Batter & Breader Premixes Market Share, Size, Trends, Industry Analysis Report, By Application (Vegetables, Poultry, Seafood, Meat); By Distribution Channel; By Product; By Region; Segment Forecast, 2021 - 2028

- Published Date:Sep-2021

- Pages: 101

- Format: PDF

- Report ID: PM1976

- Base Year: 2020

- Historical Data: 2016-2019

Report Summary

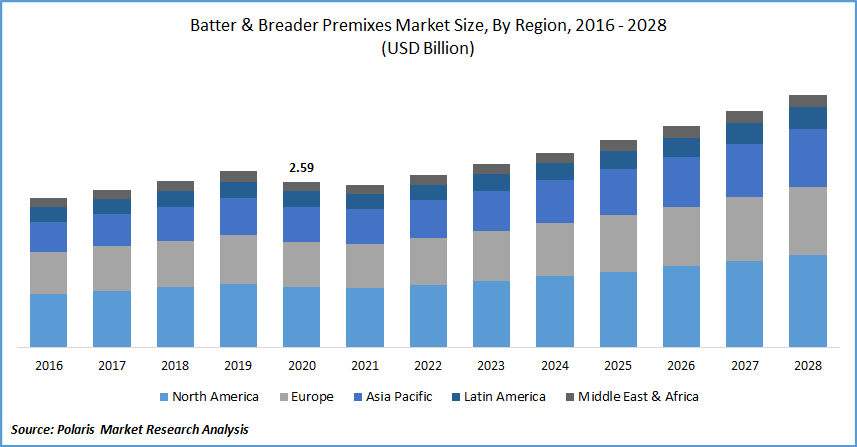

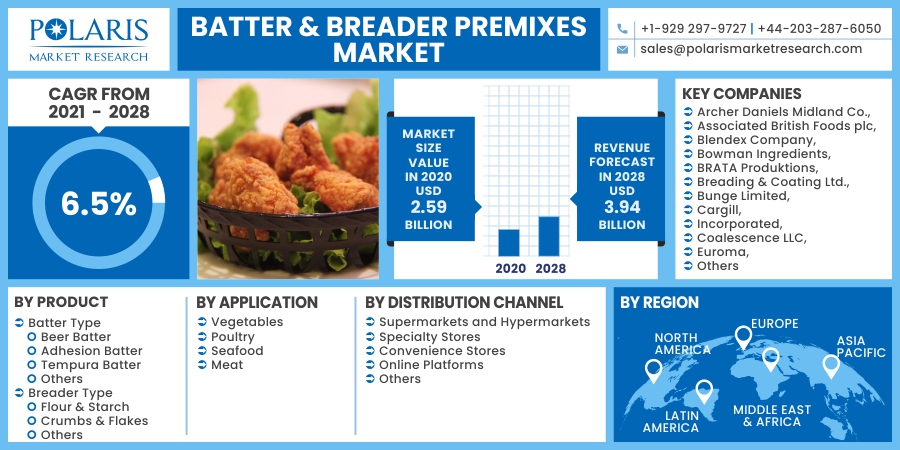

The global batter & breader premixes market size was valued at USD 2.59 billion in 2020 and is expected to grow at a CAGR of 6.5% during the forecast period. Batter & breader premixes are used for coating meat, vegetables, and other finger food for improved taste, texture, and aroma. They also offer enhanced adhesion, moisture retention, and reduced shrinkage while frying. The products provide crispiness, improved appearance, and high quality to fried food products.

Know more about this report: request for sample pages

Know more about this report: request for sample pages

Restaurants utilize these premixes to offer improved food presentation without cracks, splits, and fall-off. Increased consumption of fast food, rising adoption of western lifestyle & eating habits, and hectic consumer lifestyles have increased the demand for the breader premixes. Breader premixes market players are introducing healthier options with greater nutritional content to cater to growing consumer demand for nutritious, low-calorie, organic, and gluten-free ingredients.

During the pandemic, there has been an increase in demand for batter & breader premixes due to greater demand for convenience food products. However, the supply and production of batter & breader premixes have suffered decline owing to disruptions in the supply chain, halting of manufacturing activities, and limited availability of raw material. Closure of restaurants and food outlets due to lockdown, government regulations on movement and lockdowns, and lack of labour have affected the breader premixes market growth.

Industry Dynamics

Growth Drivers

Increasing demand for convenience food and ready to cook meals across the globe coupled with growing consumption of meat products is expected to fuel the growth of the breader market. The rising working population and sedentary lifestyle of consumers have increased the sale of packaged and processed meals. An increase in the number of quick-service restaurants and food outlets, coupled with the growing adoption of fast-food culture, boosts the breader premixes market growth.

Growing demand from developing economies and rising disposable income of consumers support the growth of the breader premixes market. Technological advancements in food technology and increasing investments in research and development are factors expected to provide growth opportunities for breader premixes during the forecast period.

E-commerce platforms have gained popularity for the sale of the product, especially during the pandemic. Online platforms offer a plethora of options to consumers on a single portal, offering convenience and saving time & effort. Rigorous online marketing supplemented with attractive offers and discounts offered by companies has increased the popularity of e-commerce in recent years.

The online distribution channel is well established in developed markets such as North America and Europe due to higher internet penetration and greater adoption of mobile devices. However, significant growth in the sale of batter & breader premixes through online channels has also been registered in the developing economies, encouraging many new market entrants to launch their own e-commerce sites.

Know more about this report: request for sample pages

Report Segmentation

The market is primarily segmented on the basis of product, application, distribution channel, and region.

|

By Product |

By Application |

By Distribution Channel |

By Region |

|

|

|

|

Know more about this report: request for sample pages

Insight by Product

On the basis of product, the industry is segmented into batter type, and breader premixes type. The batter segment is further divided into beer batter, adhesion batter, tempura batter, and others. The demand for adhesion batter is expected to be high during the forecast period owing to increasing use in vegetables and seafood. Adhesion batter is widely used to provide an excellent binding surface. It forms a coating to work with breading and pre-dust to enhance the flavor, texture, consistency, and appearance of food products.

Insight by Application

On the basis of application, the breader premixes industry is segmented into vegetables, poultry, seafood, and meat. The demand from the meat segment is expected to be high during the forecast period. Increasing demand for meat products across the globe, easy availability, and cost-efficiency of meat supports the growth of this segment. The sedentary lifestyle of consumers encourages them to consume convenience food, driving the growth of this segment.

Insight by Distribution Channel

The distribution channel segment has been divided into supermarkets and hypermarkets, specialty stores, convenience stores, online platforms, and others. The supermarkets and hypermarkets segment accounted for a major share in 2020. These stores bridge the gap between manufacturers and customers by offering a wide range of breader premixes product variety at the same place.

These stores are mainly rooted in highly populated cities and urban cities. Consumers are increasingly shopping for batter & breader premixes from these stores owing to heavy discounts, availability of a large variety of products under a single roof, and promotional offers to attract consumers.

Geographic Overview

North America dominated the global batter & breader premixes market in 2020. The high disposable income of consumers and consumption of fast food drive the growth of this segment. Increased penetration of quick-service restaurants and greater consumption of poultry and meat has increased the demand for batter and breader premixes in this region. Superior demand for fried food has encouraged industry players to develop new products catering to the local taste of consumers.

Competitive Landscape

The key players in the batter & breader premixes market include Bowman Ingredients, Blendex Company, Ingredion Incorporated, Cargill, Incorporated, Breading & Coating Ltd, McCormick & Company, Bunge Limited, Associated British Foods plc, Archer Daniels Midland Company, House-Autry Mills, Kerry Group and Showa Sangyo Co., Ltd.

These players are expanding their presence across the globe and entering new markets in developing regions to expand their customer base and strengthen their presence in the industry. The companies are also introducing new innovative products in the premixes industry to cater to the growing consumer demands.

Batter & Breader Premixes Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2020 |

USD 2.59 billion |

|

Revenue forecast in 2028 |

USD 3.94 billion |

|

CAGR |

6.5% from 2021 - 2028 |

|

Base year |

2020 |

|

Historical data |

2016 - 2019 |

|

Forecast period |

2021 - 2028 |

|

Quantitative units |

Revenue in USD million/billion Volume in kilotons and CAGR from 2021 to 2028 |

|

Segments covered |

By Product, By Application, By Channel distribution, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Archer Daniels Midland Company, Associated British Foods plc, Blendex Company, Bowman Ingredients, BRATA Produktions, Breading & Coating Ltd Bunge Limited, Cargill, Incorporated, Coalescence LLC, Euroma, House-Autry Mills, Ingredion Incorporated, Kerry Group, McCormick & Company, Newly Weds Foods, Inc., Prima Limited Showa Sangyo Co., Ltd., Solina Group |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Elevators & Escalators Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Ready to Drink Tea & Coffee Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Space Launch Services Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- B2C Mobility Sharing Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Organic Food and Beverages Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030