Blockchain Technology Market Share, Size, Trends, Industry Analysis Report, By Type; By Component; By Enterprise Size (Large Enterprise, Small & Medium Enterprise); By Application; By End-Use; By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 101

- Format: PDF

- Report ID: PM1017

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Summary

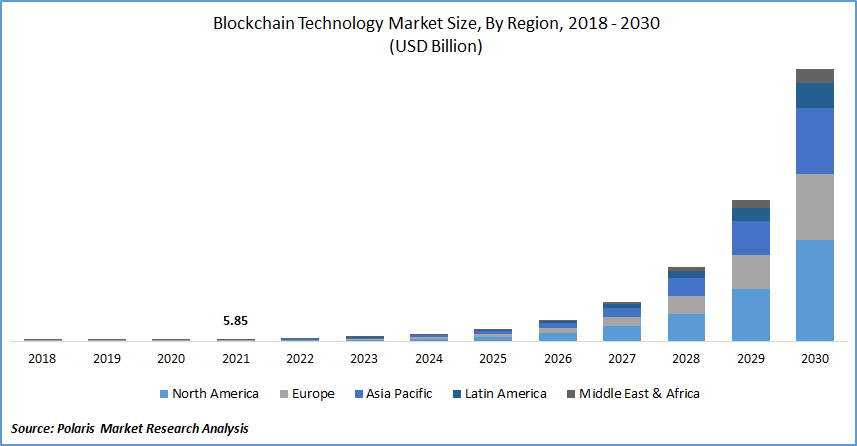

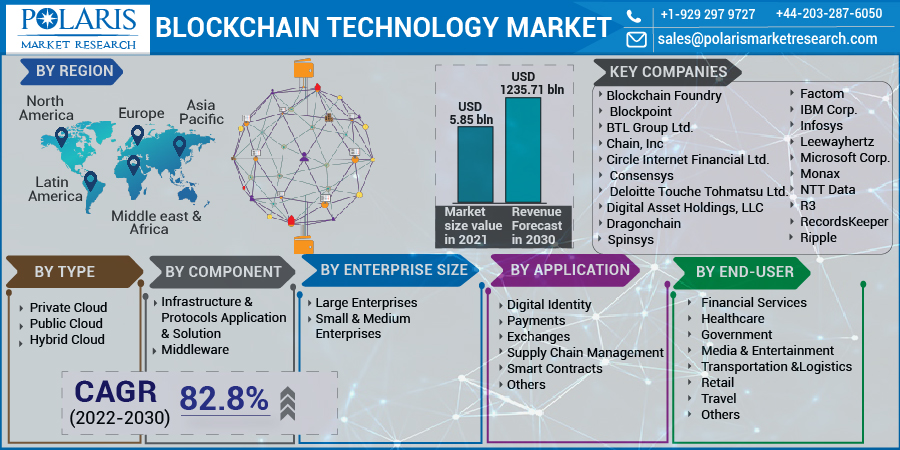

The global blockchain technology market was valued at USD 5.85 Billion in 2021 and is expected to grow at a CAGR of 82.8% during the forecast period. The rising adoption of blockchain technology in digital identities, end-use verticles, and increasing venture capital fundings are some factors anticipated to propel blockchain technology market growth.

Know more about this report: Request for sample pages

Blockchain technology is a peer-to-peer1 (P2P) system that enables information to be saved and traded. Due to consensus-based algorithms2, information may be accessed, exchanged, and safeguarded fundamentally. It is decentralized and eliminates the requirement for intermediaries or third parties. The reliance on internet enterprises has expanded dramatically as a result of the COVID-19 outbreak. The web is being used by financial services, healthcare, medical sciences, industrial, commerce, transportation and communications, and other industries to deliver critical solutions to customers, which in turn has increased the market demand for the technology.

Furthermore, owing to its numerous uses in various fields, blockchain is expanding in popularity. As a result of its value, several corporations and governments across the globe have begun to employ build technology that can aid in fighting the battle against COVID-19. Scientific experiment administration, user information control, healthcare supply network, database consolidation, donor monitoring, contact tracing, and virus monitoring are several COVID-19 application cases.

Industry Dynamics

Growth Drivers

Banking organizations are increasingly adopting blockchain technology due to advantages, including lower infrastructure expenses for reconciling accounts, information management payments, and others. It has also been shown to benefit operational efficiency by removing the need for a trusted person. Increasing awareness regarding these benefits coupled with the rising end-use application of this technology is expected to increase the blockchain technology market growth.

In 2021, over 300 million individuals utilized or held cryptocurrencies, according to information published by TripleA, a cryptocurrency service supplier. The marketplace is rising owing to the increasing requirement for blockchain in the public industry owing to advantages including data security, cost reduction, and increased effectiveness. Furthermore, increasing cross-border trade operations worldwide is expected to increase the market demand for the technology. For instance, by the end of 2022, the global cross-border transaction is expected to reach around $39 trillion. The majority of this expansion can be traced back to advancements in international business, cross-border B2C transactions, borderless e-commerce, and web-based firms.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on type, component, enterprise size, application, end-use, and region.

|

By Type |

By Component |

By Enterprise Size |

By Application |

By End-Use |

By Region |

|

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by End-Use

The financial services segment held a significant share and is expected to maintain its position throughout the projected period. The rapid digitization of the banks and financial industries has resulted in the effective adoption of blockchain technology. The increasing demand to streamline banking operations, the expanding desire to combat fraud, and the increasing involvement of businesses in using blockchain technology infrastructure are projected to boost the market growth. Furthermore, digital India, as well as other government efforts aimed at boosting digitalization in the financial sector in emerging nations, might act as development foundations for the blockchain technology market over the forecast period.

Geographic Overview

North America dominated the global blockchain technology market in 2021 and is anticipated to maintain its dominance throughout the forecast period. Increasing technology adoption across several end-use domains such as BFSI, banks, and others are expected to propel market growth. Furthermore, organizations in this region are progressively employing safety and exposure monitoring solutions to promote business continuance by allowing data protection, avoiding cyber-attacks as well as economic exploitation, and protecting data reliability and confidentiality.

The Asia Pacific is expected to hold a considerable share in the global blockchain technology market over the projected period due to the rapid development of the financial sector coupled with the growing economic development in emerging economies, including China and India. The blockchain technology market in Europe is expected to grow at a significant pace over the coming years due to increasing government initiatives by government and private organizations in order to promote the adoption of digital currencies.

Competitive Insight

Major market players operating in the global blockchain technology market include Antier Solutions Pvt. Ltd., Blockchain Foundry, Blockpoint, BTL Group Ltd., Chain, Inc., Circle Internet Financial Ltd., Consensys, Deloitte Touche Tohmatsu Ltd., Digital Asset Holdings, LLC, Dragonchain, Factom, Global Arena Holding, Inc. (GAHI), IBM Corp., Infosys, Leewayhertz, Microsoft Corp., Monax, NTT Data, R3, RecordsKeeper, Ripple, Spinsys, Stratis, and The Linux Foundation.

In order to expand their marketplace footprint and boost their profitability, these market players engage in different marketing methods such as new product launches, product up-gradation, mergers & acquisitions, partnerships, and cooperation. For instance, in March 2021, Amazon Web Services (AWS) announced the wide release of Ethereum on Amazon Managed Blockchain technology had been announced by Amazon Web Services (AWS). Ethereum is a well-known autonomous blockchain platform that creates a peer-to-peer system that allows users to trade without the need for a trusted central organization.

Blockchain Technology Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 5.85 Billion |

|

Revenue forecast in 2030 |

USD 1,235.71 Billion |

|

CAGR |

82.8% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Type, By Component, By Enterprise Size, By Application, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Antier Solutions Pvt. Ltd.Blockchain Foundry, Blockpoint, BTL Group Ltd., Chain, Inc., Circle Internet Financial Ltd., Consensys, Deloitte Touche Tohmatsu Ltd., Digital Asset Holdings, LLC, Dragonchain, Factom, Global Arena Holding, Inc. (GAHI), IBM Corp., Infosys, Leewayhertz, Microsoft Corp., Monax, NTT Data, , R3, RecordsKeeper, Ripple, Spinsys, Stratis, and The Linux Foundation. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Crypto Wallet Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Lubricants Market Share, Size, Trends, Industry Analysis Report, 2020-2026

- Customer Data Platform Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Starter Cultures Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Global Diabetes Drug Market Research Report - Trend, Analysis and Forecast till 2025