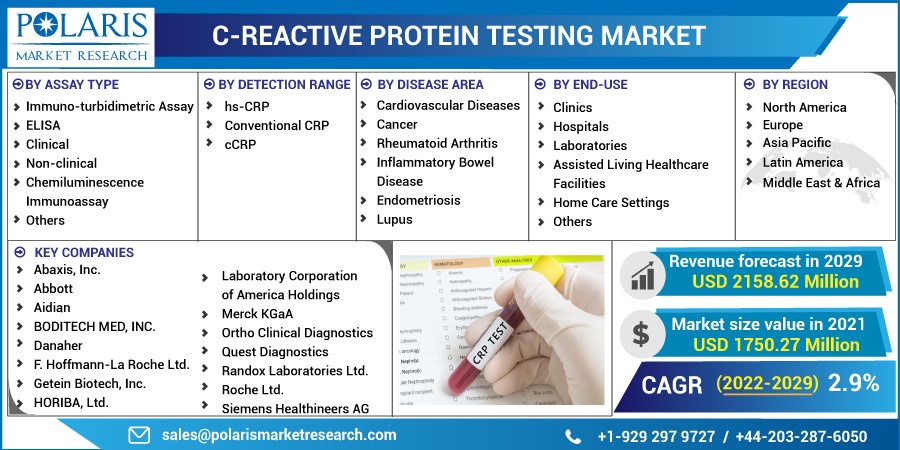

C-Reactive Protein Testing Market Share, Size, Trends, Industry Analysis Report, By Assay Type (Immuno-turbidimetric Assay, ELISA, Chemiluminescence Immunoassay); By Detection Range; By Disease Area; By End-Use; By Region; Segment Forecast, 2022 - 2029

- Published Date:Jan-2022

- Pages: 101

- Format: PDF

- Report ID: PM1770

- Base Year: 2021

- Historical Data: 2017 - 2019

Report Summary

The global c-reactive protein testing market was valued at USD 1,750.27 Million in 2021 and is expected to grow at a CAGR of 2.9% during the forecast period. Increasing adoption of point-of-care devices along with the growing prevalence of cardiovascular diseases is expected to boost the market demand.

Know more about this report: request for sample pages

C-reactive protein is a molecule produced by the liver in reaction to inflammation. A high quantity of these in the plasma might be interpreted as an indicator of inflammation. It can be caused by a wide range of illnesses, including inflammation and malignancy. Increased c- reactive protein testing readings can also signal inflammation in the heart or blood vessels, increasing the chance of heart disease.

The outbreak of the COVID-19 pandemic has positively influenced industry growth. Adoption of c-reactive protein testing is helpful for early detection of severity during COVID-19, which has boosted the demand for the test and is expected to grow over the forecast period.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Increasing cases of cardiovascular diseases are expected to increase the demand for the industry over the forecast period as a high level of c-reactive proteins detection lead to cardiovascular diseases. For instance, according to WHO, in 2019, an estimated 17.9 million individuals died from CVDs, accounting for 32% of all global fatalities. 85 % of these fatalities were caused by a heart attack or a stroke.

Furthermore, increasing government initiatives for the implementation of point-of-care screening along with the development of innovative techniques in testing c-reactive protein testing is expected to propel the c-reactive protein testing market growth.

Report Segmentation

The market has been segmented on the basis of assay type, detection range, disease area, end-use, and region.

|

By Assay Type |

By Detection Range |

By Disease Area |

By End-Use |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Assay Type

Immuno-turbidimetric assay segment is expected to hold the majority of shares in the global industry over the forecast period due to increasing research & development activities in developed economies along with increasing use in clinical biochemistry.

Insight by Disease Area

Cardiovascular disease segment is anticipated to dominate the market over the forecast period due to increasing cases of cardiovascular diseases, which is expected to increase the demand for c-reactive diagnostic approaches. Increasing obesity rates, sedentary lifestyle, along with changing food habits is also expected to favor the trend.

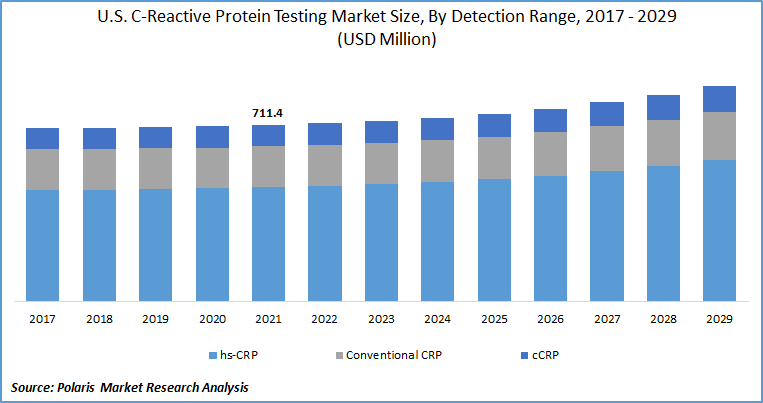

Insight by Detection Range

hs-CRP of high sensitivity c-reactive protein testing segment is expected to grow significantly over the forecast period due to advancements in CRP technologies. The hs-CRP testing is highly sensitive compared to a traditional CRP test, which helps detect a small increase in the CRP levels in the human body. Furthermore, these tests are also used to identify the risk for coronary artery disease, which in turn is expected to fuel the segment demand.

Insight by End-Use

Hospital end-use segment is expected to grow at a significant rate over the forecast period owing to the increasing adoption of diagnostics in hospitals in developing economies due to increasing heart-related diseases along with the outbreak of the COVID-19 pandemic, which has boosted the adoption of c-reactive protein testing.

Geographic Overview

North America is expected to dominate the global c-reactive protein testing market over the forecast period due to increased cardiovascular disease in countries such as the U.S. and Canada. For instance, in 2019, according to Sudden Cardiac Arrest Foundation, in the U.S., there are more than 356,000 out-of-hospital cardiac arrests (OHCA) per year, with over 90% of these being fatal. This, along with the presence of advanced healthcare facilities and government initiatives, is expected to boost the c-reactive test market growth over the forecast period.

Asia Pacific is expected to grow at a significant pace over the forecast period due to the continuously increasing population along with rising geriatric population among countries such as Japan and China. Furthermore, robust adoption of c-reactive protein testing in hospitals along with growing cardiovascular and malaria diseases are expected to drive the c-reactive protein testing market growth in the coming years.

Competitive Insight

Some of the key players operating in the global c-reactive protein testing market include Abaxis, Inc., Abbott, Aidian, BODITECH MED, INC., Danaher, F. Hoffmann-La Roche Ltd., Getein Biotech, Inc., HORIBA, Ltd., Laboratory Corporation of America Holdings, Merck KGaA, Ortho Clinical Diagnostics, Quest Diagnostics, Randox Laboratories Ltd., Roche Ltd., Siemens Healthineers AG, Thermo Fisher Scientific, Inc., and Zoetis.

These market players are adopting organic and inorganic strategies such as mergers & acquisitions, new product launches, partnerships & collaboration, and others to increase their portfolio and gain significant market share. For instance, in March 2021, Boditech Med has launched the construction of a new research & development facility in Chuncheon, South Korea. It expects to finish the new structure by March 2022, after investing USD 6 million.

C-reactive protein Testing Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 1,750.27 Million |

|

Revenue forecast in 2029 |

USD 2,158.62 Million |

|

CAGR |

2.9% from 2022 - 2029 |

|

Base year |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2029 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2029 |

|

Segments covered |

By Assay Type, By Detection Range, By Disease Area, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Abaxis, Inc., Abbott, Aidian, BODITECH MED, INC., Danaher, F. Hoffmann-La Roche Ltd., Getein Biotech, Inc., HORIBA, Ltd., Laboratory Corporation of America Holdings, Merck KGaA, Ortho Clinical Diagnostics, Quest Diagnostics, Randox Laboratories Ltd., Roche Ltd., Siemens Healthineers AG, Thermo Fisher Scientific, Inc., and Zoetis. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Sorting Machine Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- eClinical Solutions Market Research Report, Size, Share & Forecast by 2017 - 2026

- Hemostasis and Tissue Sealing Agents Market Research Report, Size, Share & Forecast by 2019 – 2026

- Terminal Block Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Healthcare IT Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030