Battery Market Share, Size, Trends, Industry Analysis Report, By Type (Lead-Acid, Lithium-Ion, Nickel Metal Hydride, Nickel Cadmium, Others); By End-Use; By Region; Segment Forecast, 2022 - 2029

- Published Date:Dec-2021

- Pages: 101

- Format: PDF

- Report ID: PM1263

- Base Year: 2021

- Historical Data: 2017 - 2020

Report Summary

The global battery market was valued at USD 83.14 billion in 2021 and is expected to grow at a CAGR of 9.5% during the forecast period. The market growth is expected to be driven by the robust demand for batteries in several end-use industries including household, automotive, industrial, medical, military, and many others. Increasing applications of batteries in energy storage systems, electrical and electronic devices, and electric transportation are anticipated to pave the way for technological development in order to improve battery performance, durability, and safety. A steady rise in the demand for electric vehicles over the years is accelerating the need for batteries.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

The increased demand for lithium-ion batteries to power electric vehicles and energy storage has witnessed substantial growth, increasing from just 0.5 gigawatt-hours in 2010 to around 526 gigawatts in 2020. Lithium-ion batteries are highly used in electric vehicles and other portable appliances.

The battery market witnessed a negative impact during the Covid-19 outbreak owing to the disruptions in the supply chain of materials. China being the largest lithium-ion battery producer and distributor across the globe were combating the Covid-19 situation within the economy. The nationwide lockdowns drove the businesses to shut down their manufacturing facilities that led to the decrease in the production of batteries in the country. In addition, strict lockdown restricted the movement of labor that was employed to work at manufacturing sites.

Furthermore, worldwide lockdowns halted the demand for electric vehicles, mobile phones, laptops, and other gadgets. Consumer spending on the purchase of these products significantly declined that ultimately led to the decreased demand for batteries.

Industry Dynamics

Growth Drivers

The growing adoption of electronic vehicles across the globe is expected to drive the demand for batteries in the near future. The most commonly used Electric Vehicle Battery (EVB) is attributed to power the electric motors of the electric vehicles. Lithium-ion-based batteries are generally used in electric vehicles, which is likely to propel the battery market demand. For instance, there were around 10 million electric cars on the roads across the globe at the end of 2020, and around 3 million electric cars were sold globally.

Furthermore, the rising disposable income and increased consumer spending on the adoption of portable devices lead to a higher demand for batteries. Lithium-ion batteries are widely used in these devices, which is likely to boost battery market demand over the forecast period.

Report Segmentation

The market is primarily segmented on the basis of type, end-use, and region.

|

By Type |

By End-Use |

By Region |

|

|

|

Know more about this report: request for sample pages

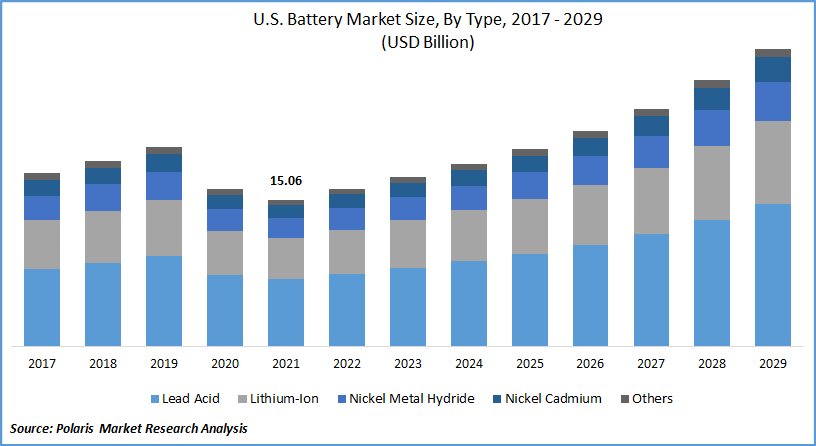

Insight by Type

The lead-acid battery segment is expected to account for the largest share owing to its utilization in non-portable applications such as vehicle ignition and lights, backup power, solar-panel energy storage, and load leveling in power generation. Lead-acid batteries are used in several high current applications, including powering automobile starter motors and storage in backup power supplies on account of their high reliability and cost-effectiveness.

However, the lithium-ion market segment is expected to hold a significant share over the forecast period. This type of battery is commonly used in electric vehicles, digital cameras, portable gadgets, and appliances. Owing to its low energy density and lightweight nature, lithium-ion batteries are largely utilized by the aerospace and military sector, which in turn, is expected to propel the battery industry growth.

Insight by End-Use

The automotive segment is expected to hold the major share over the forecast period. The rising demand for vehicles across the globe is projected to fuel the growth of the battery industry. The increased need for Electric-Vehicle Batteries (EVB) in electronic vehicles is likely to accelerate the battery industry demand in the near future. EVs market is significantly growing worldwide owing to the several government policies and initiatives facilitating the sale of electric vehicles. For instance, governments across the globe spent USD 14 billion to support electric car sales.

Geographic Overview

Asia Pacific region is expected to witness the highest growth over the forecast period. The market is projected to grow in the region due to the contribution of the emerging market, particularly China and India. India had been the fifth-largest automotive market in 2020, along with the seventh-largest manufacturer of commercial vehicles in 2019. The combined selling of passenger and commercial vehicles categories reported for around 3.49 million units in 2020. A surge in demand for vehicles has led to the increased demand for batteries in the nation.

China being the world’s largest automotive manufacturing country, accounts for the increased sale of New Energy Vehicles (NEVs), including plug-in petrol-electric hybrids, battery-powered electric vehicles, and hydrogen fuel-cell vehicles every year. Batteries are widely used in the production of these vehicles, which is likely to propel the growth of the market in the near future.

The rising consumable income of consumers, along with the favorable government policies of several economies, is expected to drive the sale of vehicles in the region. The Indian government proposed a vehicle scrappage policy, investments in infrastructures, change in basic customs duty rates of parts of the automotive industry which are expected to boost the demand for vehicles.

Competitive Insight

Some of the major players operating in the battery market include A123 Systems LLC, BYD Company Ltd., Contemporary Amperex Technology Co., Duracell, Eveready Industries, GS Yuasa International Ltd., Hitachi Chemical Co., Ltd., Johnson Controls, LG Chem Ltd., NEC Corporation, Panasonic Corporation, Saft, Samsung SDI Co., Ltd., Sony Corporation, and Toshiba Corporation. These companies are adopting several strategies to enhance their presence in the domestic as well as international market.

In November 2021, Duracell launched a residential energy storage solution through California based distributor power center. The Duracell power center product line will comprise of 5 kW and 10 kW inverter outputs with batteries expandable from 14 kWh to 84 kWh.

Battery Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 83.14 billion |

|

Revenue forecast in 2029 |

USD 169.09 billion |

|

CAGR |

9.5% from 2022 - 2029 |

|

Base year |

2021 |

|

Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2029 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2022 to 2029 |

|

Segments covered |

By Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

A123 Systems LLC, BYD Company Ltd., Contemporary Amperex Technology Co., Duracell, Eveready Industries, GS Yuasa International Ltd., Hitachi Chemical Co., Ltd., Johnson Controls, LG Chem Ltd., NEC Corporation, Panasonic Corporation, Saft, Samsung SDI Co., Ltd., Sony Corporation, and Toshiba Corporation. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Glass Coatings Market Share, Size, Trends, & Industry Analysis Report: Segment Forecast, 2018 - 2026

- Aerospace Robotics Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Silico Manganese Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Thermal Barrier Coatings Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Aircraft Filters Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028