Automotive Wiring Harness Market Share, Size, Trends, Industry Analysis Report, By Application; By Component; By Vehicle Type (Two Wheelers, Passenger Cars, and Commercial Vehicles); By Transmission Type; By Region; Segment Forecast, 2022 - 2030

- Published Date:Mar-2022

- Pages: 101

- Format: PDF

- Report ID: PM2338

- Base Year: 2021

- Historical Data: 2018 - 2020

Report Summary

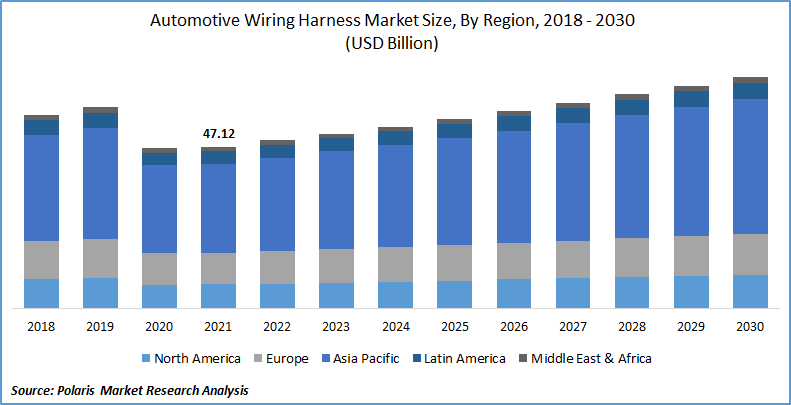

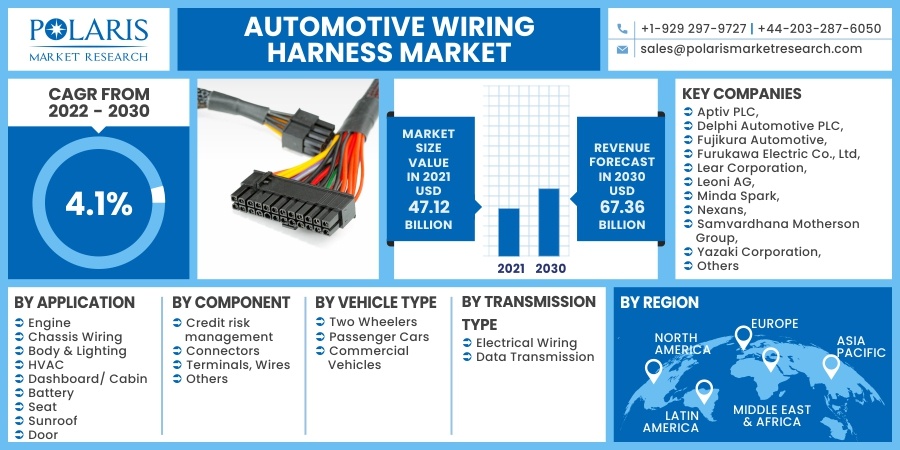

The global automotive wiring harness market was valued at USD 47.12 billion in 2021 and is expected to grow at a CAGR of 4.1% during the forecast period. The rising need to improve the sending signals, data, and power, using data transmission and electrical lines, is expected the market growth during the forecast period. Furthermore, vehicle makers must adhere to safety regulations and include airbags.

Know more about this report: request for sample pages

The Bharat New Vehicle Safety Assessment Programme (BNVSAP) requires passive safety elements. Multimedia and security systems have increased how cables and wiring harnesses are installed. Voice recognition, ambient lighting, heated seats, heated steering wheels, better infotainment capabilities, digital IP display, chilled cupholder, and extra power steering functions have gained popularity among consumers to improve the driving experience. These tasks are enabled via onboard electronic equipment that utilizes control signals generated by the battery's electrical power.

Electronic devices require an automotive wiring harness to convey data, signal, and power. In addition to these circuits, wiring harness bundles are fitted in automobiles to ensure that various functions work properly. The increasing number of wiring harnesses required to design a car with modern features drives the industry’s growth.

One of the key reasons preventing the expansion of aluminum wiring harnesses is rust. The sensor system, powered by the wiring harness, is corrosion. Excessive corrosion can also degrade voltage and current flow, which a sensor may interpret as a system problem. Safety systems such as airbags and anti-lock brakes may malfunction due to the issue. This results in various issues, including wire wear and fire risk.

Routine maintenance and repairs, which typically use a corrosive lubricant solution, can damage wiring harnesses and cause electronics failure. Corrosion can spread to adjacent wires, resulting in system failure on a broad scale. Corrosion of wiring harnesses could thus be a significant stumbling block for the business.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

Expansion in the small and medium enterprises involved in developing ancillary automotive components is driving the market forward. For instance, in July 2021, Furukawa Electric created a 6,912 optical cable using thin 16-fiber ribbons, the S124M16 fusion splicer, and accompanying instruments. They help expand high-capacity networks by reducing the time necessary for fusion splicing. The firm created the world's thinnest optical fiber cable with the highest core density. A significantly thinner wire provides extremely high density with an outside diameter of only 29 mm (6912 cores).

In addition, in January 2021, Morocco's Ministry of Industry, Trade, Green, and Digital Economy announced the signing of two memorandums of understanding (MoU) for the construction of four automobile factories worth MAD 912 million, resulting in the creation of 8,300 jobs. The two Japanese companies, Yazaki and Sumitomo, are investing in developing new industrial units to produce cable harnesses. Thus, significant players' signing of agreements and investment boosts automotive wiring harness market growth during the forecast period.

Report Segmentation

The market is primarily segmented based on application, component, vehicle type, transmission type, and region.

|

By Application |

By Component |

By Vehicle Type |

By Transmission Type |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Vehicle Type

Based on the vehicle type segment, the passenger vehicle segment is the most significant revenue contributor in the global market in 2021 and is expected to retain its dominance in the foreseen period. The market is dominated by passenger vehicles, owing to widespread use in luxury and high-end vehicles. The expansion in the number of electronic components used in cars and the demand for automotive safety systems were key drivers.

Over the forecast period, demand for the industry is expected to rise due to the increasing usage of electrical parts in the engine and gearbox compartments in recent decades. This is particularly true in commercial vehicles, where the number of electronic components is rapidly increasing.

Geographic Overview

In terms of geography, North America had the highest automotive wiring harness market share in 2021 due to the general significant adoption of safety technology in automobiles. The adoption of electric vehicles is expected to drive demand in this region due to rising automobile manufacturing and drive technological advancement.

Moreover, Asia Pacific is expected to witness a high CAGR in the global automotive wiring harness market in 2021. The market is being driven by rising disposable income and growth in GDP in the Asia Pacific. China has been the world's largest automotive manufacturer for many years. China produces more than a third of all automobiles in the world.

This capability is greater than the combined capabilities of the European Union, the U.S., and Japan. China is also the largest producer and seller of electric vehicles globally. Due to increased electrification in conventional vehicles and rising adoption rates of electric vehicles, China's automotive wire harness market is predicted to grow significantly throughout the forecast period.

Growing government laws encouraging the adoption of electric vehicles and aggressive expansion by OEMs and suppliers in the region to meet expanding demand from China's automotive industry are likely to boost the market growth.

Competitive Insight

Some of the major players operating in the global market include Aptiv PLC, Delphi Automotive PLC, Fujikura Automotive, Furukawa Electric Co., Ltd, Lear Corporation, Leoni AG, Minda Spark, Nexans, Samvardhana Motherson Group, Sumitomo Electric Industries, Ltd, Yazaki Corporation, and Yura Corporation.

Automotive Wiring Harness Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2021 |

USD 47.12 billion |

|

Revenue forecast in 2030 |

USD 67.36 billion |

|

CAGR |

4.1% from 2022 - 2030 |

|

Base year |

2021 |

|

Historical data |

2018 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Application, By Component, By Vehicle Type, By Transmission Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Aptiv PLC, Delphi Automotive PLC, Fujikura Automotive, Furukawa Electric Co., Ltd, Lear Corporation, Leoni AG, Minda Spark, Nexans, Samvardhana Motherson Group, Sumitomo Electric Industries, Ltd, Yazaki Corporation, and Yura Corporation. |

License and Pricing

Purchase Report Sections

- Regional analysis

- Segmentation analysis

- Industry outlook

- Competitive landscape

Connect with experts

Suggested Report

- Automated Test Equipment Market Research Report, Share and Forecast, 2018 – 2026

- Thermal Barrier Coatings Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Secure Access Service Edge Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Open Banking Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030

- Routing Market Share, Size, Trends, Industry Analysis Report, 2022 - 2030