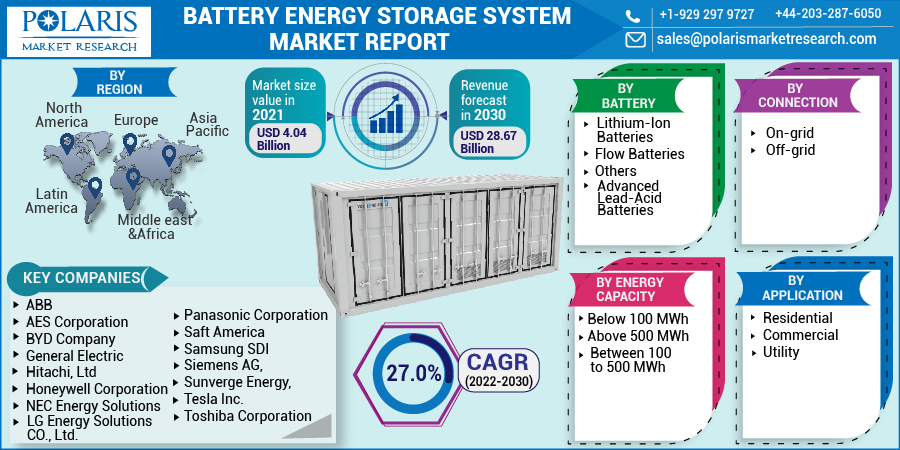

Battery Energy Storage System Market Share, Size, Trends, Industry Analysis Report, By Battery Type; By Connection Type (On-grid, Off-grid); By Energy Capacity; By Application (Residential, Commercial, Utility); By Region; Segment Forecast, 2022 - 2030

- Published Date:Jun-2022

- Pages: 101

- Format: PDF

- Report ID: PM2439

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Summary

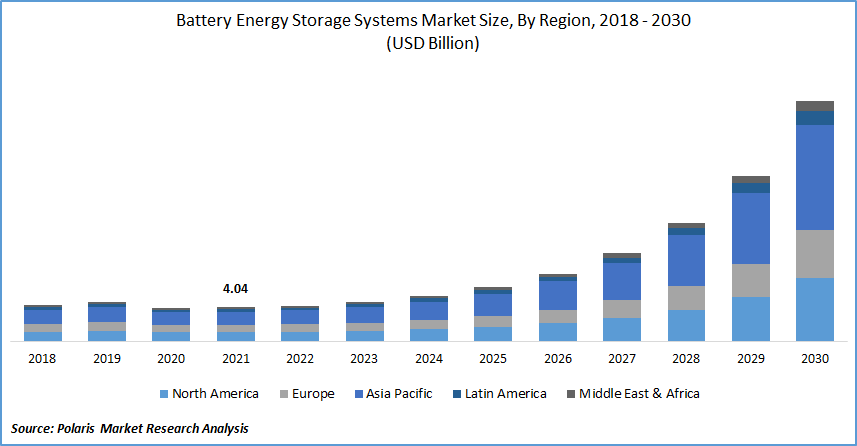

The global battery energy storage system market was valued at USD 4.04 billion in 2021 and is expected to grow at a CAGR of 27.0% during the forecast period. Key factors such as the rising demand for power system energy storage systems due to continuous grid modernization and the increasing absorption of lithium-ion batteries in the renewable energy market are expected to propel battery energy storage system market demand.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Furthermore, the emerging demand for adopting a low-carbon and less fossil fuel-based economic system and the continuing renewable energy revolution is boosting the battery energy storage system market growth during the forecast period. Solar and wind power are the most common types of renewable power stored in grids. Various factors, such as weather changes and wind fluctuations, cause power-generated variations, increasing the demand for grid systems to keep the power.

A power storage system allows the grid to store surplus generated electricity and then use it when there is a power outage. These systems are quickly becoming an essential component of grid modernization. Implementing these storage systems provides excellent reliability and greater electricity generation, transmission, and flexibility. All of the above factors facilitate the adoption of these systems, fueling the market's growth.

Furthermore, as per the International Energy Agency (IEA), the number of other countries pledging to accomplish net-zero emissions in the coming decades is growing. Governments must reduce global power -related greenhouse gas emissions to zero by 2050, giving the world an equal chance of continuing to reduce temperature rise to 1.5 degrees Celsius.

However, the rising capital expenditure required for installing battery storage systems limits the market growth. On the other hand, an increase in the proportion of rural electrification projects worldwide, growth in the need for supplying power due to a growth in the number of data centers, and a drop in lithium-ion prices are expected to generate massive market opportunities for the adaptation of battery power storage systems in the coming years.

Industry Dynamics

Growth Drivers

The major players' rising launches of battery power storage systems are driving the market growth during the forecast period. For instance, in September 2021, Jakson Group, Noida-based power and infrastructure firm, introduced EnerPack, an innovative (BESS), to mitigate climate change and the uninterrupted supply of green power. In December 2021, TotalEnergies opened France's biggest battery-based power storage system. This site, which also reacted to the need for grid stabilization and is situated at the Flandres center in Dunkirk, has a power storage capacity of 61 MW. It is composed of 272.5 MWh capable of dealing and assembled by Saft, TotalEnergies' battery association specializing in advanced batteries for the sector.

Further, in January 2022, Vistra recently announced plans to build its Moss Landing Energy Storage Facility. Pacific Gas and Electric Company (PG&E) has agreed to a 15-year asset adequacy agreement for an innovative 350 MW battery system. This would be in addition to the existing 400 MW of power storage capacity at the premises.

Know more about this report: Request for sample pages

Report Segmentation

The market is primarily segmented based on battery type, connection type, energy capacity, application, and region.

|

By Battery Type |

By Connection Type |

By Energy Capacity |

By Application |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

Insight by Battery Type

Based on the battery type segment, the lithium-ion segment is expected to be the most significant revenue contributor in the global market. The growing popularity of lithium-ion batteries as a power storage good or service can be credited to their high power density, efficiency improvements, and long discharge cycle. Lowering lithium-ion battery prices and technical progress are expected to boost market demand further. Also, lead-acid batteries have the second-largest revenue share. Lead-acid batteries are less expensive than other batteries and can be quickly produced with low-tech equipment, driving system growth over the forecast period.

The on-grid connection segment holds the largest market share based on the connection type. Since surplus power is sent to the grid and can be used later on metered grounds, on-grid connections have lower upfront costs than off-grid systems. The decrease in power bills for customers who rely on the utility grid for electricity will drive the segment's growth. Popularity for grid modernization from sustainable power suppliers and new power regulatory policies are propelling the development of the on-grid battery storage equipment market for utilities.

Geographic Overview

In terms of geography, North America had the largest market share. Battery technology has become a cornerstone of all power policy in the U.S. The safety of these power storage devices is one of market leaders' highest priorities. Lithium-ion battery storage systems are in high demand in North America because they are the region's most advanced and widely available solutions for storing power from renewable channels. Furthermore, rapid cost reductions and soaring storage demand for variable renewable power integration are expected to drive the region's market.

Moreover, Asia Pacific is expected to witness a high CAGR in the global battery energy storage system market. The rising investments in the emerging countries and increasing projects by the government for the power projects are boosting the market growth during the forecast period. As per the IEA, the Chinese government announced plans to install more than 30 GW of power storage by 2025. Also, in October 2021, the government has given the green light to invite expressions of interest for the initial setup of a 1,000 MWh Battery Energy Storage System (BESS).

Further, in October 2021, the Central Government has approved inviting expressions of interest to set up a 1000 MWh BESS as a pilot scheme, which significantly boosts India's Goals. The decision supports the Ministry of New and Renewable Energy, aiming to achieve 450 GW sustainability goals by 2030. These factors are propelling the market growth during the forecast period.

Competitive Insight

Major market players operating in the global battery energy storage system market include ABB, AES Corporation, BYD Company, Contemporary Amperex Technology, General Electric, Hitachi, Ltd., Honeywell Corporation, LG Energy Solutions CO., Ltd., NEC Energy Solutions, Panasonic Corporation, Saft America, Samsung SDI, Siemens AG, Sunverge Energy, Tesla Inc., and Toshiba Corporation.

Battery Energy Storage System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 4.04 Billion |

|

Revenue forecast in 2030 |

USD 28.67 Billion |

|

CAGR |

27.0% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Battery Type, By Connection Type, By Energy Capacity, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

ABB, AES Corporation, BYD Company, Contemporary Amperex Technology, General Electric, Hitachi, Ltd., Honeywell Corporation, LG Energy Solutions CO., Ltd., NEC Energy Solutions, Panasonic Corporation, Saft America, Samsung SDI, Siemens AG, Sunverge Energy, Tesla Inc., and Toshiba Corporation. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Military Sensors Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Dental Inlays & Onlays Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Patient Referral Management Software Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Biocides Market Share, Size, Trends, Industry Analysis Report, 2021 - 2028

- Recreational Boat Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030